As Sui’s native token trades at $0.9110 with a modest 24-hour dip of -0.0478%, traditional investors now have a straightforward path to exposure through two groundbreaking products: Canary Capital’s Staked SUI ETF (SUIS) on Nasdaq and Grayscale’s Sui Staking ETF (GSUI) on NYSE Arca. These ETFs hold physical SUI tokens, stake them on the Sui Network for yields, and reflect net staking rewards in their net asset value. For beginners eyeing altcoin growth in 2026, this regulated entry beats fumbling with wallets and validators.

Sui Network has quietly built momentum as a high-throughput layer-1 blockchain, processing over 100,000 transactions per second in tests. Its object-centric model solves scalability pains plaguing older chains. With SUI at $0.9110, down slightly from a 24-hour high of $0.9720, these ETFs arrive at a pivotal moment. Canary’s SUIS, the first U. S. -listed spot staked SUI ETF, tracks the spot price while capturing staking rewards net of fees. Grayscale’s GSUI mirrors this on NYSE Arca, charging a 0.35% annual fee waived for the first three months or until $1 billion in assets.

SUI Staking ETFs Demystified: Key Features and Differences

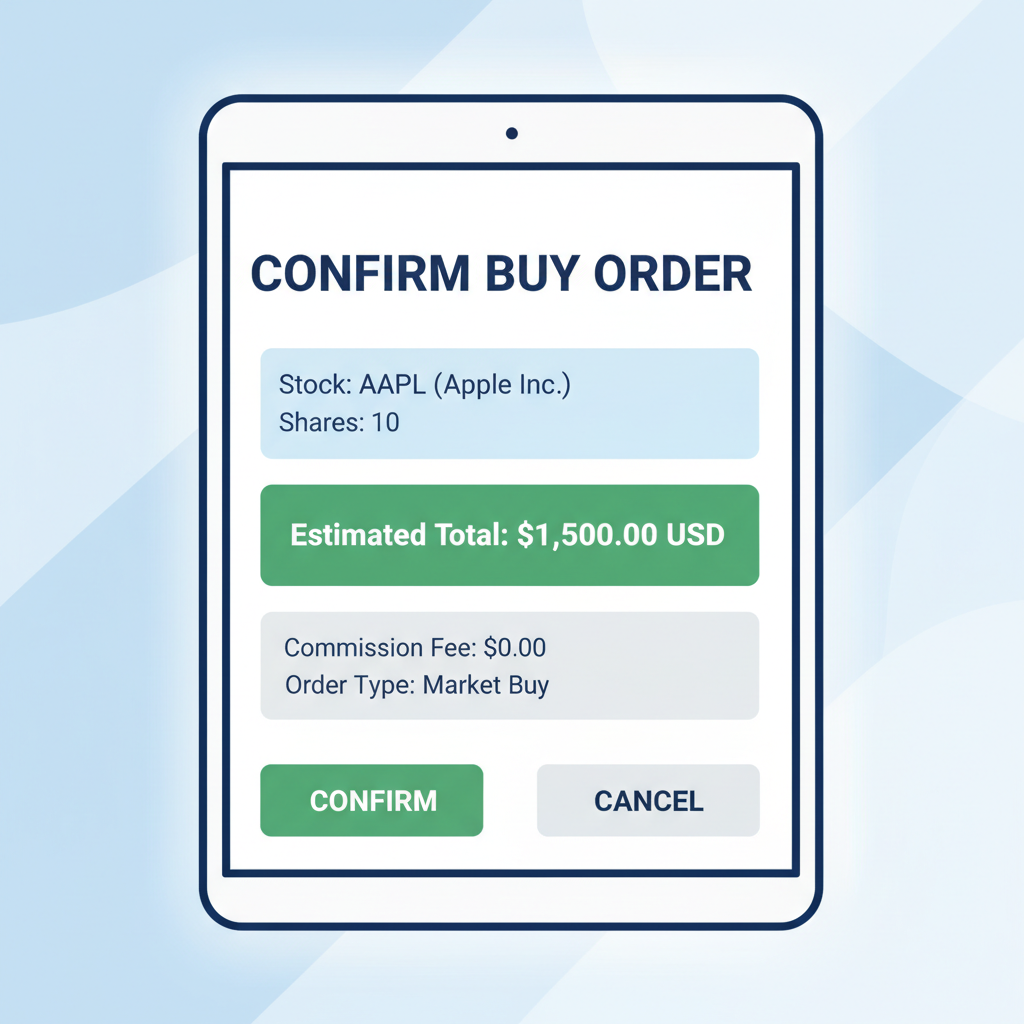

Let’s break down the mechanics methodically. Both funds custody SUI tokens with qualified custodians and delegate them to validators on Sui’s Proof-of-Stake network. Staking yields, typically 3-5% annually based on network participation rates, accrue daily and boost the ETF’s NAV. No need for you to run nodes or worry about slashing risks; the issuers handle that.

Canary’s SUIS emphasizes simplicity for Nasdaq traders, mirroring SUI’s spot price with staking uplift. Grayscale’s GSUI, live on NYSE Arca, leverages the firm’s crypto expertise since Bitcoin’s early days. Fee structures favor early adopters: Grayscale’s waiver creates a low-cost window, while Canary passes net rewards directly. Current data shows SUI’s 24-hour range from $0.8985 to $0.9720, underscoring the ETFs’ appeal for capturing volatility without direct holdings.

Investors who believe in the potential of the Sui Network can get direct spot exposure to SUI, with staking, on Nasdaq via SUIS.

In my analysis, GSUI edges out for institutional-grade custody, but SUIS suits retail Nasdaq flows. Track both against SUI’s $0.9110 price to spot premium or discount opportunities.

