In the ever-evolving world of cryptocurrency investments, a bold move from Trump Media and Technology Group through its Truth Social Funds arm has captured attention. As Bitcoin holds steady at $70,582.00, with a modest 24-hour gain of and $821.00, filings for two new ETFs promise easier access for beginners. The Truth Social Bitcoin and Ether ETF and the Truth Social Cronos Yield Maximizer ETF could blend digital assets with familiar stock market tools, even as spot Bitcoin ETFs face $360 million in recent outflows.

This development arrives at a pivotal moment in 2026. Truth Social Funds seeks to offer a 60% Bitcoin and 40% Ethereum allocation in one fund, incorporating Ethereum staking rewards to boost potential returns. The Cronos-focused ETF targets yield through staking the CRO token, native to the Crypto. com ecosystem. Both carry a 0.95% management fee and rely on Crypto. com for custody and liquidity. For newcomers, these filings signal a maturing crypto landscape, where branded ETFs might lower barriers to entry.

Why Truth Social’s ETFs Matter for Purposeful Investing

From my vantage as a fundamental analyst, these ETFs represent more than hype; they align with a vision of democratizing finance. Trump Media’s push via Truth Social Funds taps into a brand known for disruption, potentially drawing retail investors wary of direct crypto custody. Imagine gaining Bitcoin exposure at $70,582.00 alongside Ethereum staking yields, all without managing private keys. The Cronos Yield Maximizer adds a yield-generating twist, appealing to those seeking income in volatile markets.

Yet context matters. These products are pending SEC approval and won’t trade immediately. Custody by Crypto. com and advising by Yorkville America Equities add layers of institutional credibility. In a market where BlackRock’s IBIT saw significant withdrawals, Truth Social’s entry could refresh interest, offering diversified crypto baskets over single-asset bets.

Beginners often overlook how ETFs simplify exposure. Unlike spot buying on exchanges, ETFs trade like stocks during market hours, with liquidity from authorized participants. This structure mitigates some risks, though crypto’s volatility persists. Bitcoin’s current resilience above $70,000 underscores long-term potential, even amid outflows signaling profit-taking or rotation.

Deciphering 2026 ETF Outflows and Opportunities

Recent data reveals $360 million in net outflows from U. S. spot Bitcoin ETFs over the past week, a stark reminder of market cycles. Factors include profit realization after Bitcoin’s climb, macroeconomic shifts, or preference for yield-bearing alternatives. BlackRock’s IBIT led with substantial withdrawals, yet overall crypto adoption grows. For thoughtful investors, outflows create entry points; lower inflows might temper prices short-term but build foundations for rallies.

Staying informed on SEC progress is key. Regulatory green lights have historically sparked inflows; Grayscale’s conversion proved that. With Bitcoin at $70,582.00, positioning ahead of approvals demands patience and preparation.

Step-by-Step Guide to Buying Crypto ETFs: Getting Started

For absolute beginners, the path begins with foundational steps. First, assess your risk tolerance. Crypto ETFs, even pending ones like Truth Social’s, amplify market swings; allocate no more than 5-10% of your portfolio initially. Open a brokerage account suited for ETFs, such as those offering commission-free trades and fractional shares. Vanguard, Fidelity, or Schwab provide robust platforms with educational resources.

