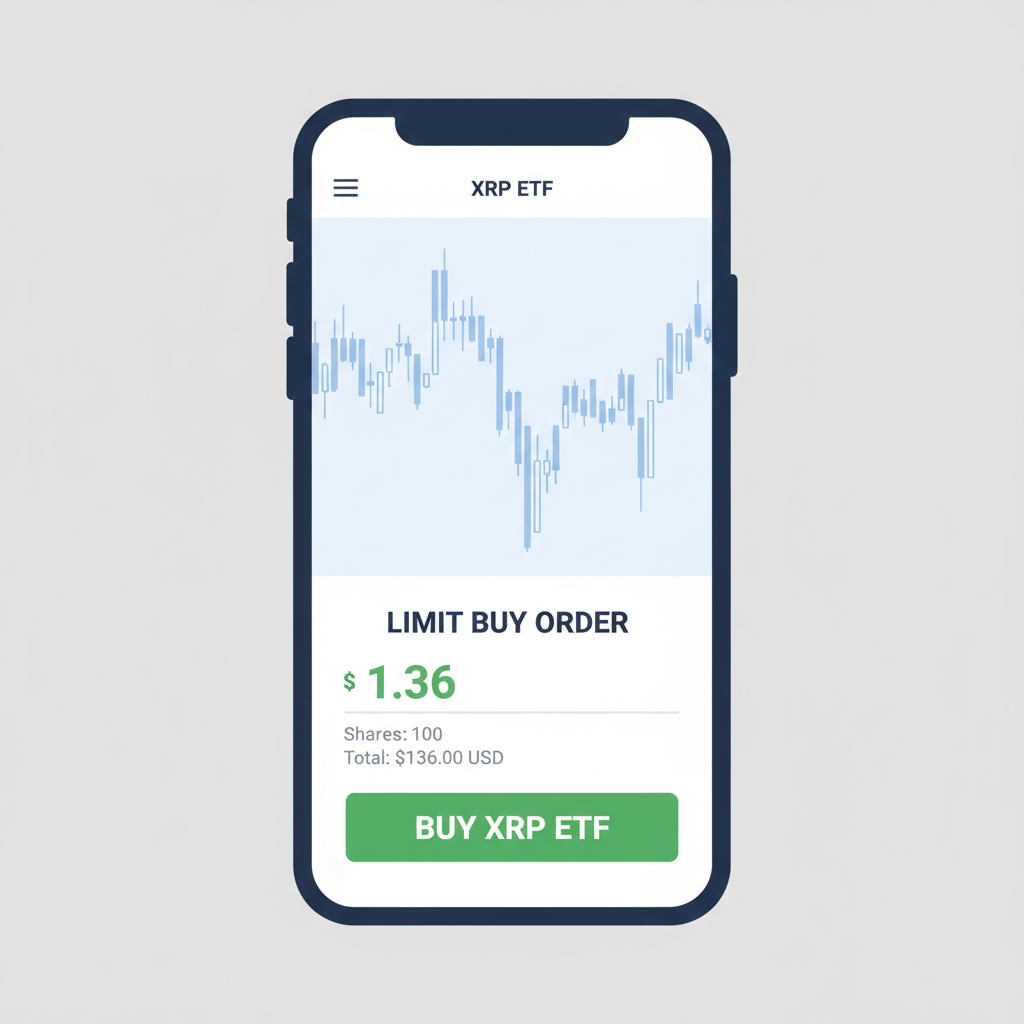

Goldman Sachs’ recent disclosure of a $153 million position in XRP through exchange-traded funds marks a pivotal moment for cryptocurrency accessibility. In its Q4 2025 filing, the Wall Street giant revealed this exposure, part of a broader $2.3 billion crypto portfolio that includes Bitcoin, Ethereum, XRP, and Solana. With XRP trading at $1.36 as of February 13,2026 – down 1.45% over the past 24 hours from a high of $1.41 – this move underscores institutional validation at a time when beginners seek straightforward entry points into digital assets. Traditional investors, wary of direct crypto purchases, now have a regulated pathway that mirrors stock market familiarity.

