As Bitcoin trades at $67,733 on February 20,2026, marking a 2.52% gain over the past 24 hours, investors face a pivotal moment. This uptick follows a brutal 41.3% plunge from the October 2025 all-time high of $126,198, sparking widespread talk of on-chain capitulation signals. Analysts like James Check from Checkonchain label recent sell-offs as the largest capitulation in history, with over $2 billion in realized losses locked in during a single day. For beginners eyeing a bitcoin rally signal 2026, these metrics scream opportunity, but only if approached with discipline.

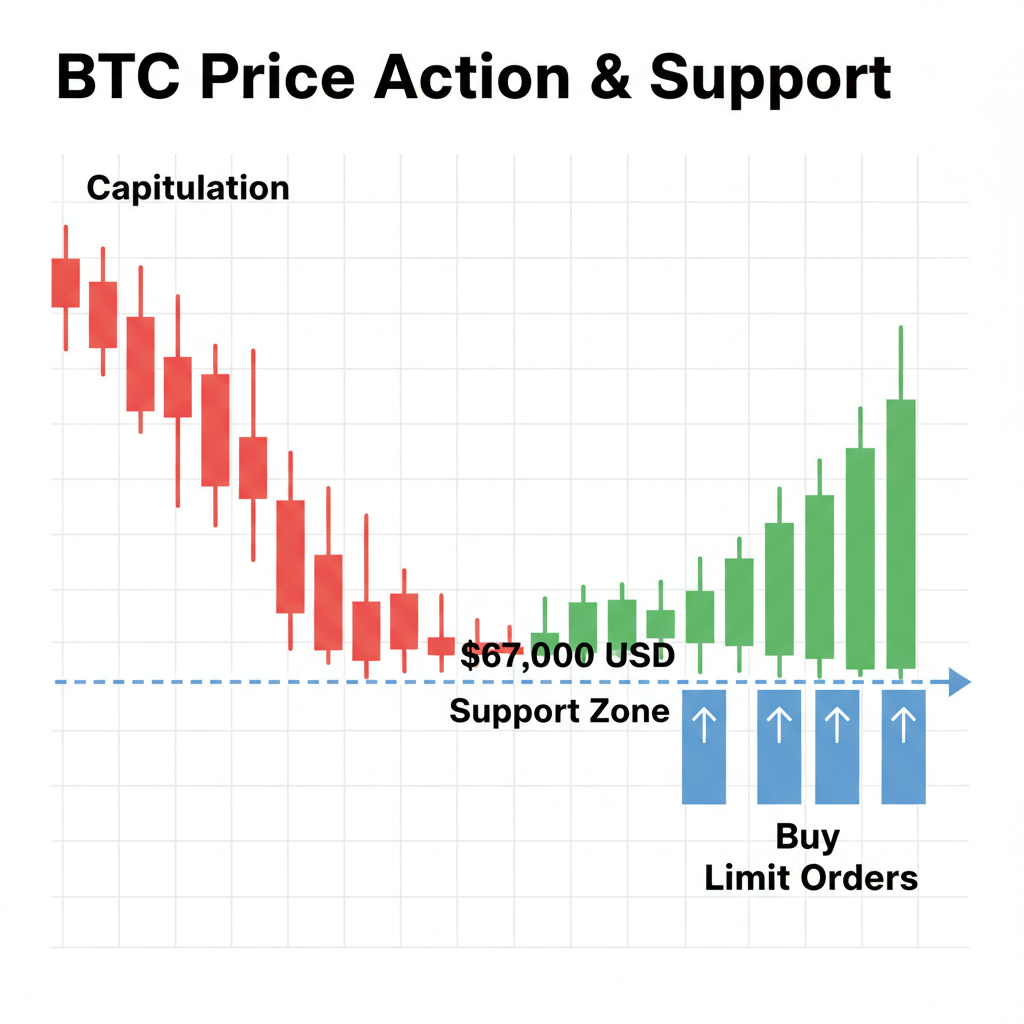

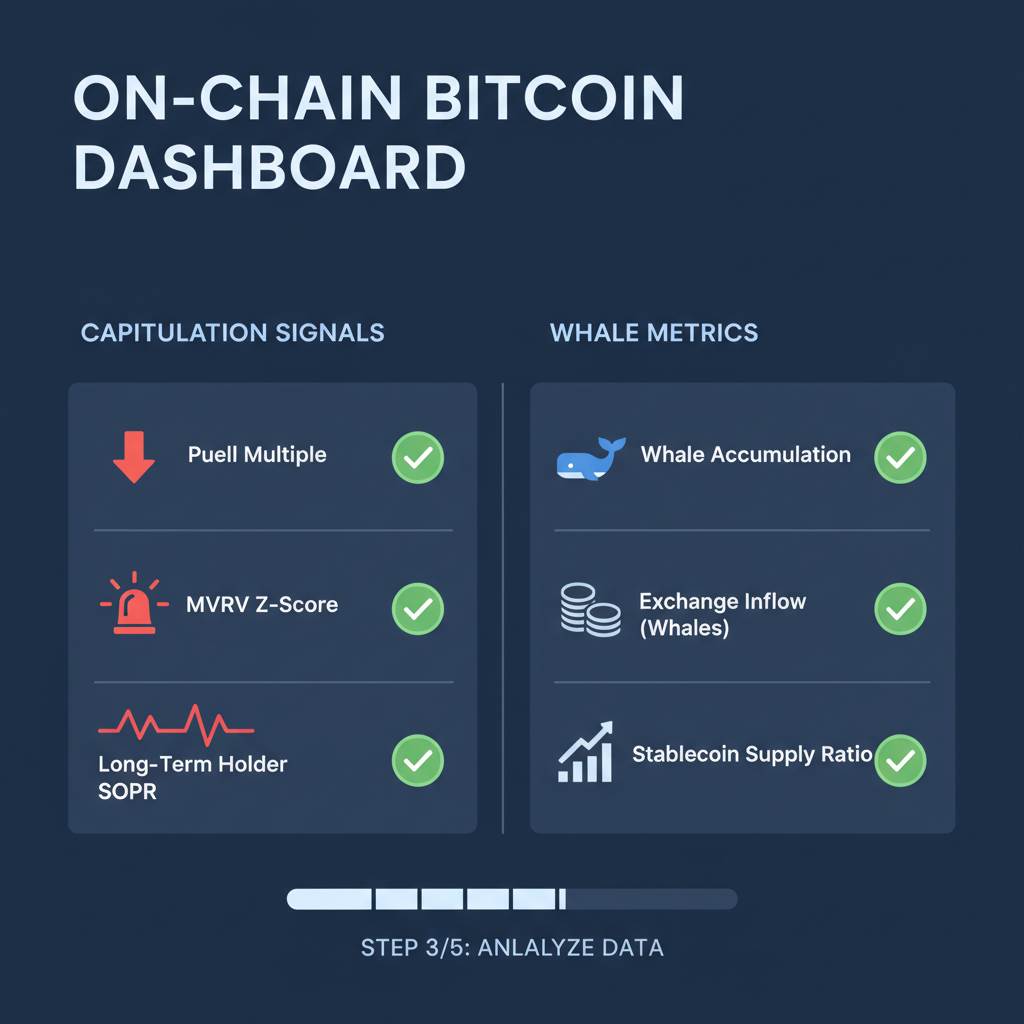

Capitulation occurs when panicked holders dump assets at any price, exhausting weak hands and paving the way for recovery. On-chain data captures this through metrics like realized loss volume and holder behavior. Unlike price charts alone, these reveal true market sentiment. Recent events align perfectly with historical bottoms, suggesting the dip at $67,733 could be your entry for a bull run.

Decoding the Historic Capitulation Event

James Check’s analysis pinpoints Friday’s sell-off as unmistakable capitulation, driven by fear overtaking greed. Investors realized over $2 billion in losses in one day, dwarfing prior events. This matches patterns from past cycles; for instance, the 2022 bear market saw multiple capitulations before the floor formed. Checkonchain notes Bitcoin tested key supports: the ascending trendline from 2021 and horizontal levels. Yet, at $67,733, price action shows resilience, with shorts squeezed during the recent bounce.

