Counterfeit stablecoins have become a persistent threat in crypto, undermining trust and putting beginners at risk of scams. As digital assets like USDC and PYUSD gain adoption, the need for robust verification has never been greater. Enter ‘Know Your Issuer’ (KYI) technology: a data-driven solution designed to help users verify the authenticity of stablecoins and protect against fraud.

How ‘Know Your Issuer’ Tech Protects Stablecoin Holders

The core innovation behind KYI is straightforward yet powerful. By embedding verifiable issuer credentials directly into each token, KYI allows anyone – from retail users to institutions – to confirm that their stablecoin was minted by the legitimate entity. This on-chain verification is critical as fake tokens mimicking brands like USDC and PYUSD have flooded blockchains, tricking even experienced users.

According to Georgetown law professor Chris Brummer, who helped lead the KYI initiative, counterfeit cryptocurrencies “hurt everyone involved. ” The launch of PayPal USD (PYUSD), for example, saw nearly 30 fake versions appear almost instantly across Ethereum and BNB Smart Chain (source). Without KYI or similar safeguards, distinguishing real from fake becomes a technical challenge for beginners.

USDC and PYUSD: Security Features You Need to Know

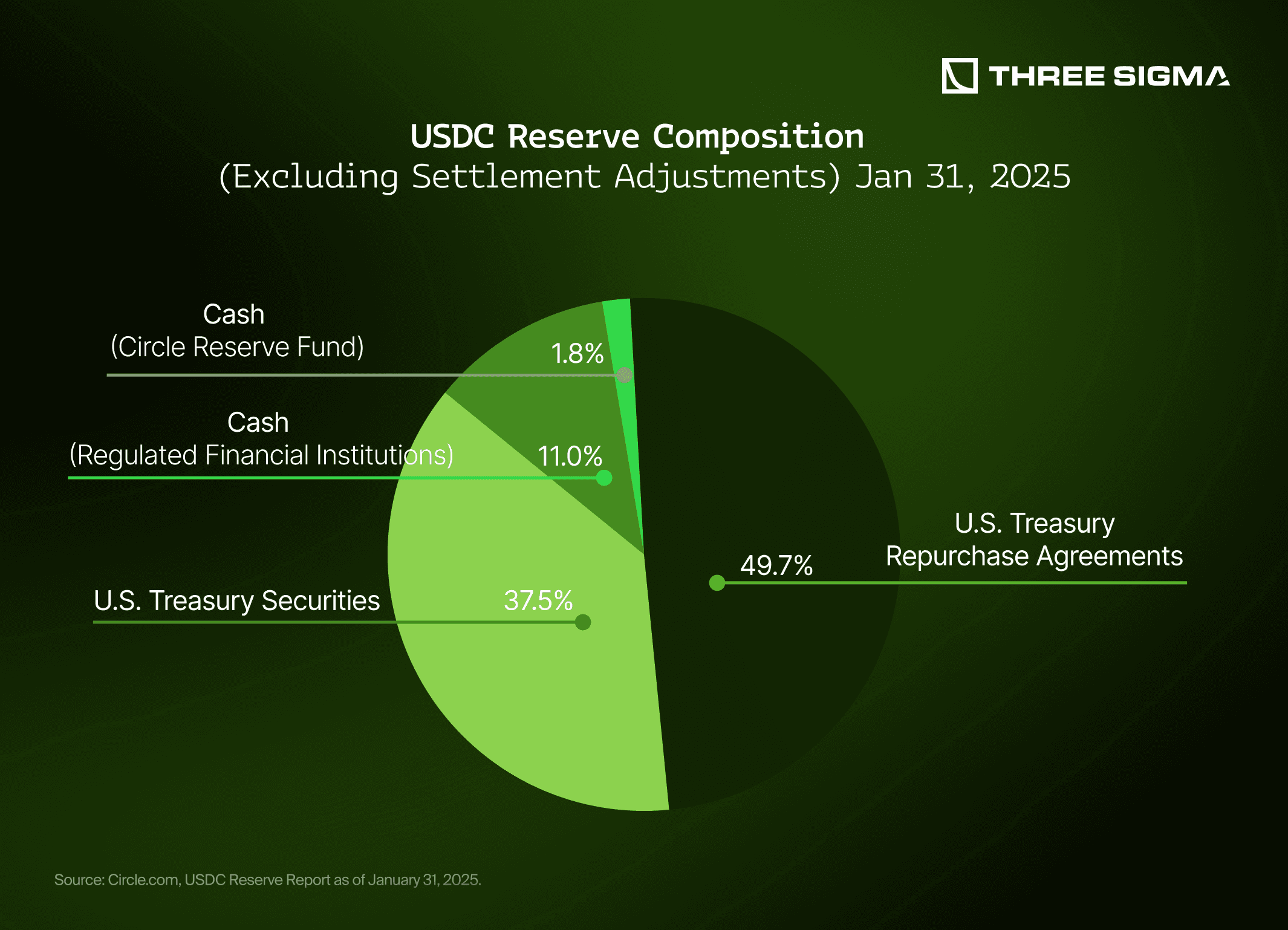

USDC, issued by Circle, has integrated KYI tech to let users verify its legitimacy on-chain. This is in addition to Circle’s monthly reserve attestations and compliance mechanisms such as address blacklisting (source). Transparency is non-negotiable: each USDC token is backed 1: 1 with U. S. dollars, confirmed via public reports.

