Crypto onboarding in 2025 just got a lot more complicated for US users. If you’re used to buying Bitcoin or other digital assets from a local crypto ATM, prepare for serious changes. As of August 2025, the US is in the middle of a regulatory crackdown, with lawmakers across both red and blue states pushing new restrictions, and in some cases, outright bans on crypto ATMs. The goal? To fight a surge in fraud that’s cost Americans, especially seniors, hundreds of millions of dollars.

Crypto ATM Bans and New Rules: What’s Happening Right Now?

The numbers are stark: In 2023 alone, over 5,500 incidents involving crypto kiosks led to losses exceeding $189 million, with nearly two-thirds stolen from people over 60. Regulators have taken notice. In February 2025, Senator Dick Durbin introduced the Crypto ATM Fraud Prevention Act (S.710), which lays out strict new requirements for all operators:

- Mandatory fraud warnings on every machine

- Daily transaction limits: $2,000 per day and $10,000 over the first 14 days for new users

- Full refunds for fraudulent transactions reported within 30 days

- Live verbal confirmation required on any transaction over $500

- KYC registration and location disclosure with the Treasury Department

This is not just federal grandstanding either. Read more about the bill here.

The State-by-State Patchwork: Where Crypto ATMs Are Being Restricted or Banned

You can’t talk about crypto ATM bans in the US without mentioning how fragmented things have become at the state level. Here’s what’s happening on the ground:

Key States and Cities Cracking Down on Crypto ATMs in 2025

-

Spokane, Washington: In 2025, Spokane became one of the first major U.S. cities to completely ban crypto ATMs after a surge in scam activity. The city council voted unanimously to remove all virtual currency kiosks, citing widespread fraud targeting vulnerable residents.

-

Stillwater, Minnesota: Following a series of high-profile crypto ATM scams, Stillwater joined a growing list of cities banning these kiosks outright. Local officials cited over $189 million in national losses as a driving factor.

-

Illinois: Illinois enacted new state-wide regulations, limiting daily crypto ATM transactions and mandating clear fraud warnings on every machine. These measures aim to protect users, especially older adults, from scams.

-

Vermont: Vermont passed laws requiring daily usage caps and mandatory fraud alerts at all crypto ATMs. The state is recognized for its proactive approach to consumer protection in the crypto space.

-

Iowa: Iowa introduced legislation to limit transaction sizes and require written fraud warnings on all crypto ATMs. These rules are part of a broader push to reduce crypto-related fraud across the state.

-

Chico, California: Anticipating statewide action, Chico is preparing for new regulations that will include transaction limits and mandatory receipts for every crypto ATM transaction, aiming to boost transparency and user safety.

– Minnesota: Cities like Stillwater have banned crypto ATMs after high-profile scams targeting seniors (source)

– Washington: Spokane has removed all virtual currency kiosks following unanimous city council votes (source)

– Iowa and Vermont: New laws limit daily transactions and require written fraud warnings

– California: Chico is prepping for statewide rules that will cap daily purchases and enforce receipt requirements (source)

If You’re New to Buying Crypto: What These Changes Mean For You in 2025

If you’re just getting started with crypto onboarding in 2025, don’t expect to walk up to a kiosk and buy Bitcoin anonymously like it’s still 2019. The landscape has shifted hard toward compliance and risk management.

Main changes you’ll face as an onboarding user:

- Tighter KYC (Know Your Customer) checks.

- $2,000 daily purchase limits for newbies (federally mandated).

- No-go zones: Some cities have zero machines left, check your local laws before heading out.

- Loud anti-fraud warnings at every step.

- If you’re scammed and report it within 30 days, you may get your money back.

The Current Market Context: Bitcoin Price at $117,743.00 Sets the Tone for Access Restrictions

The drama isn’t happening in a vacuum. With Bitcoin holding steady at $117,743.00, demand for easy access remains sky-high, but so does risk appetite among scammers. Lawmakers are scrambling to balance consumer protection with legitimate access as more people try to get onboard during this bull market surge.

