Bitcoin’s sitting pretty at $91,924 today, down just 1.15% in the last 24 hours after testing $93,577 highs. But forget the minor dip; the real action is how Wall Street giants are flipping the script on crypto. Vanguard’s bombshell policy reversal opens their $11 trillion platform to Bitcoin ETFs, while big banks team up with Coinbase for seamless pilots. For beginners eyeing buy bitcoin beginners 2025, this is your green light. No more sketchy exchanges or wallet headaches – institutional rails are here, making safe crypto onboarding 2025 dead simple.

I’ve traded crypto volatility for six years, and this shift screams opportunity. BlackRock’s Larry Fink, once calling Bitcoin ‘an index of money laundering, ‘ now hails it as a hedge against fiat debasement. Coinbase’s Brian Armstrong is locking arms with JPMorgan and others. React fast, manage risk – that’s how we play this.

Vanguard’s Crypto Thaw Unlocks Easiest ETF Entry for Newbies

Vanguard’s U-turn on December 2,2025, flips their long-held disdain for crypto’s volatility. Over 50 million clients can now trade spot Bitcoin ETFs like BlackRock’s IBIT right in their brokerage accounts. No new apps, no KYC nightmares – just log in and buy.

The star method here: Buy Spot Bitcoin ETFs (e. g. , BlackRock IBIT) via Vanguard Brokerage Account. Why? ETFs bundle Bitcoin exposure without you holding keys. BlackRock’s IBIT tracks BTC spot price at $91,924, with institutional custody via Coinbase. Fees? Under 0.25% annually – peanuts compared to exchange spreads.

- Fund your Vanguard account via ACH from any bank.

- Search ‘IBIT’ in the ETF screener.

- Buy shares; each mirrors ~0.00001 BTC at current prices.

Pragmatic pick for beginners scared of self-custody. Ties into Vanguard bitcoin policy reversal, pulling crypto into retirement portfolios. I’ve seen traders DCA into IBIT during dips like today’s, riding waves without leverage blowups.

Another angle: Invest in Bitcoin ETFs through BlackRock Platforms or Partner Brokers. BlackRock’s own tools or linked brokers let you stack IBIT alongside stocks. Fink’s evolution underscores institutional bitcoin adoption – their $70B and ETF inflows prove BTC’s no fad.

Coinbase-Bank Pilots: Frictionless Fiat Ramps Go Live

Enter the bank-Coinbase pilots revolutionizing Coinbase bank crypto pilots. JPMorgan’s letting Chase cardholders buy BTC on Coinbase since fall 2025, with bank links and USDC rewards by 2026. Picture redeeming points for stablecoins, then swapping to BTC at $91,924. Banks like yours become onramps overnight.

