The Philippine crypto landscape in 2025 looks nothing like it did just a year ago. With the Philippines SEC cracking down hard on unregistered crypto exchanges, onboarding safely is more critical than ever. If you’re a beginner looking to buy your first crypto or transfer funds from abroad, ignoring these new rules could put your investments and even your identity at risk.

Why the 2025 SEC Crackdown Changes Everything

On August 6,2025, the Philippine Securities and Exchange Commission released a sweeping advisory targeting ten major exchanges: OKX, Bybit, KuCoin, Kraken, MEXC, Bitget, Phemex, CoinEx, BitMart, and Poloniex. These platforms were flagged for operating without local authorization, meaning if you use them as a Filipino resident, you’re exposing yourself to potential account freezes and legal headaches.

The risks go beyond inconvenience. According to the SEC’s latest guidance (Cointelegraph, Philstar), unregistered exchanges may be used for fraud or money laundering, putting users at risk of losing their assets or getting caught in regulatory crossfire. The message is simple: If an exchange isn’t licensed by the Philippines SEC in 2025, it’s not safe for onboarding.

Your Essential Crypto Onboarding Checklist for 2025

This new regulatory era doesn’t mean beginners should avoid crypto altogether, it means you need a sharper onboarding strategy. Here’s what every newcomer in the Philippines and Southeast Asia must do:

5-Point Checklist for Safe Crypto Onboarding in the Philippines (2025)

-

Verify Exchange Licensing with the Philippines SEC: Always check the official Philippines SEC website or public advisories to confirm if a crypto exchange is licensed and authorized to operate locally before registering or depositing funds.

-

Avoid Using Flagged or Unregistered Exchanges: Steer clear of platforms explicitly named by the SEC (such as OKX, Bybit, KuCoin, Kraken, and others flagged in 2024-2025) to minimize legal risks and protect your assets from potential enforcement actions.

-

Understand Local Crypto Regulations and Updates: Stay informed about evolving crypto laws in the Philippines by following SEC announcements and reputable local news sources, as regulations may change rapidly in 2025.

-

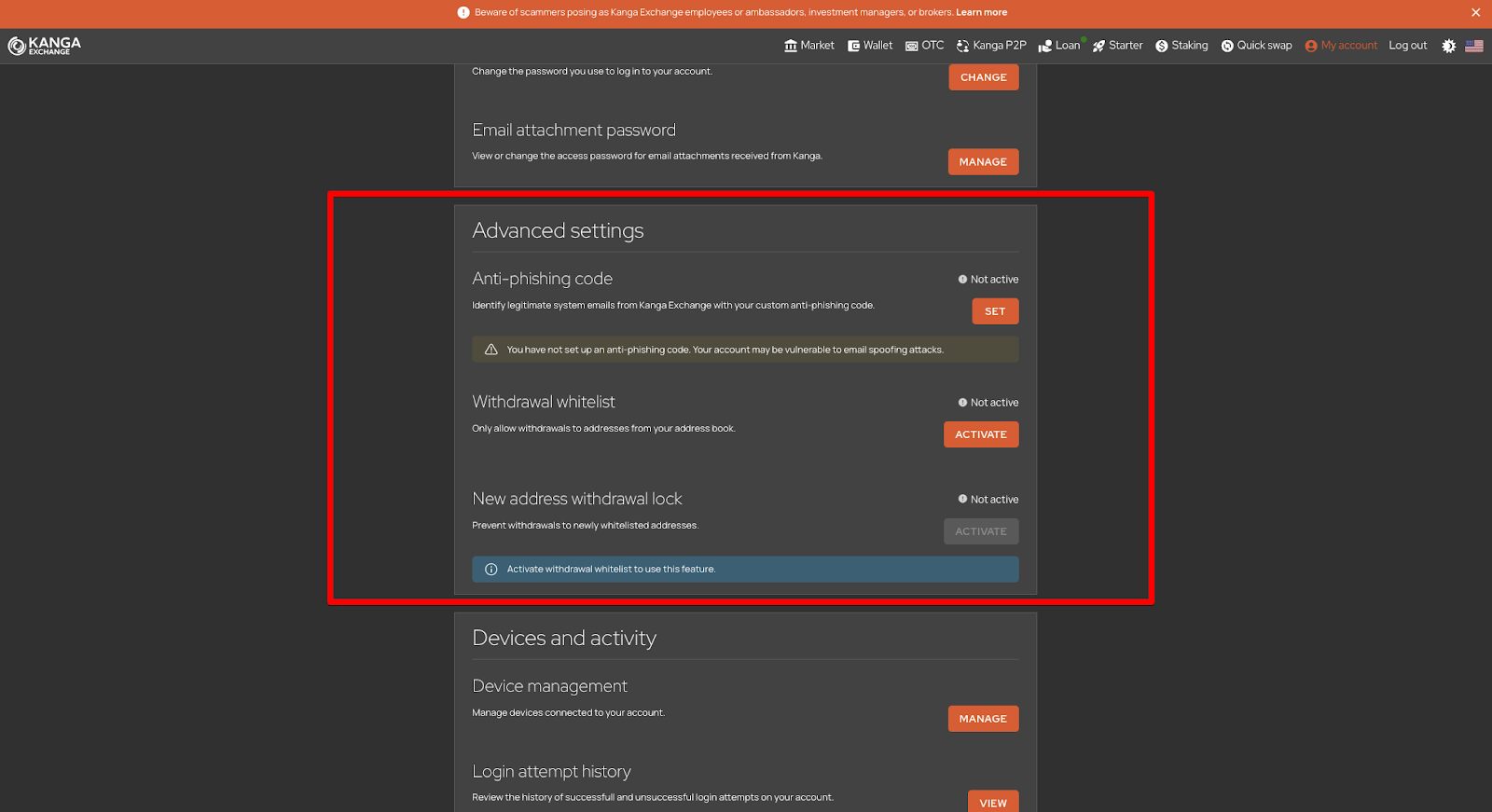

Prioritize Security Features and Asset Protection: Choose exchanges that offer strong security measures (like two-factor authentication, cold storage, and insurance for digital assets) and ensure they comply with local consumer protection standards.

