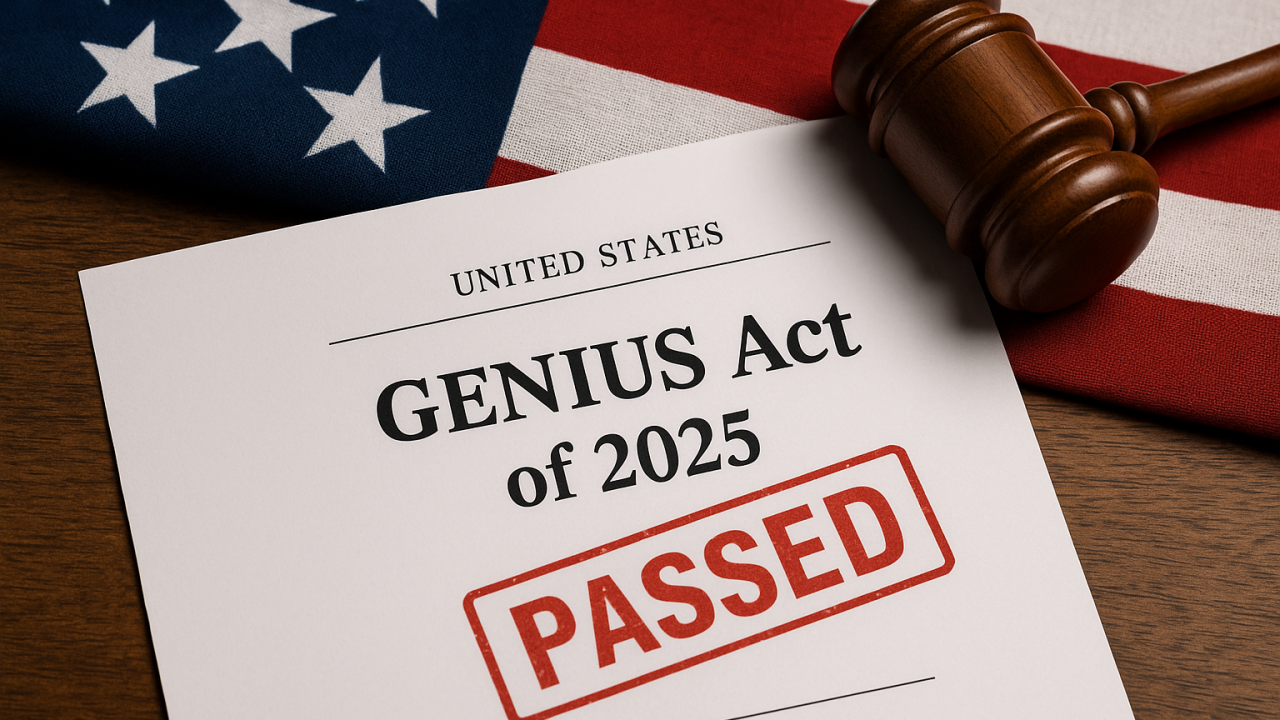

The landscape for buying crypto in the United States is transforming rapidly, and stablecoins are at the heart of this change. With the passage of the GENIUS Act in July 2025, newcomers to crypto now face a different set of rules and opportunities. If you’re just starting your journey, understanding how these new stablecoin regulations affect onboarding is essential for making smart, secure choices.