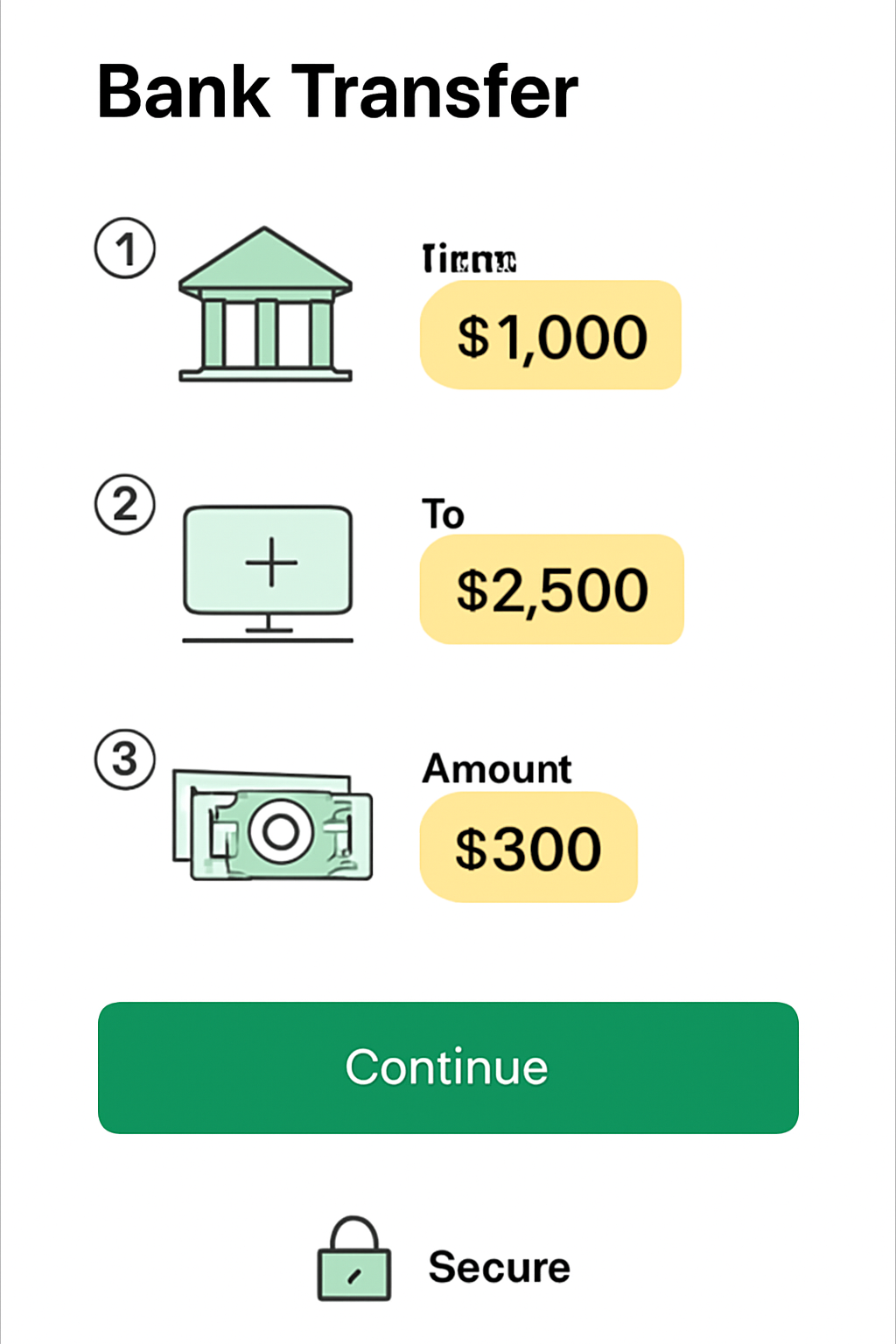

Top method: Utilize Coinbase-Bank Pilot Programs for Seamless Fiat-to-BTC Onramp. Link your major bank account directly – ACH transfers hit instantly, no fees for verified users. Buy BTC with USD, held in Coinbase custody. Safer than P2P; regulated, insured up to $250K.

- Sign up on Coinbase, verify ID (5 mins).

- Connect JPMorgan/Chase or pilot bank.

- Purchase BTC; track at current $91,924.

This bridges TradFi and crypto perfectly. Armstrong’s summit chat with Fink dismissed winter fears – institutions are all-in, stabilizing paths for rookies.

Bitcoin (BTC) Price Prediction 2026-2031

Optimistic Outlook Following Vanguard Policy Reversal and Bank-Coinbase Pilots for Beginner-Friendly Access

| Year | Minimum Price | Average Price | Maximum Price | YoY % Change (Avg) |

|---|---|---|---|---|

| 2026 | $100,000 | $150,000 | $250,000 | +63% |

| 2027 | $140,000 | $220,000 | $380,000 | +47% |

| 2028 | $200,000 | $320,000 | $550,000 | +45% |

| 2029 | $280,000 | $450,000 | $760,000 | +41% |

| 2030 | $380,000 | $620,000 | $1,050,000 | +38% |

| 2031 | $510,000 | $850,000 | $1,450,000 | +37% |

Price Prediction Summary

With Vanguard granting access to crypto ETFs for over 50 million clients and major banks like JPMorgan partnering with Coinbase for direct Bitcoin purchases, institutional adoption accelerates. Bitcoin prices are projected to grow progressively, with average prices rising from $150,000 in 2026 to $850,000 in 2031, reflecting bullish market cycles, reduced volatility, and mainstream integration.

