In early 2026, U. S. spot Bitcoin ETFs saw a staggering $2.8 billion in outflows over two weeks, pushing Bitcoin’s price down to a nine-month low around $74,600. Fast forward to today, and Bitcoin sits at $78,662.00, showing a modest 24-hour gain of and $2,062.00 or and 2.69%. This volatility has left many beginners underwater on their average ETF purchase prices, sparking fear amid macroeconomic headwinds like shifting monetary policy expectations. Yet, as someone who’s analyzed markets through multiple cycles, I see this as a classic setup for purposeful investing: a dip that rewards the prepared. If you’re new to crypto, buying the Bitcoin dip safely isn’t about chasing hype; it’s about understanding the mechanics and positioning for long-term growth.

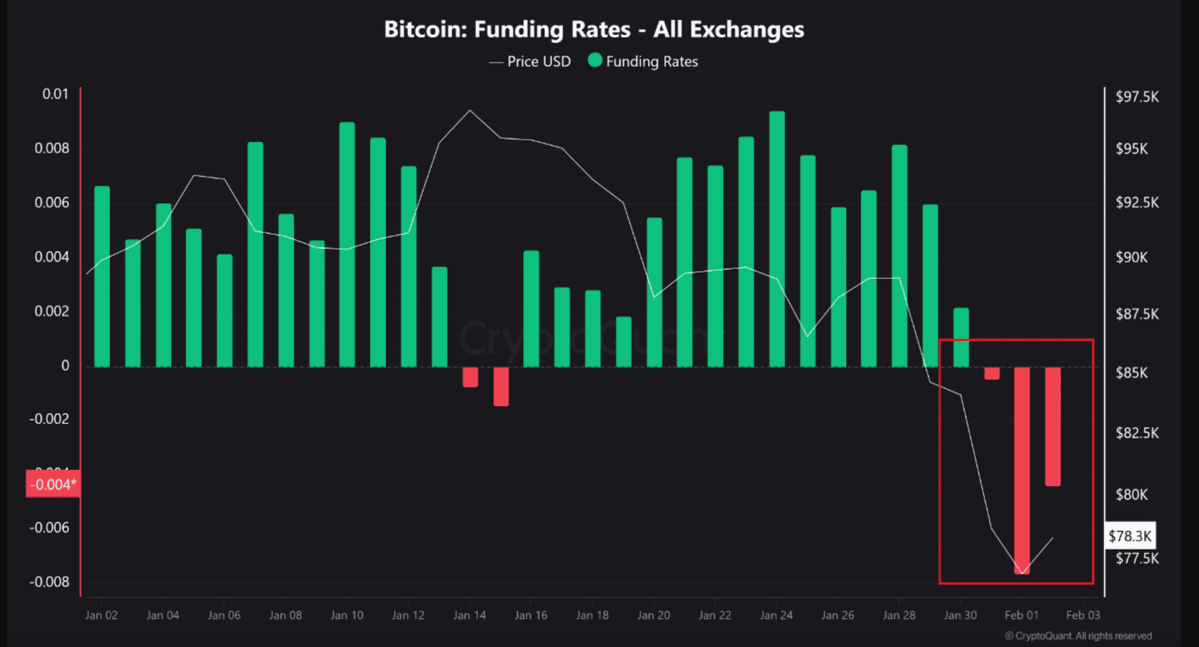

These outflows, totaling around $2.8 billion, reflect investors pulling back due to global risk factors and uncertainty over interest rates. Daily nets like $486 million on one Wednesday and $243 million the prior Tuesday piled up, turning January negative overall. But here’s the thoughtful take: ETF flows aren’t the full story. Bitcoin’s structure remains bullish with constrained supply and growing adoption. Outflows create liquidity that savvy buyers can absorb, potentially setting up for rebounds as sentiment shifts.

Decoding the $2.8 Billion Outflows: Macro Pressures Meet ETF Realities

Bitcoin ETF outflows in 2026 hit hard, with weekly nets like -$1,137.4 million from January 20-26 alone. Analysts point to a lack of conviction buying, exacerbated by U. S. data stalling momentum and Bitcoin slipping below $90,000. For beginners, this underscores a key lesson: ETFs mirror stock market hours, not Bitcoin’s 24/7 rhythm. You miss overnight pumps or dumps, and management fees nibble at returns over time.

Compare that to spot Bitcoin, which trades non-stop. ETFs offer convenience through brokerage accounts, but they introduce redemption risks. Recent data shows average ETF buys now underwater versus the current $78,662.00 price. My view? This stress tests holders, weeding out weak hands while building resilience. Structural demand, needing about 27,000 BTC monthly absorption, suggests outflows are temporary noise against adoption trends.

Bitcoin at $78,662.00: Why This Dip Screams Opportunity for Beginners

With Bitcoin rebounding from $74,600 lows to $78,662.00, supports around $86,000 come into play if momentum holds. Early 2026’s Bitcoin ETF outflows 2026 saga has faded optimism, but history favors dips as entry points. Think back to post-ETF launch in 2024: initial hype gave way to consolidation, then highs. Today, improved liquidity and ETF maturity position us similarly.

