In December 2020, the crypto world was shaken by an event that would become a cautionary tale for years to come: the LuBian Bitcoin theft. Over 127,426 BTC vanished from the little-known Chinese mining pool, a sum then worth $3.5 billion and now valued at a staggering $14.5 billion as Bitcoin trades at $114,367 today. The scale of this heist is difficult to fathom, but its lessons are painfully clear for anyone starting their crypto journey in 2025.

As digital assets grow in both value and popularity, so do the methods and sophistication of those seeking to steal them. The LuBian incident was not just a loss for one company – it was a wake-up call for the entire ecosystem. For beginners eager to onboard into crypto safely, understanding what went wrong in this historic breach is essential to avoid repeating its mistakes.

Why Did the LuBian Heist Happen? A Cautionary Snapshot

Investigations suggest that LuBian’s downfall stemmed from a critical vulnerability: poor private key management and lack of robust access controls. According to Arkham Intelligence and several blockchain security analysts, attackers exploited weaknesses in how LuBian generated and stored its private keys. With over 90% of their reserves wiped out in a single exploit – and with no multi-signature protections or real-time monitoring in place – detection came far too late.

This breach highlights that even large organizations can fall victim when they neglect fundamental security measures. For everyday users and newcomers, these risks are just as real – but there are concrete steps you can take today to protect your assets.

Five Security Habits Every Crypto Beginner Needs in 2025

5 Essential Crypto Security Tips for 2025

-

Use Multi-Signature Wallets for Large Holdings: Store significant amounts of crypto in wallets (like BitGo or Electrum) that require multiple independent approvals for transactions. This drastically reduces the risk of a single compromised key leading to catastrophic losses, as seen in the LuBian heist.

-

Regularly Audit and Monitor Wallet Activity: Set up automated alerts and conduct frequent manual reviews of wallet addresses using tools like Blockchain.com Explorer or Chainalysis. Early detection of unauthorized or unusual transactions is critical to preventing major losses.

-

Enforce Strict Access Controls and Role Separation: Limit wallet access to only essential personnel, use strong unique passwords managed by reputable services like LastPass or 1Password, and enable two-factor authentication (2FA) for all accounts. Separation of duties helps prevent internal fraud and accidental exposures.

-

Stay Updated on Security Best Practices and Vulnerabilities: Continuously educate yourself on the latest crypto security trends, common attack vectors (like phishing or supply chain attacks), and promptly apply software updates. Follow resources such as CoinDesk and The Block for timely information.

The following prioritized tips are drawn directly from lessons learned after the LuBian hack:

- Use Multi-Signature Wallets for Large Holdings: Multi-signature (multi-sig) wallets require multiple independent approvals before any transaction can be executed. This drastically reduces single-point-of-failure risk; even if one key is compromised, your funds remain protected unless all signers collude or are breached simultaneously.

- Regularly Audit and Monitor Wallet Activity: Set up automated alerts for every transaction involving your wallet address. Regular manual reviews help catch unauthorized or unusual activity early, potentially stopping theft before it escalates.

- Implement Hardware Wallets and Cold Storage: Keep most of your funds offline using hardware wallets or cold storage solutions. Devices like Ledger or Trezor ensure your private keys never touch an internet-connected device, making malware attacks virtually impossible.

- Enforce Strict Access Controls and Role Separation: Limit wallet access only to essential personnel (or yourself if you’re an individual user). Use strong unique passwords for every account and enable two-factor authentication (2FA) wherever possible – never rely solely on passwords.

- Stay Updated on Security Best Practices and Vulnerabilities: The threat landscape evolves rapidly; make it a habit to follow trusted crypto news sources, learn about new scams like phishing or supply chain attacks, and apply software updates promptly when released.

The Price of Complacency: What the LuBian Case Teaches Us About Crypto Security

The story of LuBian is not just about technical failure; it’s about underestimating risk in an ever-changing financial frontier. As digital assets like Bitcoin soar above $114,000, even modest holdings now represent significant value worth protecting with institutional-grade diligence.