Key Factors Affecting Bitcoin Price

- Vanguard’s policy shift enabling ETF trading for $11T AUM clients

- JPMorgan-Coinbase pilots for credit card and bank account crypto buys

- BlackRock CEO Larry Fink’s evolved pro-Bitcoin stance as inflation hedge

- Broader institutional inflows via ETFs and pilots reducing entry barriers

- Post-halving supply dynamics and network growth

- Regulatory tailwinds and mainstream finance integration

- Expanding use cases in payments, remittances, and store-of-value

Disclaimer: Cryptocurrency price predictions are speculative and based on current market analysis.

Actual prices may vary significantly due to market volatility, regulatory changes, and other factors.

Always do your own research before making investment decisions.

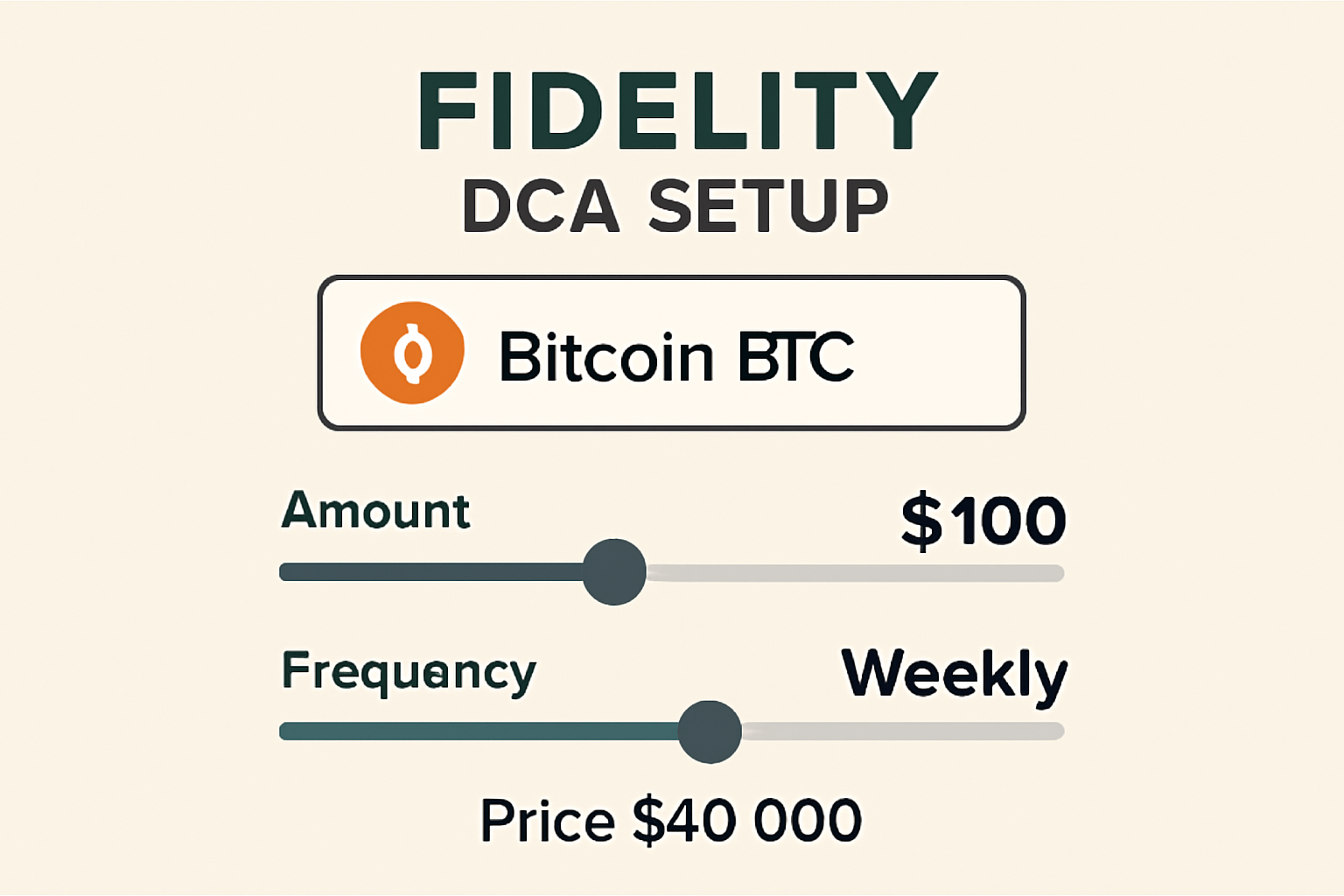

Direct play: Purchase BTC Directly on Coinbase with Linked Major Bank ACH Transfer. Skip cards; ACH is free, settles T and 1. At $91,924, dollar-cost average $100 weekly – builds positions without timing stress. Coinbase’s institutional-grade security, post-FTX, means your stack’s fortified.

These pilots crush barriers. No wire fees, no crypto ATMs. I’ve flipped forex pairs in minutes; now BTC’s that accessible via your checking account.

Fidelity enters the fray with crypto services mirroring this institutional surge. Their platform offers direct BTC buys backed by fortress-level security – think cold storage and insurance up to $1B. Perfect for dollar-cost average BTC on Fidelity Crypto with Institutional-Grade Security, smoothing out dips like today’s drop to $91,924.

Fidelity DCA: Beat Volatility Without the Sweat