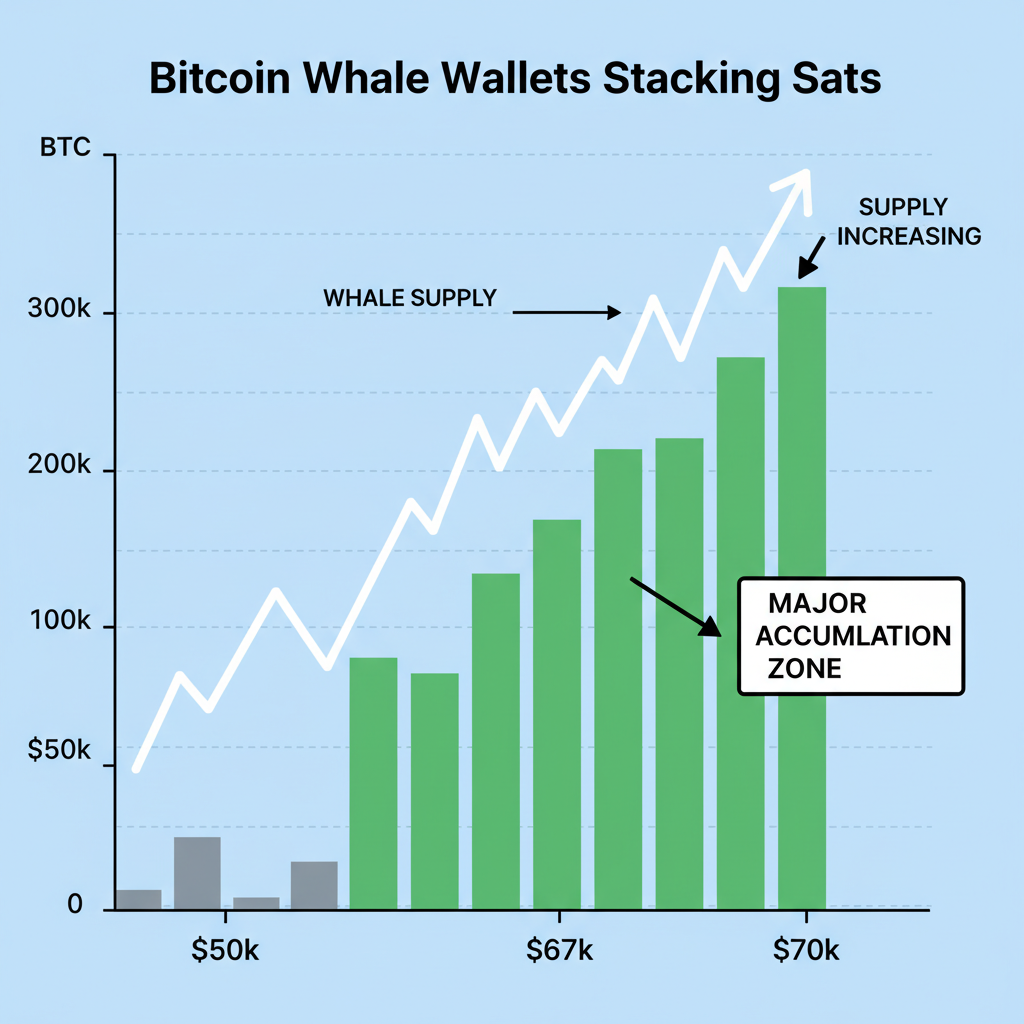

Data supports this: large wallets scooped up 53,000 BTC, worth about $4 billion, in the last two weeks. Institutions signal confidence amid retail panic. Eric Trump’s bold call for Bitcoin hitting $1 million underscores long-term optimism, even as short-term risks linger. Low liquidity amplifies volatility, as MEXC Blog warns, but on-chain strength overrides surface noise.

On-Chain Metrics Signaling a 2026 Rally

On-chain capitulation signals like spike in realized losses often precede rallies. Historical data shows post-capitulation gains averaging 300% within 12 months across cycles. Current metrics echo this: spot-driven buying dominates, per Checkonchain’s ‘A Green Open to 2026,’ with Bitcoin rallying to $93,000 early in the year before correcting. Now stabilizing at $67,733, the setup favors bulls.

