Crypto scams are not just a relic of the past, they have become more sophisticated and pervasive in 2025, targeting both new and experienced investors. With Bitcoin holding strong above $100,000, digital assets remain attractive to legitimate investors and fraudsters alike. Recent headlines highlight a troubling surge in crypto ATM fraud, imposter scams, and AI-driven deception. Regulators like the FBI and the North American Securities Administrators Association have issued urgent warnings as scammers exploit new technologies and old vulnerabilities alike.

Why Crypto Scams Are Surging in 2025

The sharp rise in crypto scams this year can be attributed to several factors: mainstream adoption of digital currencies, the proliferation of crypto ATMs in convenience stores and malls, and advanced scam tactics leveraging artificial intelligence. In Washington, D. C. , for example, the Attorney General has sued Athena Bitcoin for allegedly enabling scams through their ATMs while charging undisclosed fees as high as 26%: often targeting seniors (source).

The FBI’s latest warnings underscore that imposter scams, where criminals pose as law enforcement or tech support, are now the most reported form of Bitcoin fraud. Meanwhile, deepfake endorsements from AI-generated videos further muddy the waters for anyone trying to onboard into crypto safely.

Five Essential Strategies to Spot Red Flags and Protect Your Digital Assets

Top 5 Strategies to Avoid Crypto Scams in 2025

-

Verify All Crypto ATM Fees and Operators Before Use: Always check for clearly disclosed fees at crypto ATMs. Research the operator’s reputation—recent lawsuits against Athena Bitcoin highlight the risks of hidden fees (up to 26%) and lack of transparency. Avoid machines without upfront pricing or those operated by companies with poor legal track records.

-

Beware of Imposter Scams and Urgent Threats: Be highly skeptical of anyone claiming to be law enforcement, government, or tech support demanding urgent Bitcoin payments. The FBI reports these are the most common crypto scams in 2025. Never act under pressure or secrecy—pause and verify independently.

-

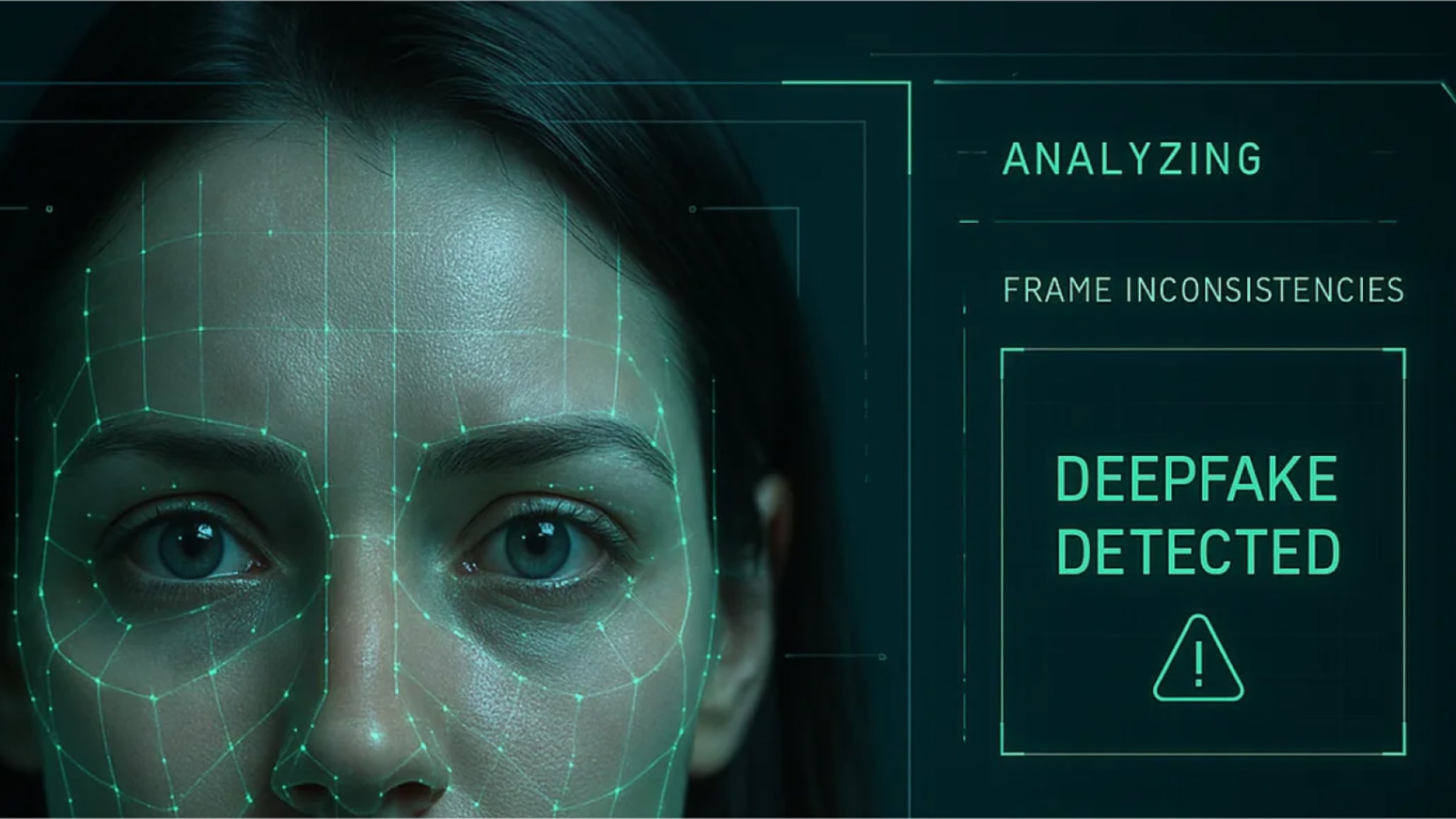

Authenticate Endorsements and Investment Offers: Cross-check all crypto investment opportunities or endorsements—especially those using celebrity images or AI-generated videos—with official sources. Fraudsters now use deepfakes and social media to appear legitimate. Always verify before sending funds.