With the price of Bitcoin at $117,743.00, every new restriction echoes louder. For many, the appeal of crypto ATMs was speed and privacy. Now, those advantages are fading fast as regulators force operators to slow down onboarding and tighten up compliance. If you’re thinking about using a crypto ATM in 2025, expect longer wait times, more paperwork, and far less anonymity.

Alternatives to Crypto ATMs: How to Buy Crypto in a Restricted Market

Don’t panic if your city’s last kiosk just vanished overnight. There are still ways to buy Bitcoin and other cryptocurrencies legally and safely, but you’ll need to adapt. Here’s what’s working now:

Top Alternatives to Crypto ATMs in 2025

-

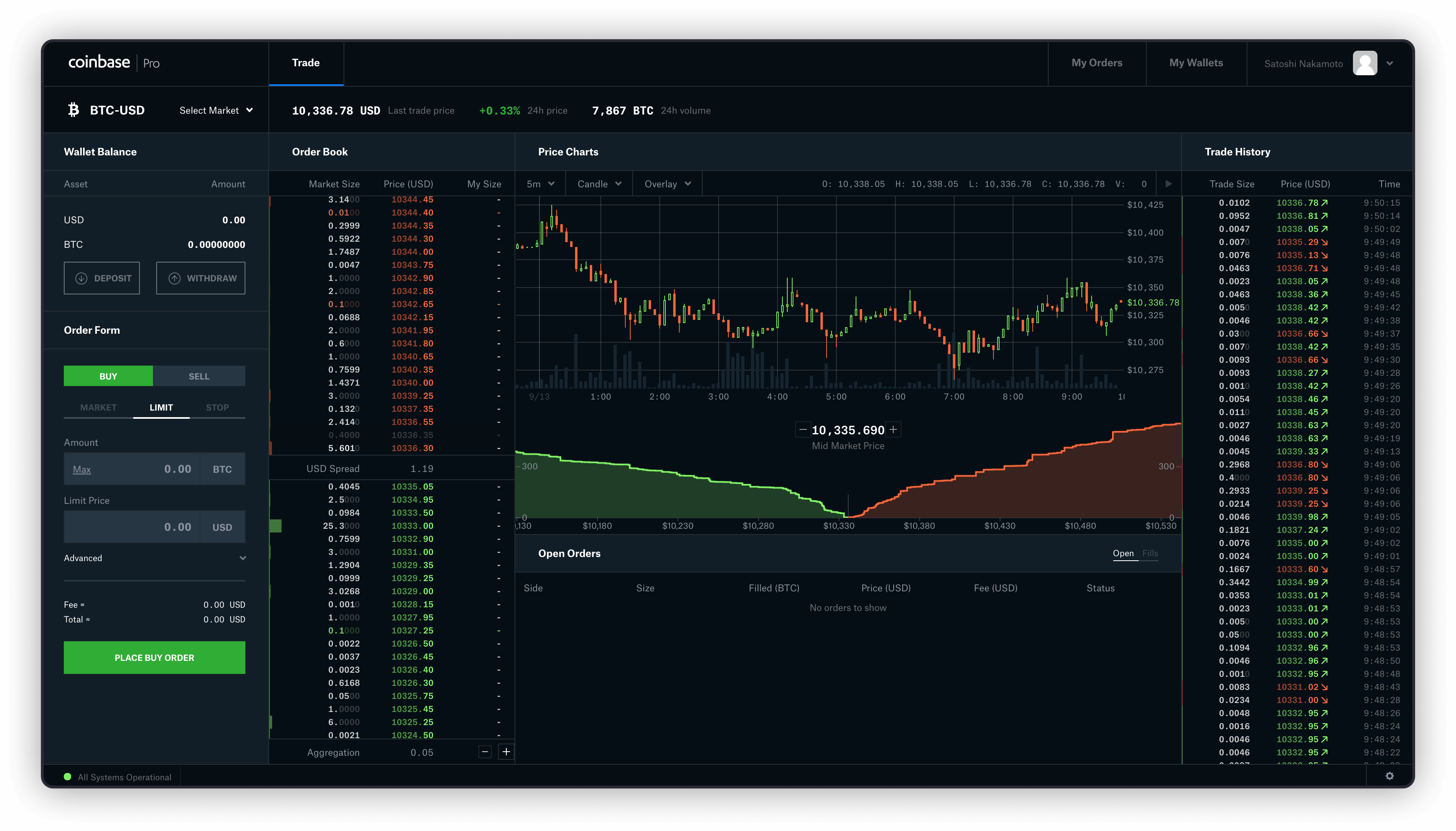

Coinbase – The largest U.S.-based crypto exchange, Coinbase offers a user-friendly app and website for buying Bitcoin and other cryptocurrencies directly from your bank account or debit card. Enhanced security, robust compliance, and instant purchases make it a top choice for beginners.