Bitcoin (BTC) Price Prediction Table: 2026–2031 (Post-LuBian Heist Era)

Forecasts reflect evolving market dynamics, security advances, and global adoption after the LuBian heist. Prices based on August 2025 baseline ($114,367).

| Year | Minimum Price | Average Price | Maximum Price | Year-over-Year Change (%) | Market Scenario Insights |

|---|---|---|---|---|---|

| 2026 | $97,000 | $123,000 | $155,000 | +7.6% | Wide range due to regulatory uncertainty post-heist; increased security adoption begins to restore confidence. |

| 2027 | $110,000 | $143,000 | $184,000 | +16.3% | Institutional adoption grows; global regulations stabilize; bullish scenario driven by ETF expansion. |

| 2028 | $135,000 | $173,000 | $225,000 | +21.0% | Bitcoin halving year; supply shock and increased scarcity expected to drive prices higher. |

| 2029 | $162,000 | $205,000 | $268,000 | +18.5% | Mainstream financial integration and payment adoption; technological improvements enhance network security. |

| 2030 | $188,000 | $232,000 | $305,000 | +13.2% | Sustained global adoption; rising competition from CBDCs and altcoins tempers upside. |

| 2031 | $170,000 | $251,000 | $340,000 | +8.2% | Mature market cycle; volatility decreases but major events (e.g., government adoption or bans) could trigger sharp moves. |

Price Prediction Summary

Bitcoin is expected to maintain a strong upward trajectory from 2026 to 2031, driven by increasing institutional adoption, technological advancements, and greater regulatory clarity following high-profile security incidents like the LuBian heist. While minimum prices reflect potential bearish scenarios due to regulatory or macroeconomic shocks, maximum predictions account for bullish outcomes including mass adoption and successful integration into global finance. The average price projection grows steadily, reflecting Bitcoin’s resilience and expanding role in diversified portfolios.

Key Factors Affecting Bitcoin Price

- Impact and aftermath of major security breaches (e.g., LuBian heist) influencing investor sentiment and security infrastructure.

- Global regulatory developments, including potential for stricter rules or greater clarity in major markets.

- Technological improvements in blockchain security, custody solutions, and scalability.

- Bitcoin halving events, especially in 2028, reducing new supply and increasing scarcity.

- Institutional and retail adoption rates, including ETF approvals and payment integrations.

- Competition from central bank digital currencies (CBDCs) and emerging altcoins.

- Macroeconomic trends, such as inflation, global liquidity, and monetary policy shifts.

- Market cycles and speculative sentiment, which can amplify volatility and price swings.

Disclaimer: Cryptocurrency price predictions are speculative and based on current market analysis.

Actual prices may vary significantly due to market volatility, regulatory changes, and other factors.

Always do your own research before making investment decisions.

If you’re new to crypto or guiding others through onboarding safely, remember: security isn’t optional – it’s foundational. The next section will explore each tip more deeply with actionable advice tailored for beginners navigating today’s high-stakes environment.

Let’s break down these essential security habits so you can confidently navigate the crypto space in 2025 and beyond. Each tip is rooted in the hard-won lessons from the LuBian Bitcoin theft, offering practical strategies to keep your digital assets safe from both common and sophisticated threats.