-

Use AI-Powered Scam Detection Tools: Leverage up-to-date browser extensions (like MetaMask), wallet security features, and AI-driven services (such as Chainalysis) to flag suspicious links, addresses, or transactions. These tools are essential as scam tactics become more sophisticated in 2025.

-

Know Your Recovery Steps in Case of a Scam: Familiarize yourself with reporting procedures—contact local authorities, the FBI’s IC3 portal, and crypto recovery hotlines. Document all scam details immediately to improve your chances of asset recovery.

Let’s break down these five critical strategies every investor should know:

1. Verify All Crypto ATM Fees and Operators Before Use

Before inserting cash into any crypto ATM, always check that fees are clearly posted on-screen or beside the machine. Research the operator’s reputation online, recent lawsuits against Athena Bitcoin highlight how hidden fees can reach up to 26%, especially impacting elderly users (source). If a machine does not provide transparent pricing or you cannot find credible reviews about the operator, it is best to walk away.

2. Beware of Imposter Scams and Urgent Threats

The most common Bitcoin scam reported by authorities in 2025 involves scammers posing as police officers, government agents, or tech support staff demanding immediate payment via cryptocurrency ATMs. These criminals create panic by threatening arrest or claiming your accounts will be drained unless you act fast. Never send funds under pressure, take time to verify requests independently.

3. Authenticate Endorsements and Investment Offers

If you receive an investment opportunity or see a celebrity endorsement (especially via social media), always cross-check it with official sources before sending any funds. AI-generated deepfakes can convincingly mimic trusted figures endorsing fake projects, a trend flagged by regulators this year (source). When in doubt, visit official websites directly rather than clicking on links from emails or messages.

The Role of Technology in Scam Prevention (and Exploitation)

As scammers use increasingly advanced tools like AI-generated content to deceive victims, investors must also harness technology for defense. From browser extensions that flag suspicious URLs to wallet apps with built-in scam detection powered by machine learning, there are more resources than ever for proactive protection.

The landscape of crypto security is evolving rapidly, but so are the tactics used by fraudsters. In the next section we’ll explore how leveraging these technologies can make all the difference when navigating today’s risky digital asset environment.

Modern crypto wallets and exchanges increasingly integrate AI-driven security features that monitor for unusual activity, phishing attempts, and known scam addresses. Before confirming any transaction, take advantage of these built-in warnings or consider reputable third-party browser extensions that alert you to suspicious links or wallet addresses. These tools are not foolproof but serve as a valuable first line of defense against the most common crypto scams in 2025.

4. Use AI-Powered Scam Detection Tools

AI-powered scam detection is no longer a luxury, it’s a necessity. With deepfakes and sophisticated phishing ploys on the rise, leveraging technology to scan communications, websites, and even QR codes can help spot red flags before you commit funds. Many leading wallets now offer real-time alerts about potentially fraudulent transactions or known scam domains.

Stay vigilant by regularly updating your wallet software and browser extensions. Consider enabling advanced security features such as address whitelisting or transaction limits for added protection.

5. Know Your Recovery Steps in Case of a Scam

Even with the best precautions, mistakes can happen. If you suspect you’ve fallen victim to a crypto scam, whether through an ATM like those operated by Athena Bitcoin or an online phishing attack, immediate action is essential:

- Document all details: Save transaction IDs, receipts, screenshots, emails, and any correspondence with the scammer.

- Report promptly: Contact your local authorities and file a complaint with the FBI’s IC3 portal (ic3. gov). Many jurisdictions also have dedicated crypto recovery hotlines.

- Notify your exchange/wallet provider: Some platforms can freeze suspicious withdrawals if alerted quickly enough.

The sooner you act, the higher your chances of asset recovery, though unfortunately, in many cases funds are difficult to retrieve once sent on-chain. By knowing these steps ahead of time, you’re better positioned to respond decisively if disaster strikes.

Staying Ahead: Proactive Crypto Safety in 2025

The digital asset landscape is evolving rapidly, and so are the tactics used by fraudsters targeting everyone from first-time buyers to seasoned investors. While headlines about lawsuits against operators like Athena Bitcoin highlight systemic vulnerabilities (source), personal vigilance remains your strongest shield.

If an opportunity seems too good to be true, or if anyone pressures you for urgent action, pause and verify before proceeding. Rely on official channels for investment information and always cross-check endorsements using multiple sources. Remember: legitimate entities will never ask for private keys or seed phrases.

The surge in crypto scams in 2025 is a wake-up call for all digital asset holders. By mastering these five strategies, verifying ATM fees/operators, watching for imposter scams, authenticating offers, using AI-powered detection tools, and knowing recovery steps, you significantly reduce your risk of falling victim to fraud. Stay informed with trusted resources like NASAA’s investor alerts (source) and make ongoing security education part of your crypto journey.