-

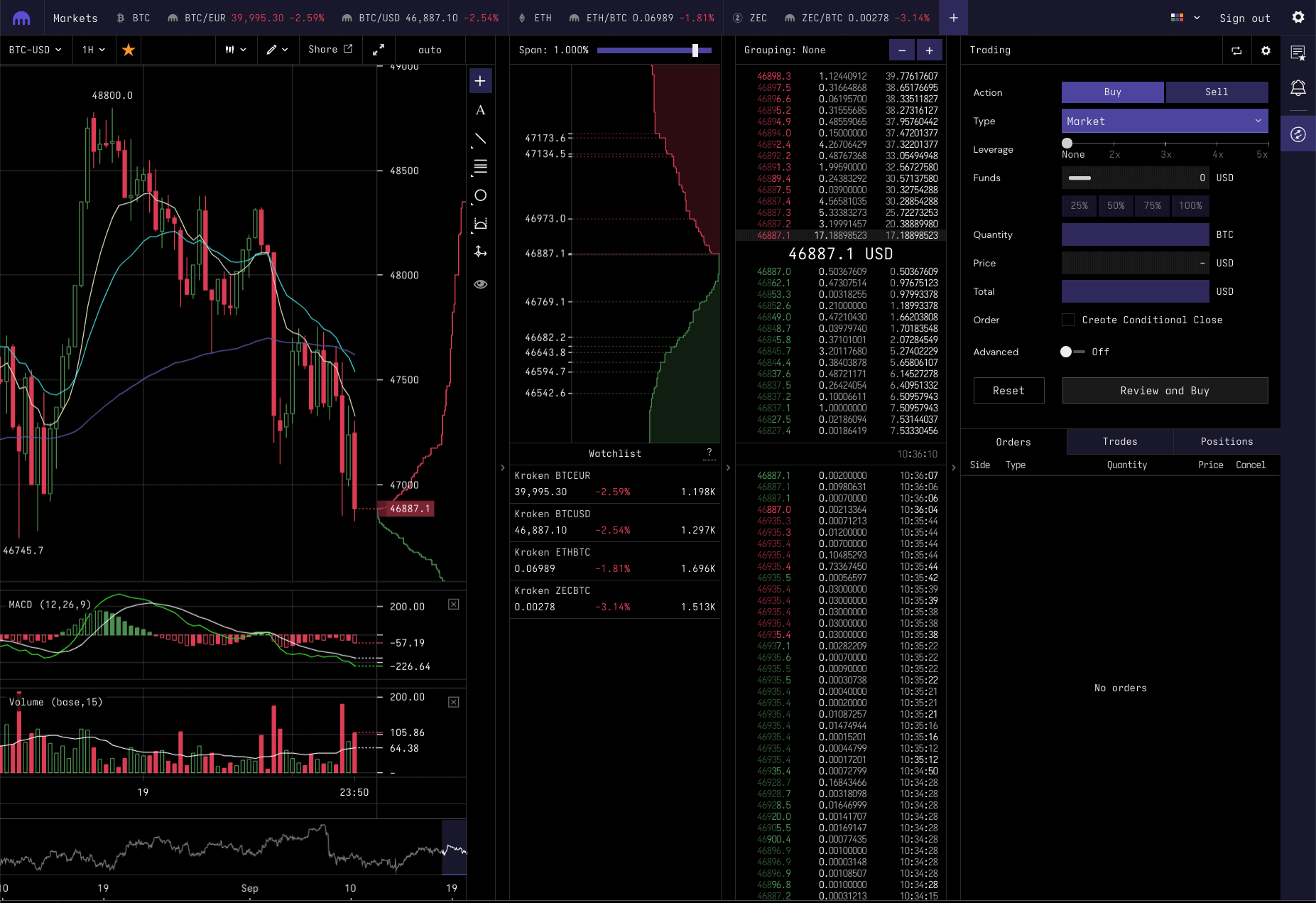

Kraken – Known for its advanced security and low fees, Kraken lets users buy, sell, and trade a wide range of cryptocurrencies. The platform supports instant ACH transfers and offers educational resources for new users.

-

Robinhood Crypto – Robinhood allows commission-free crypto purchases alongside stocks and ETFs. Its intuitive mobile app is ideal for first-time buyers, and it recently expanded its wallet features for direct crypto withdrawals.

-

Cash App – Cash App by Block, Inc. enables quick Bitcoin purchases with just a few taps. Users can buy, sell, and transfer Bitcoin, and even set up recurring purchases, all within a familiar payments app.

-

Gemini – Gemini is a regulated U.S. exchange with a focus on security and compliance. It offers a streamlined onboarding process, FDIC-insured USD balances, and a mobile app for easy crypto purchases.

-

PayPal – PayPal users can buy, hold, and sell Bitcoin, Ethereum, and other major cryptocurrencies directly through their accounts. The platform emphasizes buyer protection and seamless integration with existing PayPal balances.

Centralized exchanges like Coinbase or Kraken have streamlined onboarding with robust KYC, but they require full ID verification and often link directly to your bank account. Peer-to-peer (P2P) platforms remain an option for those seeking privacy, but always vet your counterparties thoroughly, scams aren’t limited to kiosks.

Some fintech apps now offer instant crypto purchases tied to debit cards or ACH transfers with built-in fraud monitoring. For small amounts (under $1,000), certain wallet apps still let you buy through third-party partners with minimal friction, though fees can be steep.

Staying Safe: What Every New User Needs To Know

The regulatory shift is all about risk management, something every new user should take seriously. Fraudsters love confusion and change; don’t let yourself be an easy target.

- Double-check machine legitimacy: Use only registered operators listed by FinCEN or your state authority.

- Avoid urgent requests: If someone pressures you into sending crypto via ATM, even if they claim to be from law enforcement or tech support, it’s almost certainly a scam.

- Keep receipts: Most new laws require operators to provide transaction receipts, don’t walk away without one.

- Report suspicious activity immediately: The 30-day refund window is real under S.710 if you act fast (details here).

The Future of Crypto Onboarding: Will Access Get Easier?

The short answer? Not soon. With over 20 states drafting or passing new restrictions just this year (read more), the patchwork will only get messier before it stabilizes. Expect more bans in high-fraud areas and tighter controls everywhere else.

If you want smooth onboarding in 2025, stay ahead of local news and be prepared for evolving KYC demands, even at non-ATM venues. Don’t assume yesterday’s rules apply today; cities like Spokane and Stillwater have proven how quickly things can change (source).

The bottom line: If you want exposure while Bitcoin sits at $117,743.00, you’ll need flexibility, and vigilance, as US access points evolve under pressure from both scammers and lawmakers alike.