Whale accumulation stands out. Entities holding 1,000 and BTC added steadily, countering retail exits. Combined with Eric Trump’s conviction and forecasts from Ben Cowen, the bitcoin capitulation 2026 narrative builds. Cowen, who nailed prior tops, eyes structured recovery. Stoic AI’s bull run timeline predicts acceleration mid-year, driven by halvings and adoption.

Bitcoin (BTC) Price Prediction 2027-2032

Post-2026 Capitulation Recovery Projections Incorporating Cycle Forecasts, On-Chain Signals, and Analyst Targets (Eric Trump $1M, Ben Cowen, Stoic AI)

| Year | Minimum Price | Average Price | Maximum Price | Est. YoY % Change (Avg from Prior Year) |

|---|---|---|---|---|

| 2027 | $80,000 | $180,000 | $300,000 | +100% |

| 2028 | $200,000 | $450,000 | $800,000 | +150% |

| 2029 | $350,000 | $700,000 | $1,200,000 | +56% |

| 2030 | $500,000 | $950,000 | $1,600,000 | +36% |

| 2031 | $700,000 | $1,300,000 | $2,100,000 | +37% |

| 2032 | $1,000,000 | $1,800,000 | $2,800,000 | +38% |

Price Prediction Summary

Following the largest capitulation event in history in 2026 and current price of $67,733 amid a 41% decline from the $126,198 ATH, Bitcoin shows recovery signals with institutional accumulation of 53,000 BTC ($4B). Projections forecast strong bull cycle growth, with averages rising from $180K in 2027 to $1.8M by 2032, max potentials hitting $2.8M, aligning with Eric Trump’s $1M conviction and cycle models from Ben Cowen and Stoic AI.

Key Factors Affecting Bitcoin Price

- Historic on-chain capitulation confirming market bottom

- Institutional buying (53K BTC accumulated recently)

- 2028 Bitcoin halving reducing supply

- Rising ETF inflows and mainstream adoption

- Potential regulatory clarity boosting confidence

- Macro trends and spot-driven market recovery

- Technological improvements expanding use cases

- Maturing market with logarithmic growth cycles

Disclaimer: Cryptocurrency price predictions are speculative and based on current market analysis.

Actual prices may vary significantly due to market volatility, regulatory changes, and other factors.

Always do your own research before making investment decisions.