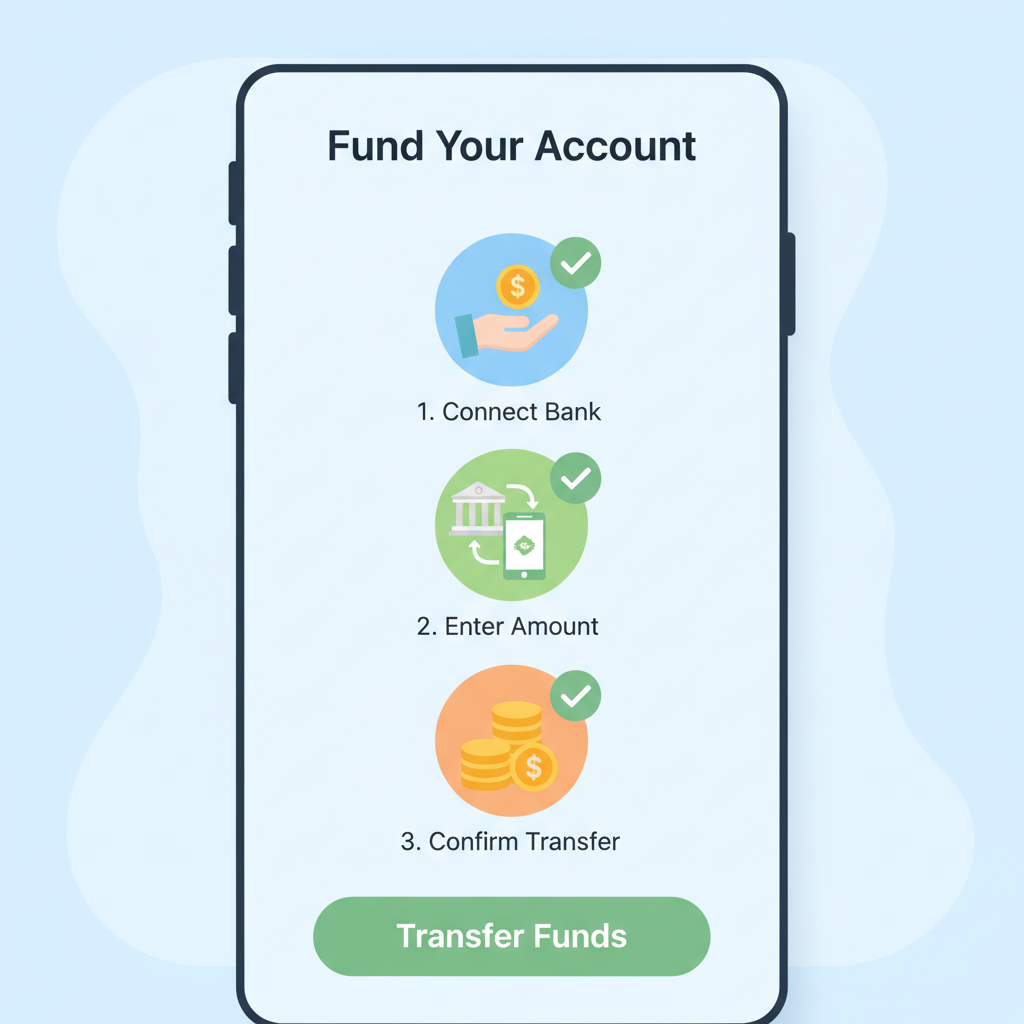

Verify account funding methods: link a bank for ACH transfers, avoiding high-fee wires. Enable two-factor authentication for security. Next, familiarize yourself with ticker symbols once approved; monitor SEC filings via EDGAR for updates. Practice with paper trading if available, simulating buys of similar ETFs like BlackRock’s IBIT.

Research tax implications early. ETF gains qualify for long-term capital rates if held over a year, unlike direct crypto trades. Use tools like cost-basis tracking in your broker to stay compliant.