Why SUI Staking ETFs Fit Beginner Portfolios in 2026

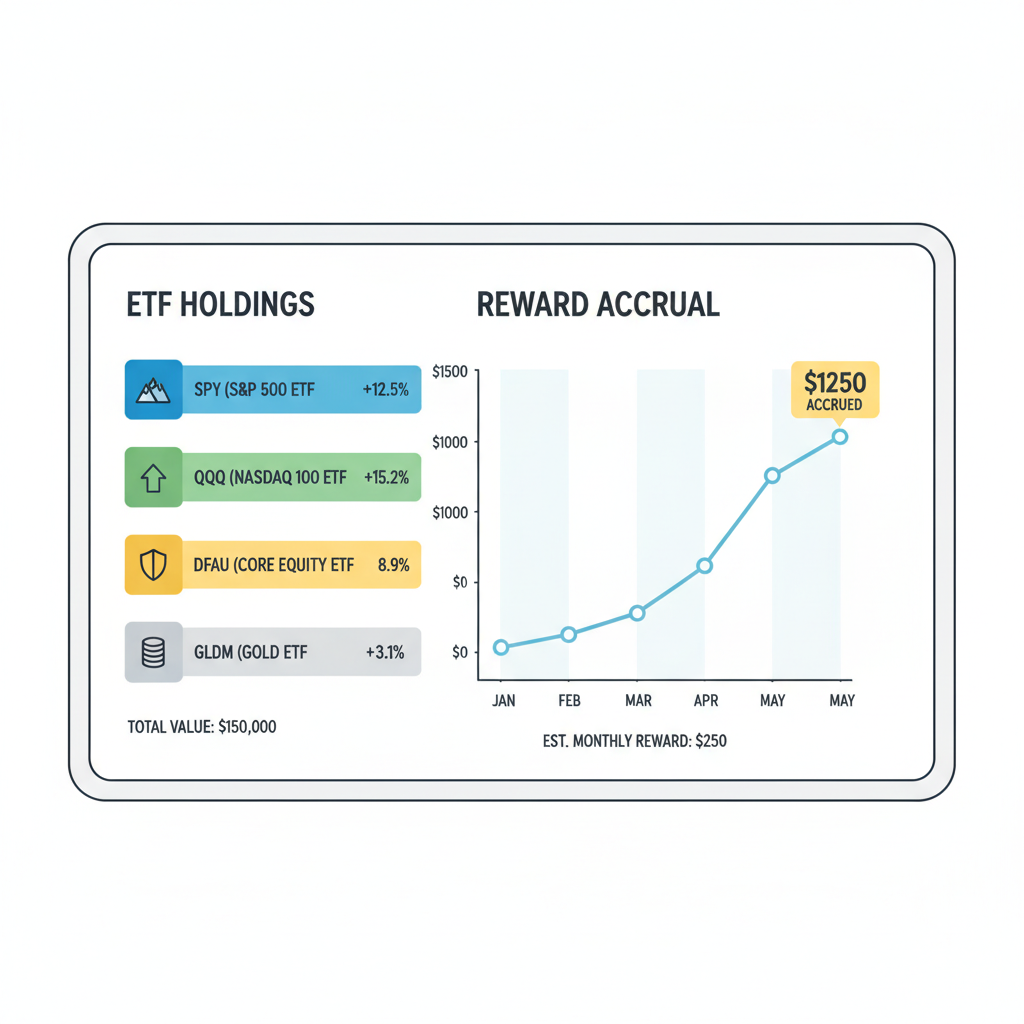

Altcoins like SUI offer asymmetric upside versus Bitcoin or Ethereum, yet most beginners shy away due to complexity. These ETFs change that equation. Sui’s ecosystem boasts DeFi protocols, gaming dApps, and NFT marketplaces scaling effortlessly. With TVL surpassing $1 billion recently, network activity signals real adoption.

Staking adds passive income: expect net yields of 2.5-4% after fees, compounding your exposure. At $0.9110, SUI sits 70% below its all-time high, primed for recovery if layer-1 narratives rebound. Regulatory wrappers mean brokerage access via IRAs or 401(k)s, sidestepping crypto exchange hacks.

Compare to direct staking: ETFs eliminate 32-EPOCH lockups and delegation choices. Data from launches shows immediate trading volume, with SUIS and GSUI debuting amid stable markets. For beginner SUI investment 2026, this is passive alpha without the hassle.

Sui (SUI) Price Prediction 2027-2032

Forecasts driven by SUI staking ETF launches (SUIS on Nasdaq, GSUI on NYSE Arca), network growth, and market cycles from current price of $0.91 (Feb 2026)

| Year | Minimum Price | Average Price | Maximum Price | YoY % Change (Avg from prior year) |

|---|---|---|---|---|