Safe Entry Strategies for Beginners Buying the Dip

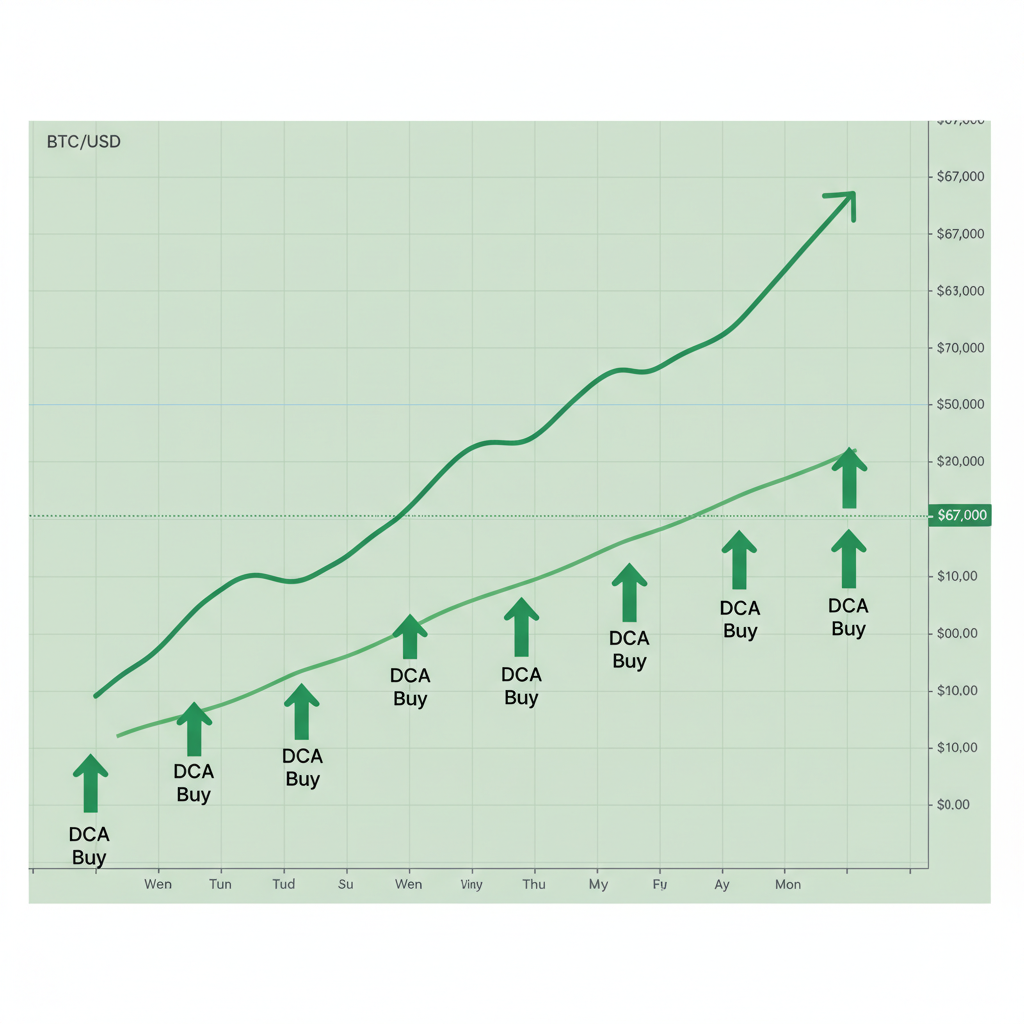

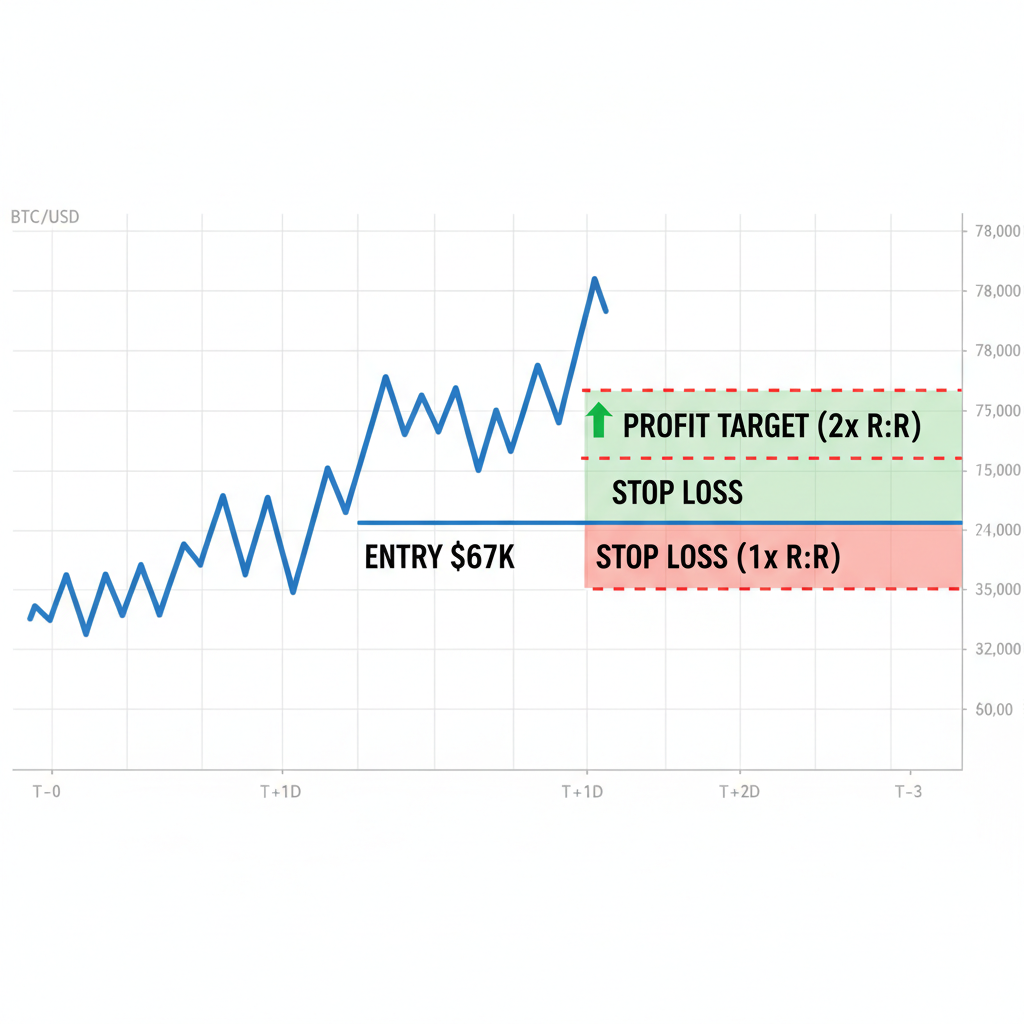

For those new to crypto, buy bitcoin dip beginners requires risk management over FOMO. First, dollar-cost average into $67,733 levels, allocating no more than 5% of portfolio per tranche. Set stops below recent lows around $66,041 to limit downside. My FRM background stresses position sizing: risk 1-2% per trade.

Monitor key on-chain dashboards like Glassnode for realized loss peaks. When they revert, that’s your green light. Pair with technicals; Bitcoin holds above 200-week moving average, a bull market staple. Avoid leverage; spot buys align with the healthy market Checkonchain describes. This methodical approach turns capitulation into your edge.

Yet discipline separates winners from the crowd. Many chase dips without a plan, only to face further drawdowns. My decade in markets teaches that on-chain capitulation signals are powerful, but timing requires confluence. Bitcoin’s current stance at $67,733, above the 24-hour low of $66,041, hints at stabilization. Large holders’ accumulation reinforces this, positioning smart money for the rebound.

Hammering Out the Bottom: Lessons from Past Cycles

History tempers optimism. The 2022 bear market delivered multiple capitulation waves before the true floor at $15,500. As The Bitcoin Layer’s update with Checkonchain observes, signals alone don’t guarantee immediacy; bottoms get hammered. Today’s $67,733 level tests that resilience after the 41.3% drop from $126,198. Yet differences emerge: institutional inflows dwarf retail pain, and spot dominance grows. Unlike 2022’s despair, 2026 carries halving momentum and ETF maturity.