Such developments lower the barriers that have long deterred newcomers. No need to grapple with private keys, exchange security, or volatile spot trading; ETFs bundle these complexities into a single ticker symbol tradable on major platforms. For those searching for a XRP ETF onboarding guide, Goldman Sachs’ bet exemplifies how institutional crypto ETFs pave the way for beginner crypto buying 2026.

Decoding Goldman Sachs’ $153M XRP Commitment

The filing highlights precision in allocation: $153 million dedicated to XRP ETFs amid consolidating prices near $1.36. This isn’t impulsive speculation; Goldman Sachs, with its FRM-certified risk frameworks, approaches crypto methodically. Their total exposure spans multiple assets, yet XRP’s slice signals targeted interest in Ripple’s payment protocol, known for cross-border efficiency.

Goldman Sachs has disclosed a new position in XRP through regulated exchange-traded funds, reporting roughly $153 million of exposure.

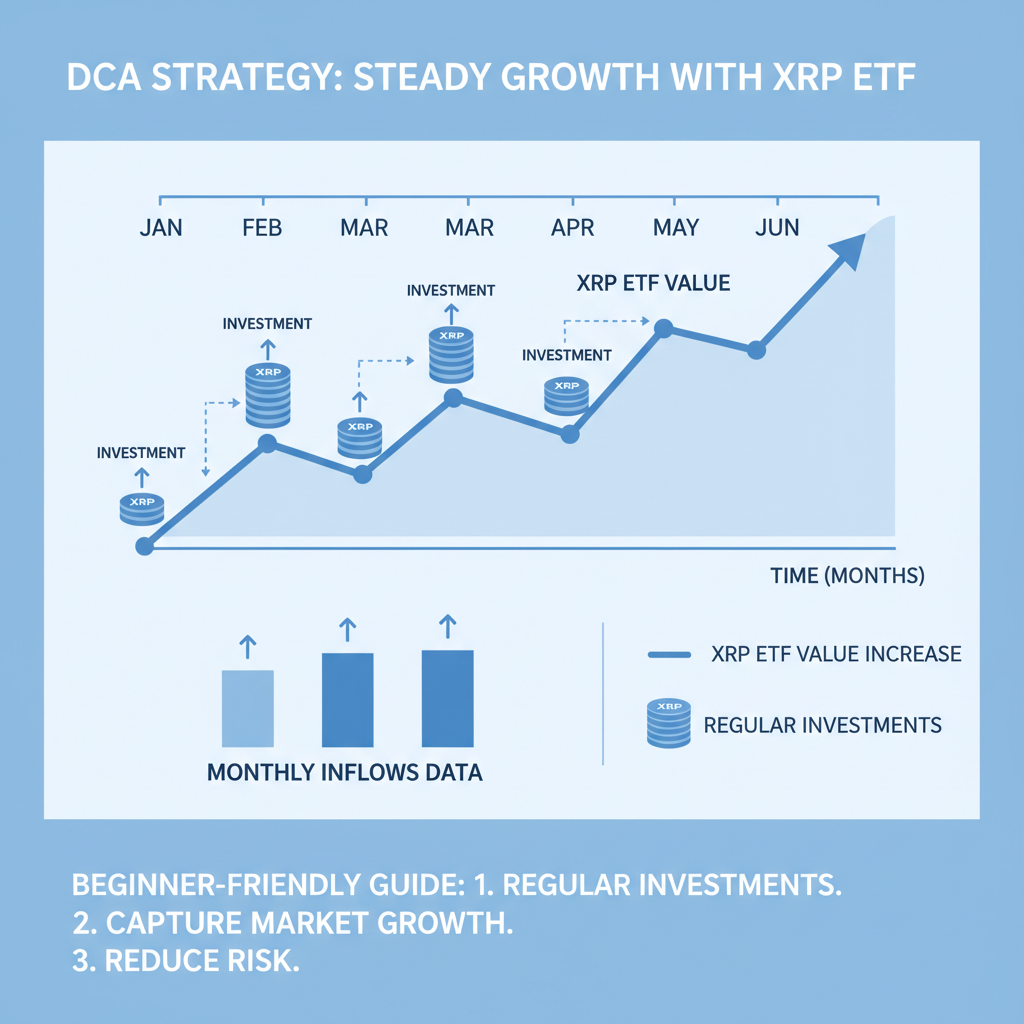

This positions XRP favorably against peers. While Bitcoin and Ethereum ETFs dominate inflows, XRP’s products have absorbed $1.3 billion since mid-November 2025 launches – 43 straight days of positive flows. Weekly net inflows hit $38.1 million in early 2026, challenging Bitcoin’s dominance with surging volumes. Analysts tie this to regulatory tailwinds, including post-shutdown ETF approval waves.

Institutional Inflows Propel XRP ETFs Past Expectations

Entering 2026, XRP ETFs have outpaced Bitcoin in inflow velocity, drawing $1.3 billion in 50 days. This institutional demand – amplified by Goldman Sachs’ Goldman Sachs XRP investment 2026 – reflects maturing infrastructure. Products from Res-Osprey and others have stabilized XRP at $1.36, holding against altcoin peers despite a 25% prior surge.

Data shows resilience: zero outflow days amid broader market dips. For beginners eyeing buy XRP ETF beginners strategies, these metrics offer quantifiable confidence. Compare to direct holdings, where 24-hour volatility swings from $1.34 to $1.41 demand constant vigilance; ETFs abstract that away via professional custodians.

| Asset | ETF Inflows (2026 YTD) | Key Milestone |

|---|---|---|

| XRP | $1.3B | 43 consecutive inflow days |

| Bitcoin | Trailing XRP | Established but slower growth |

| Ethereum | Strong but secondary | Complements XRP’s utility focus |

Regulatory clarity post-2025 approvals has funneled $1.3 billion institutionally, per reports. Goldman Sachs’ stake amplifies this, signaling to retail investors that XRP merits portfolio consideration without the onboarding friction of wallets or KYC-heavy exchanges.