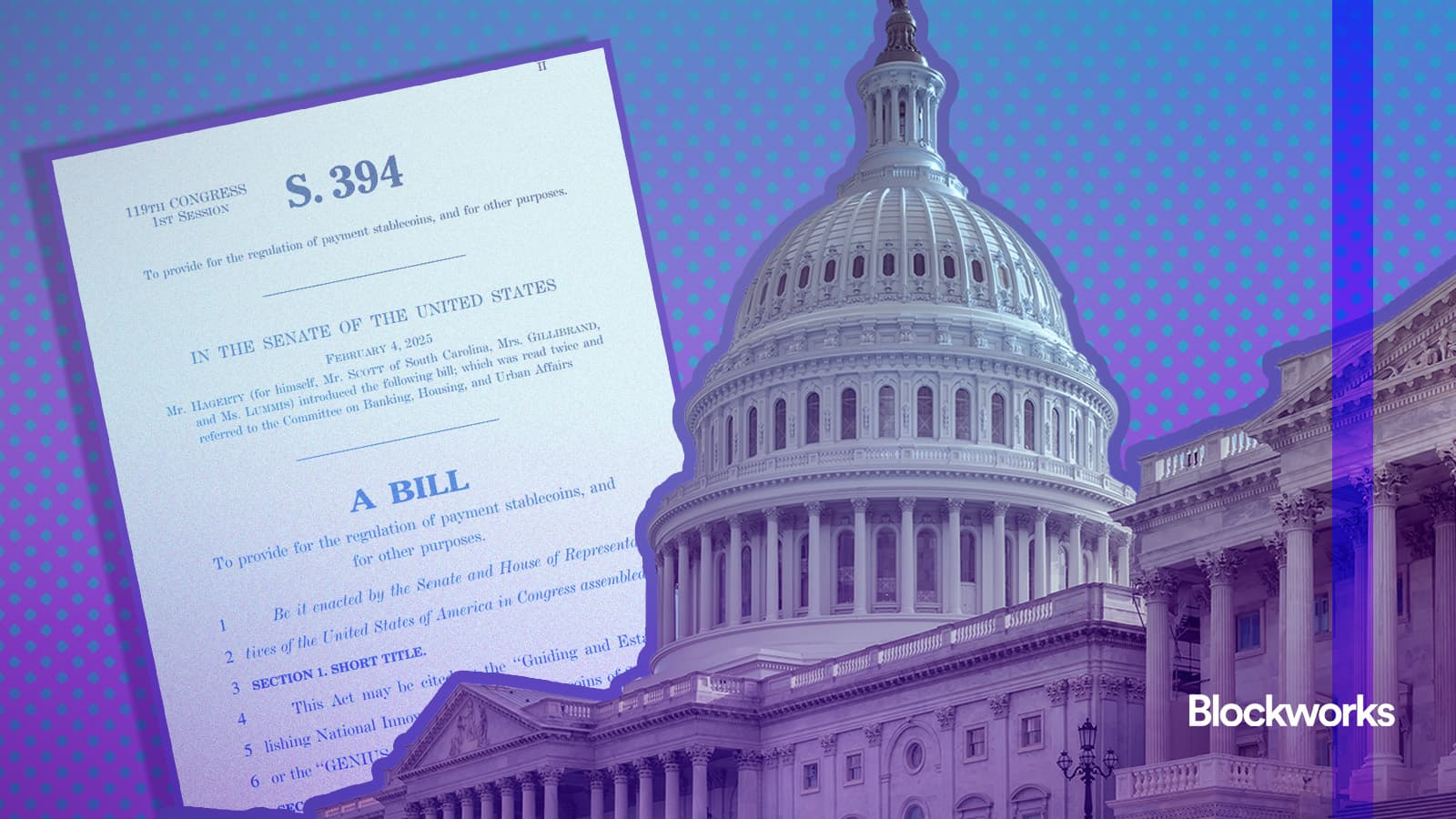

What Is the GENIUS Act and Why Does It Matter?

The GENIUS Act (Guiding and Establishing National Innovation for U. S. Stablecoins) is the first federal law to create a comprehensive regulatory framework for payment stablecoins in America. Stablecoins are digital tokens pegged to assets like the U. S. dollar, designed to offer price stability within the volatile world of cryptocurrencies. This act was designed not only to protect consumers but also to encourage innovation by providing clear rules for issuers and users alike.

Key highlights:

- 1: 1 Asset Backing: Every stablecoin issued must be backed by an equivalent value in U. S. dollars or similarly low-risk assets.

- Regulatory Oversight: Both federal and state agencies now supervise stablecoin activities, increasing transparency and accountability.

- KYC Requirements: Know Your Customer protocols are mandatory, meaning you’ll need to provide identification when onboarding with most platforms.

This new clarity is expected to drive adoption among individuals and institutions alike, while reducing risks of sudden devaluation or fraud that have plagued unregulated projects in previous years.

How Stablecoin Regulations Will Change Crypto Onboarding

For beginners, these changes bring both reassurance and new procedures. Here’s what you need to know about onboarding under the GENIUS Act framework:

Key Steps for Buying Crypto Under the GENIUS Act

-

1. Choose a Reputable, GENIUS Act-Compliant PlatformStart by selecting a well-established crypto exchange or financial institution that is registered and compliant with the new GENIUS Act regulations. Look for platforms like Coinbase, Kraken, or major banks such as Bank of America and Citigroup that have launched their own stablecoins under the new law.

-

2. Complete Know Your Customer (KYC) VerificationBe prepared to provide personal identification and verification documents. The GENIUS Act mandates strict KYC protocols for all stablecoin issuers and platforms, so this step is required to access buying and trading features.

-

3. Fund Your Account with U.S. Dollars or Approved AssetsDeposit funds using bank transfers, debit cards, or other methods supported by your chosen platform. Under the GENIUS Act, stablecoins must be backed 1:1 by U.S. dollars or low-risk assets, ensuring your deposits are securely held.

-

4. Select a Regulated Stablecoin to PurchaseChoose from federally and state-approved stablecoins, such as USDC (USD Coin) or new bank-issued stablecoins, which now operate under the GENIUS Act’s comprehensive framework for security and transparency.