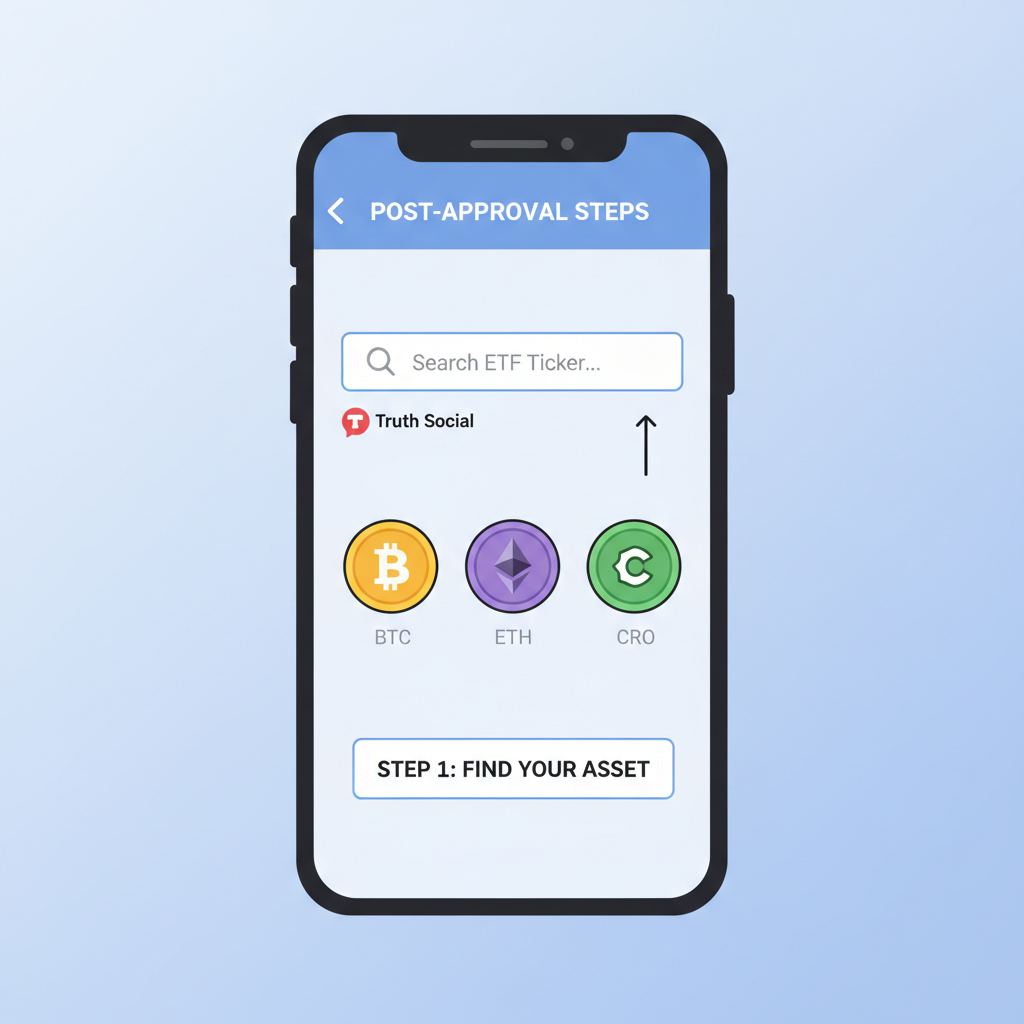

Once your account is set up, dive into the search for comparable ETFs to build confidence. Enter tickers like IBIT or ETHA to review charts, holdings, and performance metrics. This rehearsal sharpens your instincts for when Truth Social’s offerings launch with their unique 60/40 BTC-ETH split and CRO yield focus.

With the foundation laid, executing a purchase mirrors buying any stock. Post-SEC approval, locate the ETF under its ticker in your broker’s search bar. Opt for a limit order to control your entry price, especially if Bitcoin hovers near $70,582.00 amid volatility. Confirm the trade size aligns with your allocation strategy, then submit during market hours for optimal liquidity.

Navigating Risks and Maximizing Returns in Volatile Times

Crypto ETFs streamline access but don’t eliminate inherent risks. Price swings tied to Bitcoin’s $70,582.00 level can test resolve, particularly with recent outflows reflecting broader caution. I advise dollar-cost averaging: invest fixed amounts weekly to smooth entry points, turning outflows into gradual opportunities. The staking elements in Truth Social’s ETH and CRO funds offer a buffer, potentially yielding 3-5% annually, depending on network conditions, far surpassing traditional fixed-income in this era.

From an ESG lens, scrutinize custodians like Crypto. com for security audits and sustainability practices. Yorkville America Equities’ role as adviser suggests rigorous oversight, yet diversification remains paramount. Pair these ETFs with stable assets; a 5% stake in Truth Social’s Bitcoin and Ether fund could complement a balanced portfolio, capturing upside while limiting downside.

Truth Social Bitcoin & Ether ETF vs Cronos Yield Maximizer vs BlackRock IBIT

| Feature | Truth Social Bitcoin & Ether ETF | Truth Social Cronos Yield Maximizer ETF | BlackRock IBIT |

|---|---|---|---|

| Asset Allocation | 60% BTC ($70,582), 40% ETH | 100% CRO (Cronos) | 100% BTC |

| Staking | Yes (ETH rewards on 40%) | Yes (CRO staking for yield) | No |

| Management Fee | 0.95% | 0.95% | N/A |

| Custodian | Crypto.com | Crypto.com | N/A |

| Status | Pending SEC approval | Pending SEC approval | Live (spot BTC ETF) |

| Market Context | Exposure to BTC/ETH with staking amid outflows | CRO-focused yield amid outflows | $360M weekly BTC ETF outflows IBIT leads with $157.56M |

Outflows from incumbents like BlackRock’s IBIT, totaling $360 million last week, highlight rotation toward innovative products. Truth Social’s filings, with their yield maximization, position them as fresh alternatives. Beginners benefit from this competition, fostering lower fees and better features over time. Track on-chain metrics for CRO staking efficiency and Ethereum validator performance to gauge real-world yields.

Monitoring post-purchase involves more than price checks. Set alerts for SEC updates, fee waivers, or AUM growth, which signal institutional buy-in. Rebalance quarterly, selling high performers like a surging CRO allocation to fund Bitcoin at dips below $70,582.00. Tools within brokers often automate this, freeing you to focus on the bigger picture: building wealth aligned with disruptive innovation.

As these ETFs await approval, reflect on your why. Trump Media’s Truth Social brand evokes boldness, mirroring crypto’s ethos. In a market rewarding patience, these funds could bridge traditional finance with blockchain’s promise. Start small, learn continuously, and invest not just for returns, but for a future where digital assets empower purposeful growth. With Bitcoin’s steady poise and staking innovations, the path forward feels ripe for newcomers ready to step in thoughtfully.