Streamlining Onboarding: ETFs Over Direct Crypto Purchases

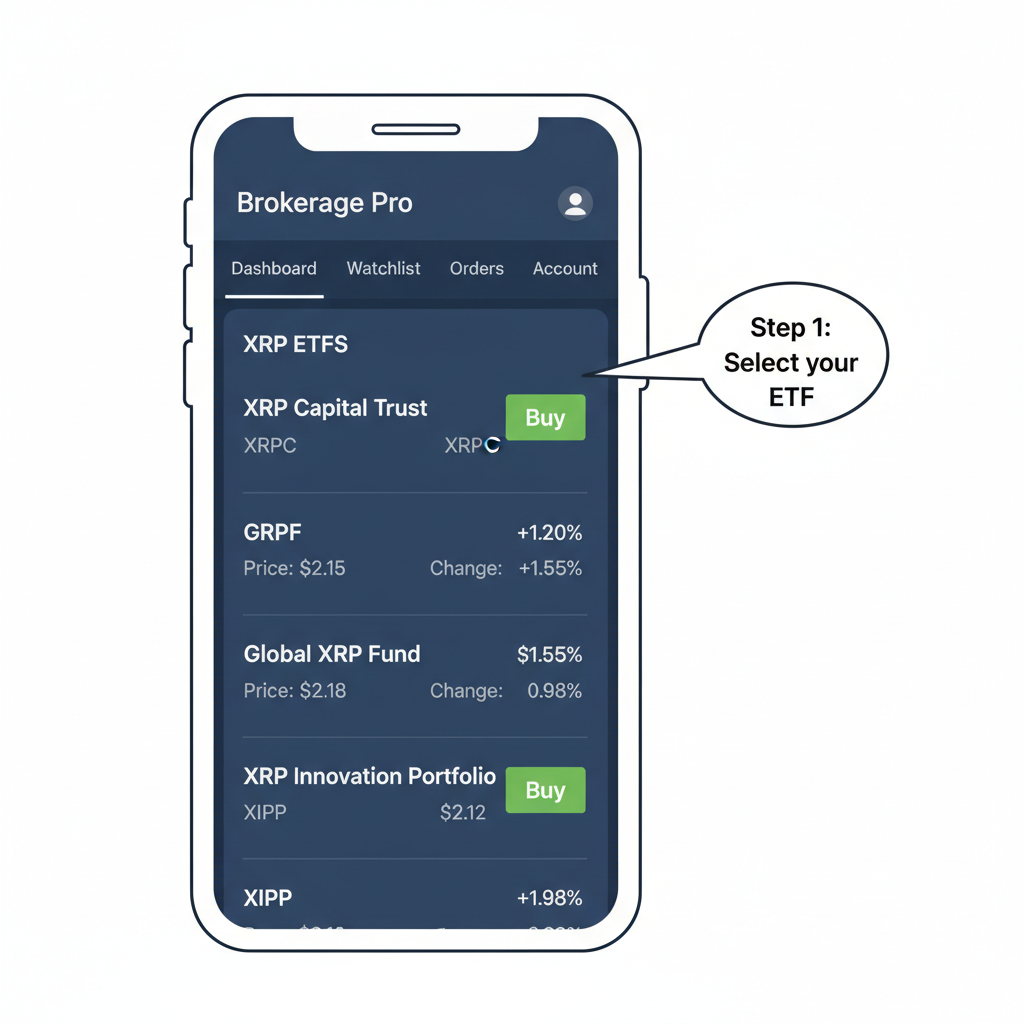

Imagine buying stocks via your brokerage app – that’s the ETF promise for crypto. Goldman Sachs’ involvement assures compliance layers absent in spot markets. Beginners avoid pitfalls like phishing scams or lost seed phrases; instead, they trade XRP exposure during market hours, with dividend-like liquidity.

For XRP ETF onboarding guide seekers, the process mirrors Vanguard funds: select ticker, set limit order, done. This step-by-step accessibility democratizes gains from XRP’s $1.36 base, where institutional bids provide downside protection.

XRP Price Prediction 2027-2032

Projections influenced by Goldman Sachs’ $153M ETF stake, $1.3B inflows, regulatory clarity, and institutional adoption amid 2026 market consolidation near $1.36-$3.10

| Year | Minimum Price | Average Price | Maximum Price | YoY % Change (Avg from Prev Year) |

|---|---|---|---|---|

| 2027 | $2.80 | $5.00 | $8.00 | +61% |

| 2028 | $4.50 | $8.00 | $12.50 | +60% |

| 2029 | $6.50 | $11.00 | $17.00 | +38% |

| 2030 | $9.00 | $15.00 | $23.00 | +36% |

| 2031 | $12.00 | $20.00 | $30.00 | +33% |

| 2032 | $16.00 | $27.00 | $40.00 | +35% |

Price Prediction Summary

XRP’s outlook for 2027-2032 is strongly bullish, with average prices projected to grow from $5.00 to $27.00, driven by sustained ETF inflows surpassing Bitcoin, Goldman Sachs’ exposure, regulatory tailwinds, and Ripple’s payment utility. Min/Max ranges account for bearish corrections (e.g., market cycles) and extreme bull scenarios (institutional FOMO).

Key Factors Affecting XRP Price

- Goldman Sachs’ $153M XRP ETF position simplifying institutional and retail onboarding

- Record $1.3B XRP ETF inflows in early 2026 with 43 consecutive positive days

- Regulatory clarity from 2025-2026 ETF approvals and potential US policy shifts

- Rising institutional demand challenging Bitcoin dominance

- Ripple’s cross-border payment adoption and tech upgrades

- Broader crypto market cycles with halving effects and macro trends

Disclaimer: Cryptocurrency price predictions are speculative and based on current market analysis.

Actual prices may vary significantly due to market volatility, regulatory changes, and other factors.