Ben Cowen’s forecast, post his accurate cycle top call, projects structured recovery. He anticipates volatility but favors logarithmic growth into year-end. Pair this with Stoic AI’s timeline: mid-2026 acceleration as liquidity returns. Even MEXC Blog’s liquidity warnings don’t derail the thesis; thin books explain the bounce from $66,041 to $68,241. For bitcoin rally signal 2026, watch if realized losses taper without new spikes.

Your Step-by-Step Playbook to Buy the Dip Now

Beginners often freeze amid fear. Here’s how to act methodically at $67,733. First, verify capitulation exhaustion via tools like Checkonchain dashboards. Second, scale in via dollar-cost averaging to mitigate timing risk. Third, anchor decisions to data, not headlines. This beginner guide buy btc now prioritizes survival over speculation.

Consider the playbook from DeFi Dad’s 2026 predictions: focus on spot accumulation, ignore noise, and layer strategies. Eric Trump’s $1 million conviction aligns, but ground it in metrics. Whales added 53,000 BTC amid the rout, a $4 billion bet on reversal. As fear fades, this shifts to greed, fueling the rally.

Risks and Position Management in Volatile Times

No signal is infallible. Low liquidity, as flagged in January analyses, risks flash crashes below $66,041. Multiple capitulations could extend pain, echoing 2022. My FRM lens demands hedges: allocate 20% to stablecoins, trail stops dynamically. Risk only what you can lose; at 1-2% per position, even a 50% drawdown preserves capital.

Technicals bolster the case. Bitcoin clings to the 200-week MA, a level unbroken in bull markets. RSI oversold readings from the capitulation day now recover. Combine with on-chain: MVRV Z-score normalizing post-spike signals undervaluation. This confluence screams buy bitcoin dip beginners opportunity, but scale methodically.

The path to 2026 profits lies in data over emotion. Capitulation cleansed weak hands; institutions load up. At $67,733, with shorts squeezed and accumulation surging, the rally setup strengthens. Track these metrics weekly, adjust positions ruthlessly, and let the plan unfold. Markets reward the prepared.