If you’re new to crypto, 2025 has already been a wild ride, especially if you’ve been watching the stablecoin market. In August, total stablecoin capitalization hit a jaw-dropping $278 billion, marking nearly two years of non-stop growth. But what’s really making headlines now is the launch of Tether’s new USAT stablecoin and the impact of fresh U. S. regulations designed to make digital dollars safer and more transparent than ever before.

Stablecoins in 2025: Why Everyone’s Talking About Them

Stablecoins aren’t just for pro traders anymore. These digital assets, pegged to real-world currencies like the U. S. dollar, are quickly becoming the backbone of mainstream crypto adoption. Their appeal? They combine the speed and borderless nature of crypto with the price stability of fiat currency. For beginners, that means you can avoid the wild price swings that make Bitcoin and Ethereum both exciting and intimidating.

In 2025, stablecoins are everywhere, from payments at online stores to treasury management for businesses. The proliferation is partly due to increased institutional trust and regulatory clarity, which has helped push daily volumes and user numbers through the roof.

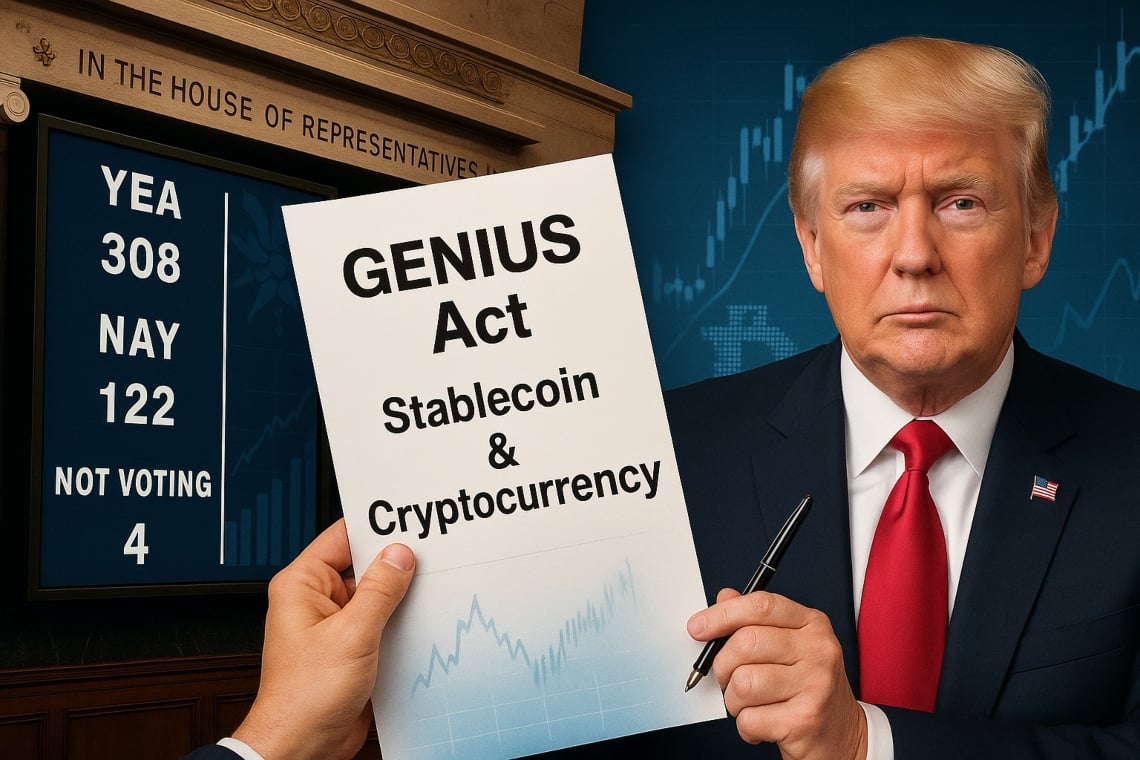

The GENIUS Act: How New U. S. Laws Are Shaping Stablecoin Safety

The most important development for American crypto newcomers is the GENIUS Act, a landmark piece of legislation passed this year that sets strict standards for stablecoin issuers operating in the U. S. Here’s what matters:

- Full Asset Backing: Every stablecoin must be backed by highly liquid assets, think actual U. S. dollars or short-term Treasury bills.