| 2027 | $1.80 | $3.20 | $5.80 | +94% (from 2026 avg ~$1.65) |

| 2028 | $2.80 | $5.40 | $9.50 | +69% |

| 2029 | $3.50 | $6.00 | $10.00 | +11% |

| 2030 | $4.50 | $9.00 | $14.00 | +50% |

| 2031 | $6.00 | $12.00 | $19.00 | +33% |

| 2032 | $8.00 | $16.00 | $25.00 | +33% |

Price Prediction Summary

SUI price is projected to grow substantially from 2026 levels due to institutional adoption via Canary’s SUIS and Grayscale’s GSUI staking ETFs, which offer regulated exposure and staking yields. Average prices are expected to rise progressively to $16.00 by 2032 in base case, with bullish maxima up to $25.00 amid adoption surges and bearish minima reflecting potential corrections.

Key Factors Affecting Sui Price

- Institutional inflows from SUIS (Nasdaq) and GSUI (NYSE Arca) ETFs with integrated staking rewards

- Sui Network expansion in DeFi, gaming, and high-throughput applications

- Bullish market cycles influenced by Bitcoin trends and halvings

- Regulatory tailwinds for crypto ETFs and staking products

- Technological upgrades enhancing scalability and object-centric model

- Risks from L1 competition (e.g., Solana, Aptos) and macroeconomic volatility

Disclaimer: Cryptocurrency price predictions are speculative and based on current market analysis.