Always do your own research before making investment decisions.

Predictions hinge on sustained inflows and XRP’s utility in payments, but methodical risk assessment remains key. At $1.36, with a 24-hour range of $1.34 to $1.41, downside buffers from ETF custodians appeal to conservative entrants.

Risk-Adjusted Entry for Beginners

Goldman Sachs’ Goldman Sachs XRP investment 2026 isn’t blind optimism; it’s calibrated exposure within a $2.3 billion crypto basket. For novices, this translates to diversified risk: XRP ETFs cap volatility through daily rebalancing, unlike spot holdings that swung 1.45% yesterday alone. Historical data post-ETF launches shows reduced drawdowns – XRP stabilized amid $1.3 billion inflows, defying broader dips.

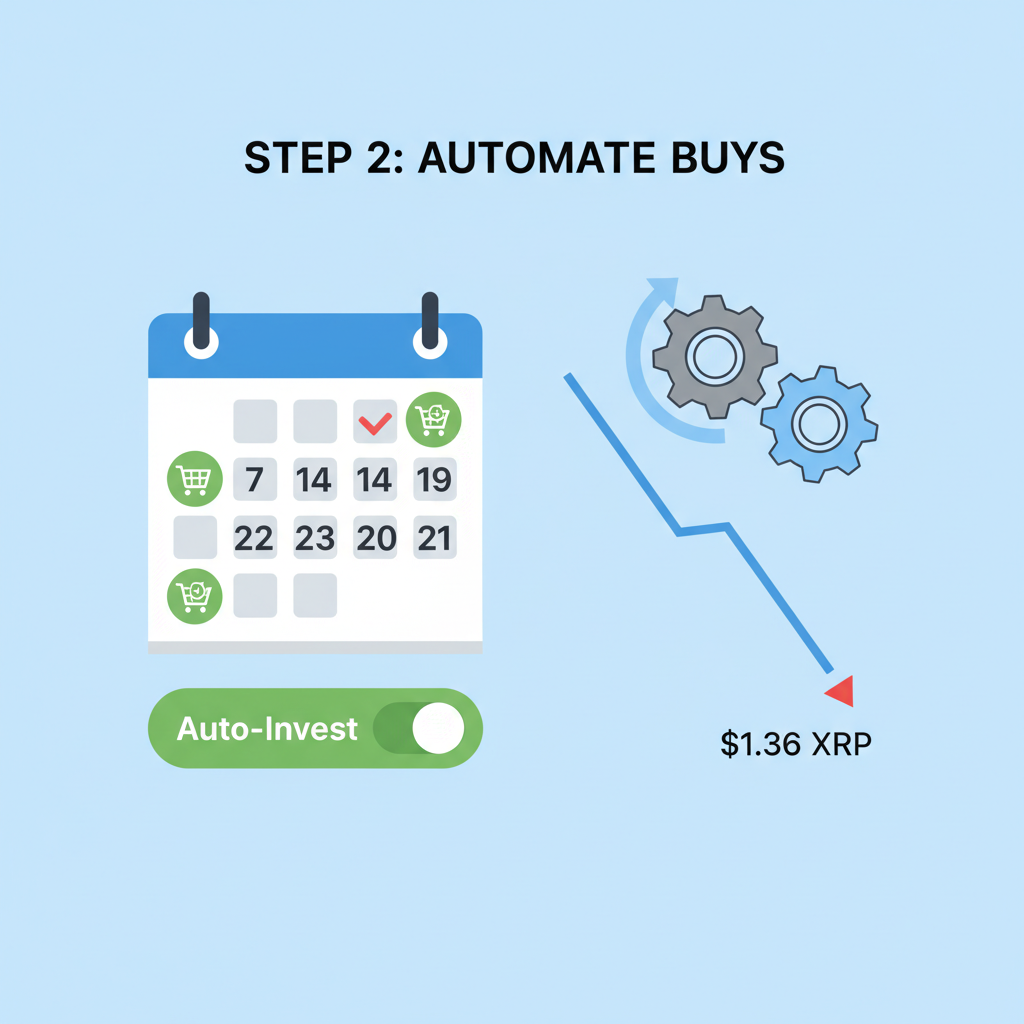

Consider the metrics: 43 consecutive inflow days signal demand persistence, yet Goldman Sachs allocates just $153 million to XRP amid broader holdings. This discipline suits beginners, who can allocate 5-10% of portfolios without overexposure. Volatility at current levels – $1.36 base with tight ranges – favors dollar-cost averaging via ETFs over lump-sum spot buys.