-

5. Review Platform Security and Consumer ProtectionsCheck that your platform offers robust security measures (like two-factor authentication) and clear consumer protections, as required by the new regulations. This helps ensure your assets are safe and recoverable in case of issues.

Enhanced Security and Trust: The requirement that issuers maintain 1: 1 reserves means every dollar-backed stablecoin in circulation has real assets behind it. This reduces systemic risk, a concern highlighted during previous years’ high-profile stablecoin failures, and makes it easier for first-time buyers to trust their chosen asset won’t lose its peg overnight.

Banks Entering the Arena: Major financial institutions like Bank of America and Citigroup are now launching their own regulated stablecoins (source). For new users, this means more familiar brands are entering crypto, potentially offering better customer support, easier fiat onramps, and robust security measures compared to smaller startups or overseas exchanges.

Your First Steps: What Beginners Should Prepare For

If you’re considering your first purchase of digital assets under this new regulatory regime, here’s how your experience will differ from previous years:

- You’ll likely need to complete a KYC process, uploading government ID or other documents before you can buy or transfer regulated stablecoins.

- The platforms offering these coins will be subject to regular audits and oversight, so look for transparency reports or certifications when choosing where to start your journey.

- You’ll see more choices as banks roll out their own coins, but it’s still important to compare fees, user experience, and security features before committing funds.

This shift also brings American regulation closer in line with some European standards, though differences remain between US and EU approaches (for instance, around interest payments on stablecoins). For a deeper dive into how these laws stack up internationally, check out recent coverage by policy analysts at major law firms (read more here).

While the GENIUS Act paves a clearer path for crypto newcomers, it also means that onboarding is no longer the wild west. Every step will be guided by new compliance rules and transparency measures. This is both a blessing and a challenge: you’ll be safer, but you’ll also need to adapt to more formal processes when buying, transferring, or holding stablecoins.

One key aspect is that stablecoin issuers can no longer pay interest to holders. This is a significant departure from previous years when some platforms enticed newbies with high-yield offers. The change is designed to keep stablecoins focused on payments and settlements, not as speculative investment vehicles. For those just entering, this means your USD-backed tokens are for stability and utility rather than passive income.

Comparing US Stablecoin Laws with Europe

The GENIUS Act’s framework brings the US closer to Europe’s approach to stablecoin oversight, but there are still notable differences. In Europe, regulations often allow more flexibility in how reserves are held or managed, while the US model now requires strict 1: 1 cash or near-cash reserves. Additionally, the US outright bans interest payments on stablecoins, a move not yet mirrored across all European markets.

If you’re curious about global regulatory trends or plan to use stablecoins across borders, it pays to stay informed about these distinctions. Regulatory clarity in the US is expected to attract more mainstream users and institutional players, while in Europe, innovation may take different forms due to lighter-touch rules in some jurisdictions.

Staying Safe as You Onboard

- Double-check platform credentials: Ensure your chosen provider is registered under federal or state oversight as required by the GENIUS Act.

- Understand KYC expectations: Be ready for ID checks and personal data requests before you can transact.

- Review transparency reports: Look for proof of reserves and audit results, these should be published regularly by reputable issuers.

- Avoid offers promising interest: Under new law, regulated issuers cannot pay yield on stablecoins. If you see such offers from a US provider, consider it a red flag.

If stability and regulatory clarity are your top priorities as a beginner, this is arguably the best environment yet for onboarding into crypto with confidence.

Top Benefits of Regulated Stablecoins for Beginners

-

Greater Safety and Transparency: The GENIUS Act requires stablecoin issuers to maintain 1:1 reserves in U.S. dollars or low-risk assets, ensuring each stablecoin is fully backed. This boosts user confidence and reduces the risk of sudden losses.

-

Improved Consumer Protections: With federal and state oversight, stablecoin activities are closely monitored, helping to safeguard user funds and reduce the risk of fraud or mismanagement.

-

Trusted Financial Institutions Entering the Market: Major banks like Bank of America and Citigroup are planning to launch stablecoins under the new law. Their involvement offers beginners access to reliable and familiar platforms.

-

Faster and Cheaper Payments: Regulated stablecoins can enable quick, low-cost cross-border transactions, making it easier for new users to send and receive money globally without high fees.

-

Clearer Rules and Safer Onboarding: The GENIUS Act introduces Know Your Customer (KYC) requirements, helping to prevent illicit activity and making it safer for beginners to enter the crypto space.

The bottom line? With robust federal oversight and bank-grade security standards becoming the norm after July 2025, buying crypto through regulated stablecoins is safer than ever for American beginners. As always in finance, especially digital assets provides a little homework goes a long way. Compare platforms carefully, keep up with evolving rules (they will keep changing), and don’t hesitate to seek out educational resources before making your first move into this newly structured landscape.