How to Put Security Habits into Practice

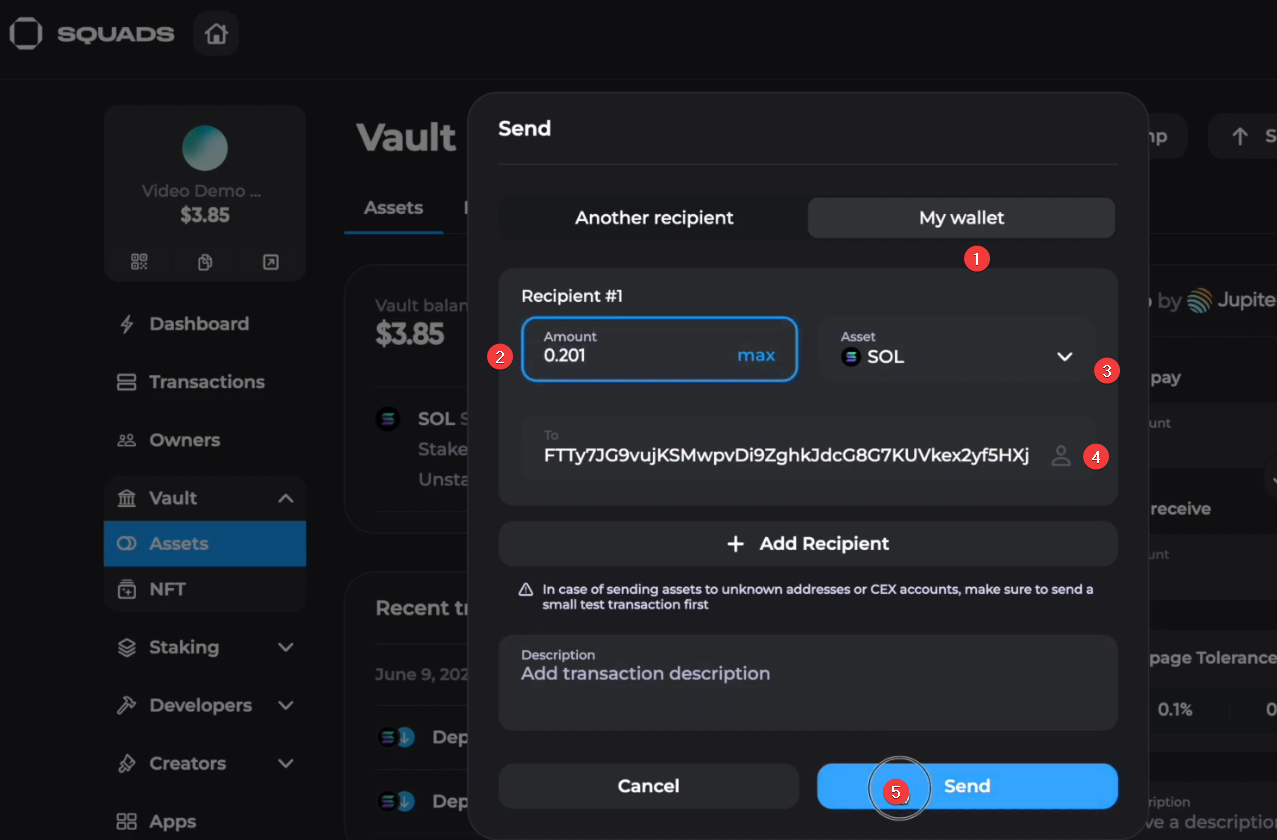

1. Use Multi-Signature Wallets for Large Holdings

If you’re holding a meaningful amount of crypto, relying on a single key is a gamble. Multi-signature wallets distribute transaction approval across several parties, think of it as needing multiple keys to open a vault. For individuals, this could mean requiring your hardware wallet and a trusted friend’s approval; for teams, it means no one person can move funds unilaterally. This simple shift could have saved LuBian from catastrophe.