Institutional crypto ETFs like these enforce transparency absent in direct trades. Beginners gain SIPC protection parallels, audited holdings, and 9: 30 AM-4 PM trading windows – a far cry from 24/7 exchange frenzy.

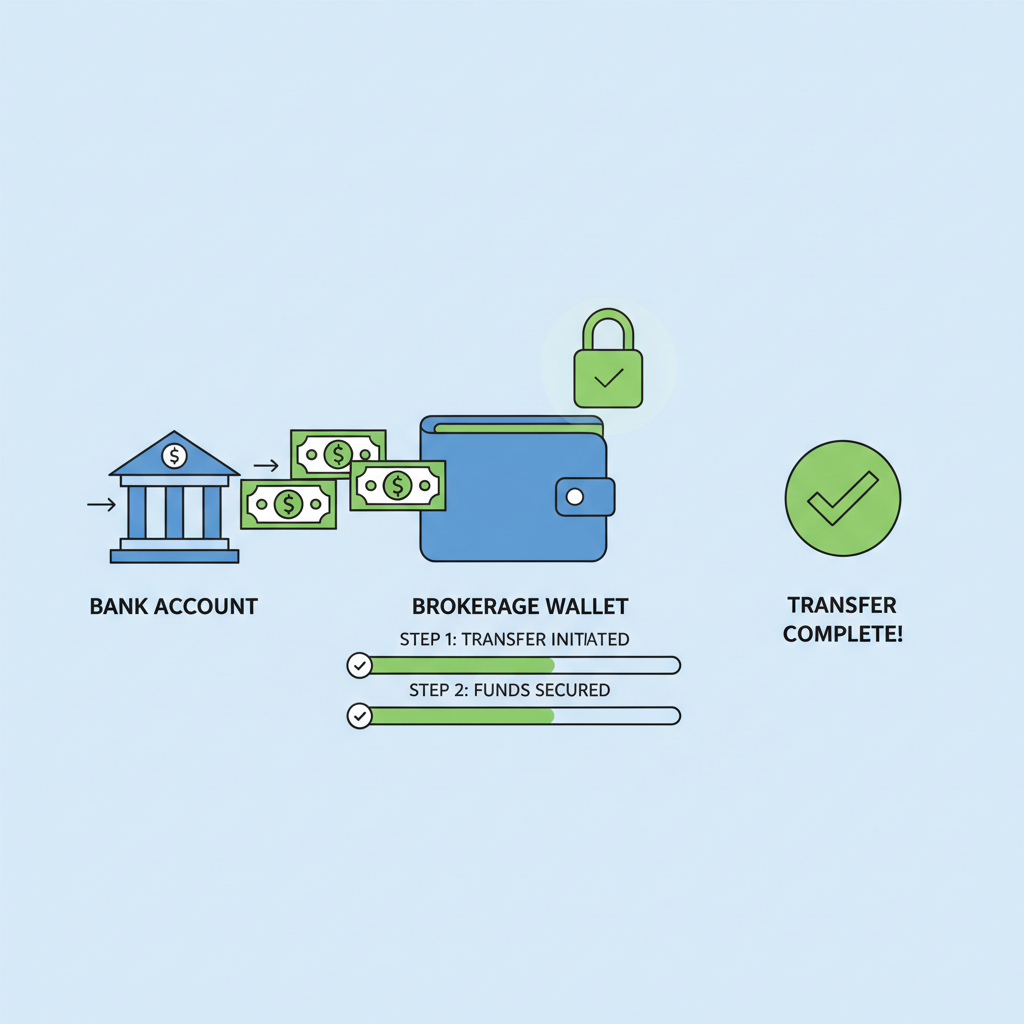

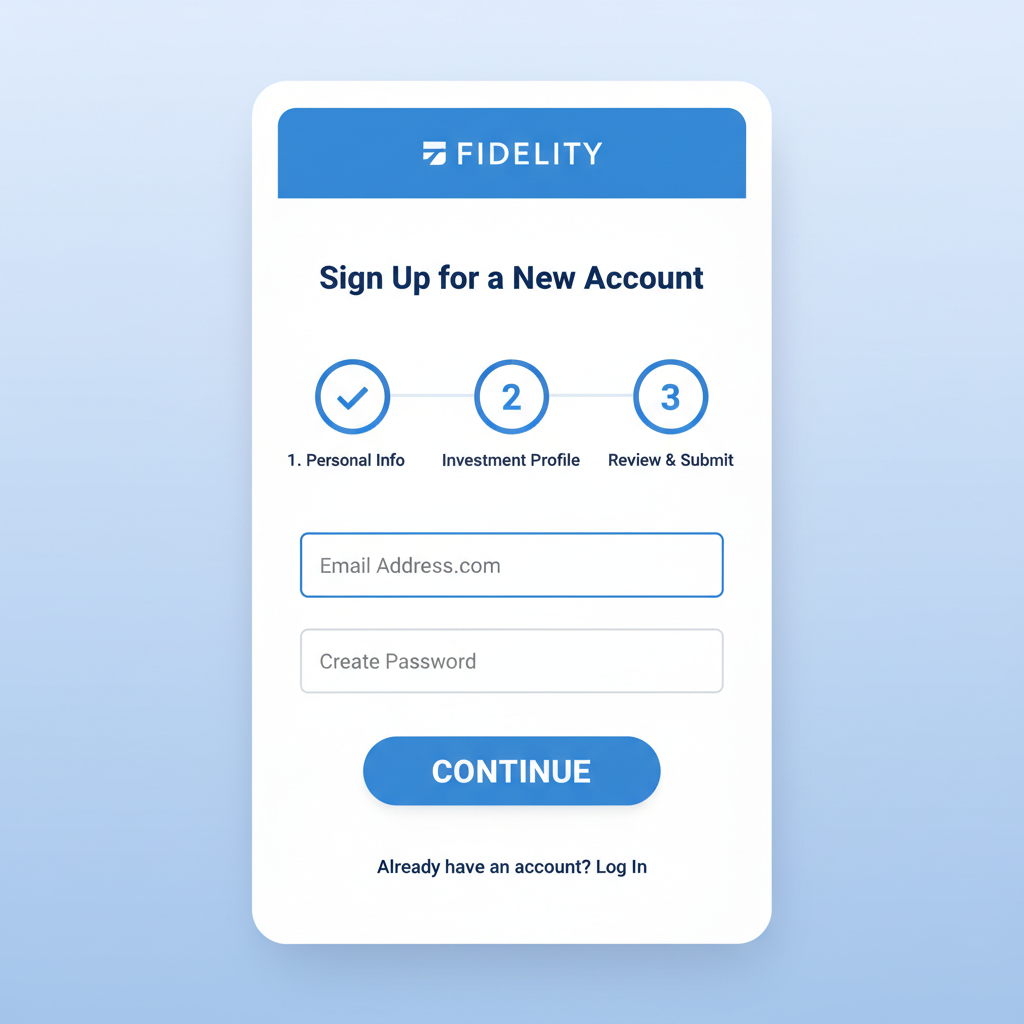

Practical Steps: Buy XRP ETF Beginners Guide

Transitioning to crypto via ETFs mirrors equity onboarding. No downloads, no wallets; just a brokerage account. Goldman Sachs’ validation boosts confidence, as their $153 million stake underscores vetted access at $1.36 price levels.