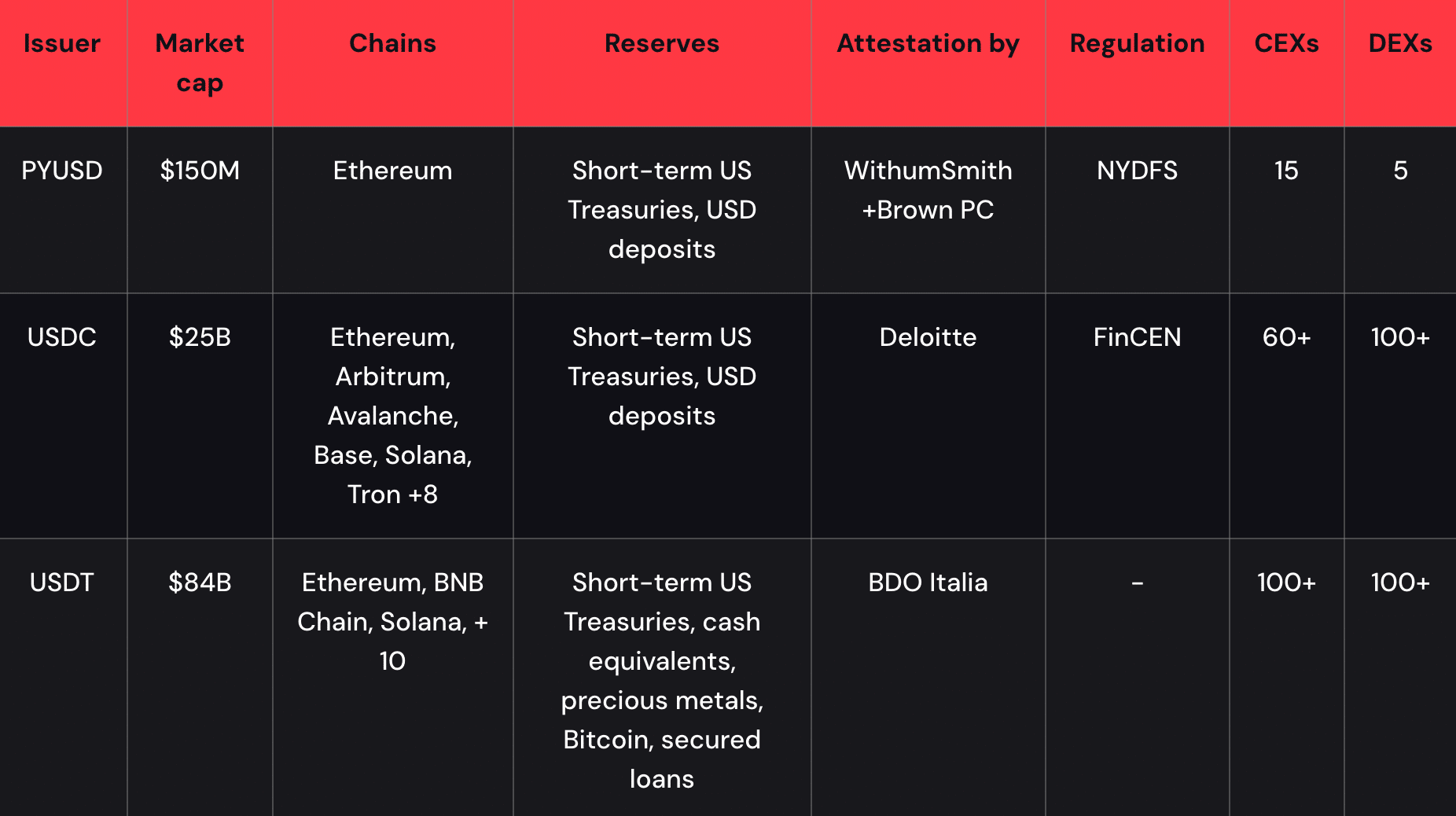

PYUSD, PayPal’s stablecoin launched with Paxos Trust Company, also leverages KYI measures. Its reserves consist of U. S. dollar deposits, Treasuries, and cash equivalents; monthly reserve reports are published for public scrutiny (source). Supervised by the New York Department of Financial Services (NYDFS), PYUSD benefits from advanced anti-fraud systems and blockchain analytics partnerships.

Key Security Differences: USDC vs. PYUSD

-

Issuer and Regulatory Oversight: USDC is issued by Circle and operates under Circle’s compliance framework. PYUSD is issued by Paxos Trust Company in partnership with PayPal and is regulated by the New York Department of Financial Services (NYDFS), providing an additional layer of regulatory supervision.

-

Implementation of ‘Know Your Issuer’ (KYI) Technology: Both USDC and PYUSD have integrated KYI technology to combat counterfeit tokens. This allows users to verify the legitimacy of a token by checking the issuer’s credentials directly on-chain, reducing the risk of interacting with fake stablecoins.

-

Transparency and Reserve Attestations: USDC publishes monthly reserve attestations to confirm that each token is fully backed by U.S. dollar reserves. PYUSD also provides monthly reserve reports, detailing backing by U.S. dollar deposits, U.S. Treasuries, and cash equivalents. This transparency ensures users can verify the solvency of each stablecoin.

-

Anti-Fraud and Compliance Mechanisms: USDC incorporates address blacklisting to prevent illicit activities, managed by Circle. PYUSD leverages advanced anti-fraud systems and collaborates with blockchain forensics firms to monitor and prevent suspicious transactions, reflecting PayPal’s focus on user security.

-

Market Integration and User Assurance: Both stablecoins offer regulatory assurance and enhanced user trust through their security protocols, but PYUSD benefits from PayPal’s global compliance infrastructure and user protections, while USDC is widely integrated across major crypto platforms, offering broad accessibility and liquidity.

A Crypto Beginner’s Guide to Stablecoin Verification

If you’re new to crypto onboarding or worried about falling victim to PYSUD scams or counterfeit stablecoins in general, here are actionable steps:

- Always verify the contract address: Use trusted sources like Etherscan or official issuer websites before transacting.

- Look for on-chain issuer credentials: With KYI-enabled tokens, you can check if your coin was minted by Circle (for USDC) or Paxos/PayPal (for PYUSD).

- Avoid deals that seem too good to be true: Counterfeiters often lure victims with unrealistic yields or discounts.