-

Prepare for KYC/AML Compliance Requirements: Be ready to provide valid identification and undergo Know Your Customer (KYC) and Anti-Money Laundering (AML) checks on licensed platforms, as these are now strictly enforced under Philippine regulations.

1. Verify Exchange Licensing with the Philippines SEC

Before you even create an account or deposit funds anywhere, go straight to the source. The official SEC advisories list which platforms are authorized. If your chosen exchange isn’t there, or worse, is explicitly named as unlicensed, walk away immediately.

2. Avoid Using Flagged or Unregistered Exchanges

This cannot be overstated: Platforms such as OKX, Bybit, KuCoin, Kraken and all others listed by the SEC are now high-risk zones for Filipino users. Even if these sites still allow registration and trading from Philippine IP addresses today, enforcement actions could freeze your assets overnight.

Navigating New Local Crypto Regulations: What You Need to Know

The rules have changed fast in 2025, and they’re being enforced with teeth. Under new Memorandum Circulars No. 4 and No. 5 (effective since July), every crypto-asset service provider (CASP) must:

- Register as a domestic corporation with at least ₱100 million (about $1.8 million) paid-up capital

- Maintain a physical office in the Philippines

- Submit regular reports to both the SEC and Anti-Money Laundering Council

If an exchange can’t meet these requirements, or hasn’t bothered trying, you’re better off steering clear.

3. Understand Local Crypto Regulations and Updates

Don’t just rely on word of mouth or social media buzz. The regulatory environment in the Philippines is moving at breakneck speed, with new advisories and enforcement actions rolling out almost monthly. Bookmark the official SEC portal and set up news alerts from trusted sources like Philstar or Cointelegraph. This isn’t just about rule-following, it’s about protecting yourself from sudden platform bans, asset seizures, or worse.

4. Prioritize Security Features and Asset Protection

Even among licensed exchanges, not all are created equal. Look for platforms that offer robust security: two-factor authentication (2FA), cold wallet storage for most user funds, insurance coverage for digital assets, and a proven track record with no major hacks or breaches. Make sure these security features aren’t just window dressing, read reviews from local users and check if the exchange complies with Philippine consumer protection standards.

5. Prepare for KYC/AML Compliance Requirements

The days of anonymous crypto onboarding are over in the Philippines. Licensed platforms will require you to submit valid government IDs, proof of address, and possibly even take a selfie for identity verification. While this might feel intrusive, it’s now standard under Philippine law to prevent money laundering and terrorist financing. Have your documents ready before you sign up, this will save you headaches and avoid delays when markets move fast.

The Cost of Non-Compliance: Why It Pays to Play By the Rules

Let’s put this in perspective: using an unregistered exchange in 2025 isn’t just risky, it could be disastrous. Besides possible loss of funds due to account freezes or exit scams, there’s a very real chance you’ll be cut off from customer support or legal recourse if something goes wrong. Some ISPs are already blocking flagged sites at the SEC’s request (Philstar), making it harder for users to even access their accounts.

For beginners in Southeast Asia, especially those sending remittances home or starting their investment journey, the message is clear: do your homework before onboarding anywhere new.

Visual Recap: Your 2025 Safe Crypto Onboarding Checklist

5 Steps for Safe Crypto Onboarding in the Philippines

-

Verify Exchange Licensing with the Philippines SEC: Always check the official Philippines SEC website or public advisories to confirm if a crypto exchange is licensed and authorized to operate locally before registering or depositing funds.

-

Avoid Using Flagged or Unregistered Exchanges: Steer clear of platforms explicitly named by the SEC (such as OKX, Bybit, KuCoin, Kraken, and others flagged in 2024-2025) to minimize legal risks and protect your assets from potential enforcement actions.

-

Understand Local Crypto Regulations and Updates: Stay informed about evolving crypto laws in the Philippines by following SEC announcements and reputable local news sources, as regulations may change rapidly in 2025.

-

Prioritize Security Features and Asset Protection: Choose exchanges that offer strong security measures (like two-factor authentication, cold storage, and insurance for digital assets) and ensure they comply with local consumer protection standards.

-

Prepare for KYC/AML Compliance Requirements: Be ready to provide valid identification and undergo Know Your Customer (KYC) and Anti-Money Laundering (AML) checks on licensed platforms, as these are now strictly enforced under Philippine regulations.

If you stick to these five essentials, verifying licensing, avoiding flagged platforms, staying current on regulations, choosing secure exchanges, and preparing your KYC documents, you’ll dramatically lower your risk profile as a crypto newcomer.

The landscape may look intimidating right now, but these changes are designed to make crypto safer for everyone willing to play by the rules. Treat this checklist as your onboarding compass, and let it point you toward safe investing as regulations evolve.