For buy bitcoin dip beginners, the dip to $78,662.00 isn’t a cliff; it’s a ledge. Outflows signal caution, not collapse. Pair this with bullish outlooks, like Fundstrat’s $400,000 and calls, and you see why patient capital wins. This crypto onboarding guide 2026 emphasizes alignment: only invest what aligns with your values and timeline.

Bitcoin (BTC) Price Prediction 2027-2032

Forecasts from 2026 dip (~$78k amid $2.8B ETF outflows), emphasizing recovery via inflows, halving, and adoption

| Year | Minimum Price | Average Price | Maximum Price | YoY % Change (Avg from Prev) |

|---|---|---|---|---|

| 2027 | $75,000 | $120,000 | $180,000 | +41% |

| 2028 | $100,000 | $180,000 | $300,000 | +50% |

| 2029 | $140,000 | $250,000 | $450,000 | +39% |

| 2030 | $180,000 | $350,000 | $650,000 | +40% |

| 2031 | $250,000 | $500,000 | $900,000 | +43% |

| 2032 | $350,000 | $700,000 | $1,200,000 | +40% |

Price Prediction Summary

Bitcoin recovers from 2026 ETF outflows and $78k price low, with average prices climbing to $700k by 2032 amid halving-driven bulls and adoption. Min reflects bearish macro risks; max captures extreme ETF inflow and scarcity scenarios.

Key Factors Affecting Bitcoin Price

- Resumption of Bitcoin ETF inflows post-2026 outflows

- 2028 halving reducing supply issuance

- Growing institutional and sovereign adoption

- Favorable regulatory clarity on ETFs and custody

- Layer-2 scaling improvements enhancing utility

- Macro liquidity cycles and risk-on sentiment

- Halving market cycles and historical patterns

- Competition from altcoins managed by BTC dominance

Disclaimer: Cryptocurrency price predictions are speculative and based on current market analysis.

Actual prices may vary significantly due to market volatility, regulatory changes, and other factors.

Always do your own research before making investment decisions.

Spot Bitcoin vs. ETFs: Choose Your Path Wisely Before Buying the Dip

Diving into spot bitcoin vs etf reveals trade-offs perfect for beginners. Spot Bitcoin means direct ownership via wallets or exchanges: full 24/7 access, no fees beyond trading spreads, but you handle custody. ETFs, like those from BlackRock, simplify via familiar stock tickers, yet cap trading hours and add 0.2-0.4% annual expenses.

Recent BTC price drop February 2026 amplified these differences. Direct holders rode the full volatility; ETF investors faced redemption queues. My advice, drawn from years in ESG-aligned portfolios: start with ETFs for ease if you’re risk-averse, but graduate to spot for control. Safety hinges on diversification; never go all-in on one asset, even at $78,662.00.

Ready to act? Next, we’ll map exact steps to buy safely, from broker selection to position sizing. This dip tests conviction, but with purpose, it forges wealth.

Position sizing starts with self-assessment: determine your risk tolerance and allocate no more than 5-10% of your portfolio to crypto, even at this $78,662.00 entry. Beginners often overlook this, but it’s the bedrock of sustainable growth. Let’s break it down into actionable steps tailored for those eyeing buy bitcoin dip beginners strategies amid the bitcoin etf outflows 2026.

Your Pre-Purchase Safety Net: Essential Checklist for ETF Dip Buyers

Before clicking buy, run through this mental audit. Outflows have made many average positions underwater, but discipline separates winners. I’ve seen portfolios thrive by treating dips not as discounts, but as tests of alignment with long-term values like Bitcoin’s scarcity-driven potential.

Dollar-cost averaging shines here: instead of lump-sum at $78,662.00, spread purchases weekly. This mitigates volatility from events like further outflows or Fed surprises. Pair it with monitoring ETF flows; resumption could propel Bitcoin toward $100,000-plus scenarios analysts outline for late 2026.

Consider tax implications too, a nuance lost on new entrants. ETFs in taxable accounts trigger capital gains on sales, unlike holding spot Bitcoin long-term. For ESG-minded investors like myself, ETFs from firms prioritizing transparent custody add ethical layers, ensuring your dip buy supports responsible finance.

Navigating Risks in the $78,662.00 Era: Common Pitfalls and Pro Tips

The btc price drop February 2026 exposed ETF-specific hurdles: delayed redemptions during stress and premium/discount swings to net asset value. Spot holders dodged some, but faced wallet security burdens. My opinionated take? Hybrid approach: 60% ETF for simplicity, 40% spot for sovereignty, rebalanced quarterly.

Watch liquidity traps. Outflows demand ~27,000 BTC monthly absorption for bullish validation; current $78,662.00 tests that threshold. If supports at $74,600 hold, expect rotation back in. Pro tip: set alerts for inflow reversals via tools like SoSoValue, turning data into your edge.

BlackRock’s strategic buys amid outflows remind us institutions accumulate during fear. Emulate that: view $78,662.00 as your purposeful entry, not a gamble.

Blending these tactics crafts resilience. As Bitcoin digests early 2026 turbulence, your informed moves at $78,662.00 plant seeds for cycles ahead. Purposeful investing isn’t timing the bottom perfectly; it’s building through dips with knowledge and conviction. Stay aligned, stay patient, and watch adoption rewrite the narrative.