This structured approach aligns with my motto: plan the trade, trade the plan. Set stops below $1.34 lows, targets above recent $1.41 highs, leveraging ETF liquidity for exits.

Post-purchase, track via apps showing real-time $1.36 quotes and $38.1 million weekly inflows. Such tools quantify beginner crypto buying 2026, turning abstract hype into executable strategy.

Addressing Common Hurdles

These clarifications dismantle barriers. With XRP holding $1.36 amid -1.45% daily flux, ETFs from Res-Osprey deliver on promise: institutional-grade access without the grind. Goldman Sachs’ measured bet, alongside surging volumes, positions 2026 as the year retail joins the fray seamlessly.

Forward momentum builds on regulatory wins and $1.3 billion capital. Beginners, armed with ETF tickers and inflow data, step in methodically – capturing upside from a token proven in payments, now Wall Street-endorsed.

XRP Technical Analysis Chart

Analysis by Elena Prescott | Symbol: BINANCE:XRPUSDT | Interval: 1h | Drawings: 9

Technical Analysis Summary

To annotate this XRPUSDT chart in my systematic style: 1. Draw a primary downtrend line connecting the swing high at 2026-01-15 (~$2.40) to the recent high at 2026-02-05 (~$1.80), extending forward. 2. Add an uptrend line from the major low at 2026-01-25 (~$1.00) to the pullback low at 2026-02-13 (~$1.34). 3. Mark horizontal support at $1.34 (24h low, strong), $1.30 (prior low), resistance at $1.41 (24h high), $1.50 (50% fib retrace), $1.80. 4. Use fib_retracement from $1.00 low to $2.40 high. 5. Rectangle for consolidation zone $1.34-$1.41 last few days. 6. Arrow up at volume spike on bounce from $1.00. 7. Callout on MACD bullish crossover near Jan 25 low. 8. Vertical line at 2026-02-13 for current context. Label all with confidence % and risk notes. Keep clean: black lines for trends, blue for support, red for resistance.

Risk Assessment: medium

Analysis: High volatility from news/ETFs, but structured support and bullish indicators mitigate; aligns with medium tolerance

Elena Prescott’s Recommendation: Long bias with tight stops; scale in on dips to $1.34. Monitor ETF inflows for confirmation. Plan the trade: 1% risk max.

Key Support & Resistance Levels

📈 Support Levels:

-

$1.34 – 24h low and recent consolidation base, volume-backed

strong -

$1.3 – Psychological + prior test level

moderate -

$1 – Major cycle low, fib 0.618

strong

📉 Resistance Levels:

-

$1.41 – 24h high, initial breakout hurdle

moderate -

$1.5 – 50% fib retrace of drop from $1.80

strong -

$1.8 – Recent swing high, downtrend touch

strong

Trading Zones (medium risk tolerance)

🎯 Entry Zones:

-

$1.37 – Break above consolidation high with volume, aligning with uptrend and ETF momentum

medium risk -

$1.34 – Dip buy at strong support if holds, lower risk entry

low risk

🚪 Exit Zones:

-

$1.5 – Initial profit target at fib 50%, trail stops

💰 profit target -

$1.8 – Extended target at prior high

💰 profit target -

$1.28 – Below support invalidates, 1:2 RR

🛡️ stop loss

Technical Indicators Analysis

📊 Volume Analysis:

Pattern: Bullish spike on bounce from $1.00, drying up on pullback

Confirms accumulation at lows, lack of distribution volume supports upside

📈 MACD Analysis:

Signal: Bullish crossover

MACD line crossed signal from below near Jan 25 low, histogram expanding positively

Applied TradingView Drawing Utilities

This chart analysis utilizes the following professional drawing tools:

Disclaimer: This technical analysis by Elena Prescott is for educational purposes only and should not be considered as financial advice.

Trading involves risk, and you should always do your own research before making investment decisions.

Past performance does not guarantee future results. The analysis reflects the author’s personal methodology and risk tolerance (medium).