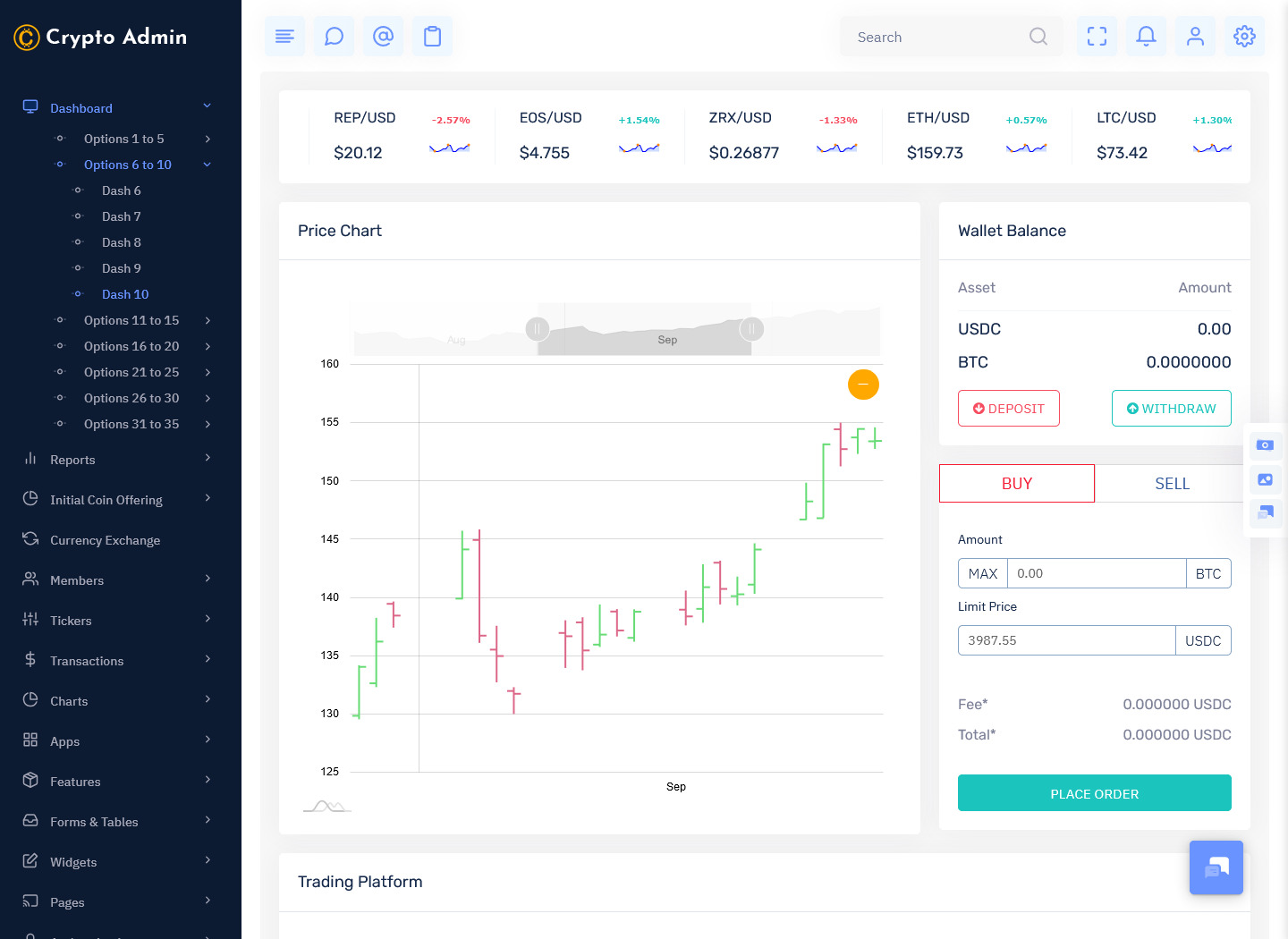

2. Regularly Audit and Monitor Wallet Activity

Set up notifications for every transaction involving your wallet address. Many wallet providers offer real-time alerts or integrate with blockchain monitoring tools that flag suspicious activity instantly. Make it a habit to review your wallet’s transaction history weekly, early detection is often the only thing standing between you and irreversible loss.

3. Implement Hardware Wallets and Cold Storage

Online (hot) wallets are convenient but vulnerable to malware, phishing, and exchange hacks. Move most of your holdings into hardware wallets or cold storage solutions that never connect directly to the internet. This strategy drastically reduces exposure to cyberattacks, a crucial step overlooked by LuBian, with devastating results.

4. Enforce Strict Access Controls and Role Separation

If others help manage your assets, ensure each person only has access necessary for their role, nothing more. Always use strong, unique passwords generated by reputable managers and enable two-factor authentication (2FA) everywhere possible. Even if you’re solo, these steps erect extra barriers against unauthorized access.

5. Stay Updated on Security Best Practices and Vulnerabilities

Crypto evolves quickly: what was secure last year may be vulnerable today. Subscribe to respected crypto news outlets or community forums that post about new scams, vulnerabilities, and updates (more security tips here). Apply software updates promptly, delays create openings for attackers exploiting known exploits.

Turning Lessons Into Action: Your Next Steps

The LuBian heist reminds us that even advanced players can be undone by lapses in basic security hygiene, and that prevention is always easier than recovery in crypto’s irreversible world.

- Start small: Test multi-signature setups with minor amounts before trusting them with larger sums.

- Schedule recurring reminders to audit your wallet activity, consistency beats complexity every time.

- If you haven’t yet moved funds off exchanges into hardware wallets, make this your next priority.

- Review who has access to your wallets (even shared family funds), update passwords regularly, and enable 2FA today.

- Bookmark trusted sources for ongoing education, you’ll thank yourself when new threats emerge.

The $14 billion question isn’t whether another major hack will occur, it’s whether you’ll be prepared when it does. By learning from LuBian’s mistakes, and acting on these five foundational tips, you give yourself the best chance at thriving securely as Bitcoin continues its journey above $114,367.