- Stay updated on regulatory news: Both USDC and PYUSD regularly publish compliance updates; being informed helps you spot red flags early.

Even with robust frameworks like KYI, the human element remains a key vulnerability. Phishing attacks, fake websites, and social engineering scams are constantly evolving. Beginners must be vigilant when interacting with stablecoins, especially as counterfeiters become more sophisticated in mimicking genuine assets.

Practical Crypto Safety Tips for Beginners

Protecting your digital assets goes beyond relying on technology alone. Here are essential crypto safety tips for anyone starting out:

Essential Tips for Verifying and Securing USDC & PYUSD

-

Always Verify the Official Token Contract Address: Before purchasing or transferring USDC or PYUSD, confirm the official contract address on trusted sources like Etherscan or the official issuer websites (Circle for USDC, PayPal/Paxos for PYUSD). Counterfeit tokens often use similar names but different contract addresses.

-

Use ‘Know Your Issuer’ (KYI) Verification Tools: Leverage platforms and wallets that integrate KYI technology to check the issuer’s on-chain credentials. This ensures the token’s legitimacy and helps avoid counterfeit coins.

-

Check for Reserve Transparency Reports: Only interact with USDC and PYUSD tokens whose issuers publish monthly reserve attestations (Circle for USDC, Paxos for PYUSD). These reports confirm that each token is fully backed and authentic.

-

Confirm Regulatory Oversight and Compliance: Choose stablecoins issued by entities under strict regulatory supervision (e.g., Circle is regulated in the US, Paxos is overseen by NYDFS for PYUSD). Regulatory compliance reduces fraud risk and enhances security.

-

Beware of Phishing and Impersonation Scams: Always access USDC and PYUSD information through official websites or verified wallet apps. Avoid clicking on suspicious links or interacting with unknown DMs claiming to offer stablecoins.

-

Monitor Wallet Security and Approvals: Regularly review your wallet’s token approvals and revoke access for any suspicious or unnecessary dApps. This limits exposure to counterfeit tokens and unauthorized transfers.

-

Stay Updated on Security Developments: Follow official announcements from Circle, PayPal, and Paxos for updates on security protocols, KYI adoption, and counterfeit threats. Staying informed helps you respond quickly to new risks.

Verifying a token’s authenticity can be done in seconds using on-chain explorers like Etherscan. Always cross-check the token’s contract address against the official documentation from Circle (for USDC) or PayPal/Paxos (for PYUSD). If you notice discrepancies, such as a missing dollar value or an unfamiliar logo, pause and investigate further. Coinbase offers a simple guide to help users spot fake stablecoins by examining these cues (source).

Transparency reports are another critical tool. Both Circle and Paxos regularly publish detailed reserve attestations, which can be independently reviewed by anyone. This commitment to transparency is a cornerstone of trust in the stablecoin sector, and a major differentiator from unregulated or opaque projects.

What to Do If You Suspect a Counterfeit Stablecoin

If you come across what you believe is a counterfeit stablecoin, take these steps immediately:

- Stop all transactions involving the suspected token.

- Report the contract address to your wallet provider, exchange, or directly through platforms like Etherscan.

- Consult official channels: Both Circle and PayPal maintain help desks for fraud reports and verification support.

- Avoid sharing private keys or seed phrases, even if prompted by someone claiming to offer assistance.

If it feels off, it probably is. Trust but verify, especially when your funds are at stake.

Why KYI Matters for Crypto Onboarding in 2025

The rise of ‘Know Your Issuer’ tech marks an important step forward in crypto onboarding. For beginners, this means fewer barriers to entry, less technical guesswork, and greater confidence that their digital dollars are genuine, not counterfeit imitations. As regulatory scrutiny increases worldwide, such innovations will likely become standard across all reputable stablecoins.

The current market prices reflect growing trust in these protocols: USDC remains steady at $0, while PYUSD shows minimal volatility at -0.02%. These figures underscore the value of stability, and why security innovation is so closely linked with price integrity in the stablecoin sector.