- Monthly Reserve Reports: Issuers are now required to publish monthly disclosures showing exactly what backs their coins.

- U. S. -Based Custody: Reserves must be held with federally regulated institutions (no more mystery offshore vaults).

This shift is huge for anyone worried about transparency or safety when dipping their toes into digital assets. The days of “trust us” are over; now it’s all about verifiable facts and real-time data.

Tether’s USAT Launch: What It Means for Crypto Beginners

Tether, the company behind USDT, crypto’s most traded stablecoin, has just dropped its newest product: USAT. This isn’t just another token; it’s designed specifically to meet all new U. S. regulatory requirements under the GENIUS Act.

What makes USAT different?

- Issued by Anchorage Digital Bank: A federally licensed crypto bank you can actually Google (and trust).

- Reserves managed by Cantor Fitzgerald: Yes, that Cantor Fitzgerald, the Wall Street giant.

- Pitched at American users: Finally, a Tether product built from day one with U. S. compliance in mind.

The initiative is led by Bo Hines, a former White House official, which signals just how seriously Tether is taking its U. S. expansion this time around (read more here). If you’re a beginner worried about safety or legality, USAT could be your on-ramp into stablecoins without crossing your fingers behind your back.

Tether (USDT) Price Prediction 2026-2031: Navigating Stablecoin Growth and Regulation

USDT and USAT Outlook Amid Regulatory Clarity and Market Expansion

| Year | Minimum Price | Average Price | Maximum Price | % Change (Avg) | Market Scenario Insights |

|---|---|---|---|---|---|

| 2026 | $0.98 | $1.00 | $1.02 | 0% | Stable; minor deviations possible during liquidity stress or regulatory events |

| 2027 | $0.98 | $1.00 | $1.02 | 0% | Continued US regulatory oversight keeps peg tight; adoption in payments rises |

| 2028 | $0.97 | $1.00 | $1.03 | 0% | Increased competition from CBDCs and new stablecoins; brief volatility in risk-off markets |

| 2029 | $0.97 | $1.00 | $1.03 | 0% | USAT and USDT co-exist; technology upgrades improve transparency and liquidity |

| 2030 | $0.96 | $1.00 | $1.04 | 0% | Macro shocks (e.g., US debt issues or tech failures) could cause rare, short-lived deviations |

| 2031 | $0.96 | $1.00 | $1.04 | 0% | Stablecoin sector matures; market cap growth slows, but USDT remains a key liquidity vehicle |

Price Prediction Summary

USDT and USAT are expected to maintain their $1.00 peg through 2031, with rare deviations primarily driven by market stress, regulatory actions, or systemic events. Regulatory clarity, robust backing, and Tether’s proactive compliance measures will support long-term stability. Average price is projected to remain at $1.00 annually, with minimums and maximums reflecting short-term volatility during extreme scenarios. USAT’s launch enhances trust and integration in the US, further solidifying Tether’s leading role in the stablecoin market.

Key Factors Affecting Tether Price

- Ongoing US and global regulatory evolution, especially enforcement of reserve transparency and liquidity standards

- Tether’s ability to maintain robust reserves and transparent disclosures for both USDT and USAT

- Market adoption in payments, DeFi, and cross-border settlements

- Competition from other stablecoins (e.g., USDC), CBDCs, and emerging fintech solutions

- Potential macroeconomic shocks, such as US Treasury market disruptions or systemic crypto events

- Technological upgrades for faster settlement, improved transparency, and risk management

Disclaimer: Cryptocurrency price predictions are speculative and based on current market analysis.

Actual prices may vary significantly due to market volatility, regulatory changes, and other factors.

Always do your own research before making investment decisions.

Your First Steps: Safe Stablecoin Adoption in Today’s Market

Navigating this new era doesn’t have to be intimidating, even if you’re just starting out with crypto onboarding in 2025. Here are some quick tips for safe adoption:

Top Tips for Getting Started with Regulated Stablecoins

-

Choose a Reputable, Regulated Stablecoin: Opt for well-established, US-regulated stablecoins like USAT (Tether’s new U.S.-based token) or USDC from Circle. These coins comply with federal laws, are fully backed by liquid assets, and offer monthly reserve disclosures for transparency.