Actual prices may vary significantly due to market volatility, regulatory changes, and other factors.

Always do your own research before making investment decisions.

Preparing Your Brokerage Account for SUIS and GSUI Purchases[/h2>

Buying these SUI staking ETFs mirrors stock trades. Start with a brokerage supporting NYSE Arca and Nasdaq: Fidelity, Schwab, or Interactive Brokers work seamlessly. Verify options trading if hedging, but spot buys suffice for starters.

Fund your account via ACH or wire; aim for diversification at 5-10% portfolio allocation given SUI’s $0.9110 volatility. Search tickers SUIS or GSUI in the platform’s equity screener. Pre-market data hinted at tight spreads, confirming liquidity from day one.

Review order types: market orders execute instantly at $0.9110 equivalent, while limit orders let you set entry below the 24-hour low of $0.8985 for value hunting. Confirm share prices track SUI closely, with staking uplift visible in daily NAV updates.

Step-by-Step: Buying Your First SUI Staking ETF

Once positioned, monitor performance against SUI’s spot price. These ETFs trade like stocks, so use stop-losses at 10% below entry to manage downside from the current $0.9110 level. Data from launch days shows premiums under 1%, a boon for arbitrage-minded beginners.

GSUI is live on NYSE Arca. The Grayscale Sui Staking ETF gives investors direct SUI exposure plus staking rewards through a regulated, exchange-traded product.

SUIS vs GSUI Head-to-Head: A Data-Driven Comparison

| Feature | SUIS (Canary) | GSUI (Grayscale) | Winner/Notes |

|---|---|---|---|

| Exchange | Nasdaq 🟢 | NYSE Arca 🔵 | Preference-based |

| Ticker | SUIS | GSUI | |

| Management Fee | Net rewards passed through ✅ | 0.35% waived first 3 months or $1B AUM 📈 | SUIS lower effective long-term |

| Staking Yield | Net 3-5% | Net 3-5% | Both ⚖️ |

| Custody | Qualified custodians | Qualified custodians | Both ✅ |

| Liquidity | High launch volume expected | High launch volume expected | Both 🚀 |

| Pros & Cons | ✅ Pros: Lower effective fees long-term, Nasdaq HFT-friendly ❌ Cons: Newer issuer |

✅ Pros: Grayscale brand, fee waiver short-term ❌ Cons: Higher base fee |

Investor choice |

Grayscale’s fee waiver tilts short-term value toward GSUI, especially if inflows hit $1 billion fast. Canary’s Nasdaq listing favors high-frequency traders. At SUI’s $0.9110 price, a 4% net yield adds $0.0364 annually per token equivalent, compounding edges over plain spot ETFs.

Risk management anchors any plan. SUI’s 24-hour volatility at -0.0478% masks beta to broader crypto cycles; expect 50-70% drawdowns in bears. Allocate no more than 5% initially, rebalance quarterly. Diversify with Bitcoin ETFs for stability. Slashing risks stay minimal via professional delegation, per network stats under 0.1% annually.

Risks and Measured Strategies for Long-Term Holds

Regulatory shifts could pressure ETFs, though spot approvals signal tailwinds. Counterparty risk exists in custodians, mitigated by Grayscale’s audited track record. For crypto ETF staking rewards, track on-chain metrics: Sui’s 100,000 and TPS and rising TVL forecast resilience. My systematic view: dollar-cost average monthly buys below $0.9720 highs, harvesting dips to $0.8985.

Algorithmic overlays suit advanced beginners: set alerts for NAV discounts over 2%. Backtests on similar products show staking boosts total returns by 20-30% over two years. With SUI undervalued versus peers, these ETFs position portfolios for layer-1 revival.

Sui’s architecture positions it for mass adoption in gaming and DeFi, where speed trumps hype. As $0.9110 stabilizes, SUIS and GSUI offer the cleanest ramp for novices chasing altcoin alpha. Trade deliberately, eyes on yields and charts, and let compounding do the heavy lifting.