Why Fidelity? Recurring buys automate your buy bitcoin beginners 2025 strategy. Set $50 weekly; it executes regardless of price swings. No timing the market – just stack sats over time. Ties into broader institutional bitcoin adoption, with Fidelity’s ETF launches complementing Vanguard’s shift. I’ve day-traded BTC drops turning into pumps; DCA lets newbies capture that without staring at charts 24/7.

Fees clock in at 1% per trade, but zero for ACH loads. Holdings stay custodied, FDIC-sweeped for USD balances. Post-2025 pilots, Fidelity’s ramp feels like the safe crypto equivalent of auto-investing in an S and amp;P fund.

Stacking these methods – Vanguard ETFs, Coinbase ACH, bank pilots, BlackRock access, Fidelity DCA – gives beginners bulletproof options. All leverage TradFi trust with crypto upside. BTC at $91,924 isn’t chasing highs; it’s entering at institutional validation.

React fast, manage risk: Start small, diversify across 2-3 methods, never bet the farm.

Safety first in this rally. Banks and brokers now gatekeep your entry, slashing scam risks. JPMorgan-Coinbase links mean your Chase app feeds BTC buys. Vanguard’s 50M users flood ETFs, boosting liquidity. BlackRock’s IBIT alone holds billions, price-tracking $91,924 spot flawlessly.

Picture this: You link Chase to Coinbase, DCA on Fidelity, nibble IBIT via Vanguard. Portfolio hedges inflation while Wall Street nods approval. Fink and Armstrong’s summit vibes? Crypto winter’s toast; pilots prove it. For safe crypto onboarding 2025, these crush offshore exchanges.

Current setup screams momentum. BTC’s 24-hour range – $93,577 high to $91,007 low – tests resolve, but institutional inflows cap downside. My six years trading volatility? This is the most beginner-friendly ramp yet. Pick your lane, execute today, watch positions compound.

Read the full guide on Vanguard’s reversal and Coinbase pilots for platform-specific tweaks.