-

Use Trusted, Licensed Crypto Platforms: Start your stablecoin journey on platforms that are federally licensed and have strong compliance track records, such as Coinbase, Kraken, or Anchorage Digital Bank (the official issuer of USAT).

-

Verify Reserve Transparency: Always check if your chosen stablecoin publishes regular, third-party audited reserve reports. For example, USAT and USDC both provide monthly disclosures detailing their liquid asset backing.

-

Understand Fees and Conversion Rates: Before buying or transferring stablecoins, review the platform’s fees and make sure you’re getting a fair conversion rate—especially since stablecoins like USDT (Polygon) are currently priced at $1.00 with minimal daily fluctuation.

-

Stay Updated on Regulatory Changes: The stablecoin landscape is evolving rapidly. Follow official news from regulators like the SEC and reputable crypto news sources (e.g., CoinDesk, Reuters) to stay informed about new laws like the GENIUS Act and upcoming products like USAT.

The bottom line? With prices holding steady (Polygon Bridged USDT is trading at exactly $1.00 today), and regulation finally catching up, there has never been a better moment for newcomers to explore stablecoins as a low-volatility entry point into crypto markets.

But as with any financial innovation, it pays to stay sharp. Even with new laws and institutional backing, not all stablecoins are created equal. Look for options that are regulated in your jurisdiction, provide transparent reserve data, and have a proven track record in the market. The launch of USAT is a big leap forward for American users, but always do your own research before jumping in.

What to Watch: Risks and Rewards for Crypto Beginners

Stablecoins offer a powerful blend of stability and flexibility, but they aren’t risk-free. Regulatory changes can shift quickly, and even well-backed coins can face operational hiccups or market stress. Here’s what beginners should keep top-of-mind:

- Counterparty Risk: Even regulated issuers depend on trusted banks and custodians. Know who holds the reserves.

- Redemption Policies: Can you easily convert your stablecoins back to cash? Check the fine print before you buy.

- Market Liquidity: Popular coins like USDT and USAT tend to hold their $1.00 peg (see latest data), but lesser-known options may not.

If you’re looking for peace of mind, stick with regulated coins like USAT or Polygon Bridged USDT, both trading right at $1.00 as of today. These tokens are designed to weather regulatory storms and provide transparent, real-time reporting so you always know what backs your digital dollars.

Top Advantages of Using Compliant Stablecoins in 2025

-

Enhanced Regulatory Protection: New laws like the GENIUS Act require stablecoins to be backed by liquid assets (such as U.S. dollars and short-term Treasury bills) and mandate transparent monthly reserve disclosures. This provides users with greater security and confidence when holding assets like Tether’s USAT or Circle’s USDC.

-

Price Stability: Leading stablecoins such as USDT, USDC, and the new USAT are designed to maintain a 1:1 peg to the U.S. dollar, minimizing volatility. For example, Polygon Bridged USDT is currently priced at $1.00, offering predictability for beginners entering crypto.

-

Seamless Integration with Financial Services: Compliant stablecoins are now widely accepted across major crypto exchanges, payment platforms, and DeFi protocols, making it easier than ever for users to trade, invest, and transfer funds globally without the complexities of traditional banking.

-

Transparent Reserve Management: With issuers like Tether USAT partnering with regulated entities such as Anchorage Digital Bank and Cantor Fitzgerald, users benefit from regular, independently verified reports on asset backing and reserve composition.

-

Improved Accessibility and User Experience: The rise of beginner-friendly platforms and clear regulatory frameworks in 2025 has made it easier for newcomers to buy, hold, and use stablecoins safely, reducing barriers to entry into the crypto space.

Getting Started: Your Onboarding Checklist

Dipping your toes into crypto doesn’t have to be overwhelming. With the right approach, you can use stablecoins as a safe entry point while building up your knowledge (and confidence) along the way.

The surge in stablecoins isn’t just hype, it’s a signal that crypto is maturing into something everyone can use. Whether you want to send money across borders, park funds in digital dollars, or simply learn how blockchain works without wild price swings, now is an ideal time to get started. Regulation is making things safer; innovation is making them easier.

If you’re ready for your first step into crypto, start by exploring well-regulated options like Tether’s USAT or Polygon Bridged USDT (still holding firm at $1.00). And remember, stay curious, stay cautious, and let transparency guide your journey into digital assets!