Coinbase’s campaign for federal crypto regulation has moved from boardroom discussions to tangible changes in the way Americans enter the digital asset ecosystem. In 2025, these efforts are not just theoretical, they’re actively reshaping how users onboard to crypto platforms, especially as Coinbase Global Inc. (COIN) trades at $320.56 as of September 18,2025. For anyone looking to buy their first bitcoin or diversify into altcoins, understanding this regulatory evolution is crucial.

Why Federal Crypto Regulation Matters More Than Ever

The United States has long been a patchwork of state-by-state crypto rules. This fragmentation often led to onboarding delays, inconsistent Know Your Customer (KYC) standards, and confusion for new users. Coinbase’s recent push, urging the U. S. Department of Justice to establish uniform federal guidelines, has been pivotal in shifting the conversation from state-level conflicts to streamlined national oversight (Edgen Tech).

This regulatory clarity is more than a legal milestone; it’s a user experience revolution. With federal guidelines in place, exchanges like Coinbase can standardize compliance procedures, making it easier and faster for individuals to start their crypto journey.

Coinbase’s Strategic Moves: From SEC Lawsuit Dismissal to Federal Bank Charter

2025 saw two watershed moments: the SEC dropping its lawsuit against Coinbase, and Coinbase signaling interest in a U. S. federal bank charter (Cointelegraph). The lawsuit dismissal marked a shift toward regulatory collaboration rather than confrontation, sending a positive signal across the industry.

The potential acquisition of a federal bank charter would allow Coinbase to bridge traditional finance and digital assets more seamlessly. This could mean not only faster fiat onramps but also access to products like interest-bearing accounts and crypto-backed loans, features that were previously out of reach due to regulatory uncertainty.

Onboarding Experience: Faster Compliance, Better Security

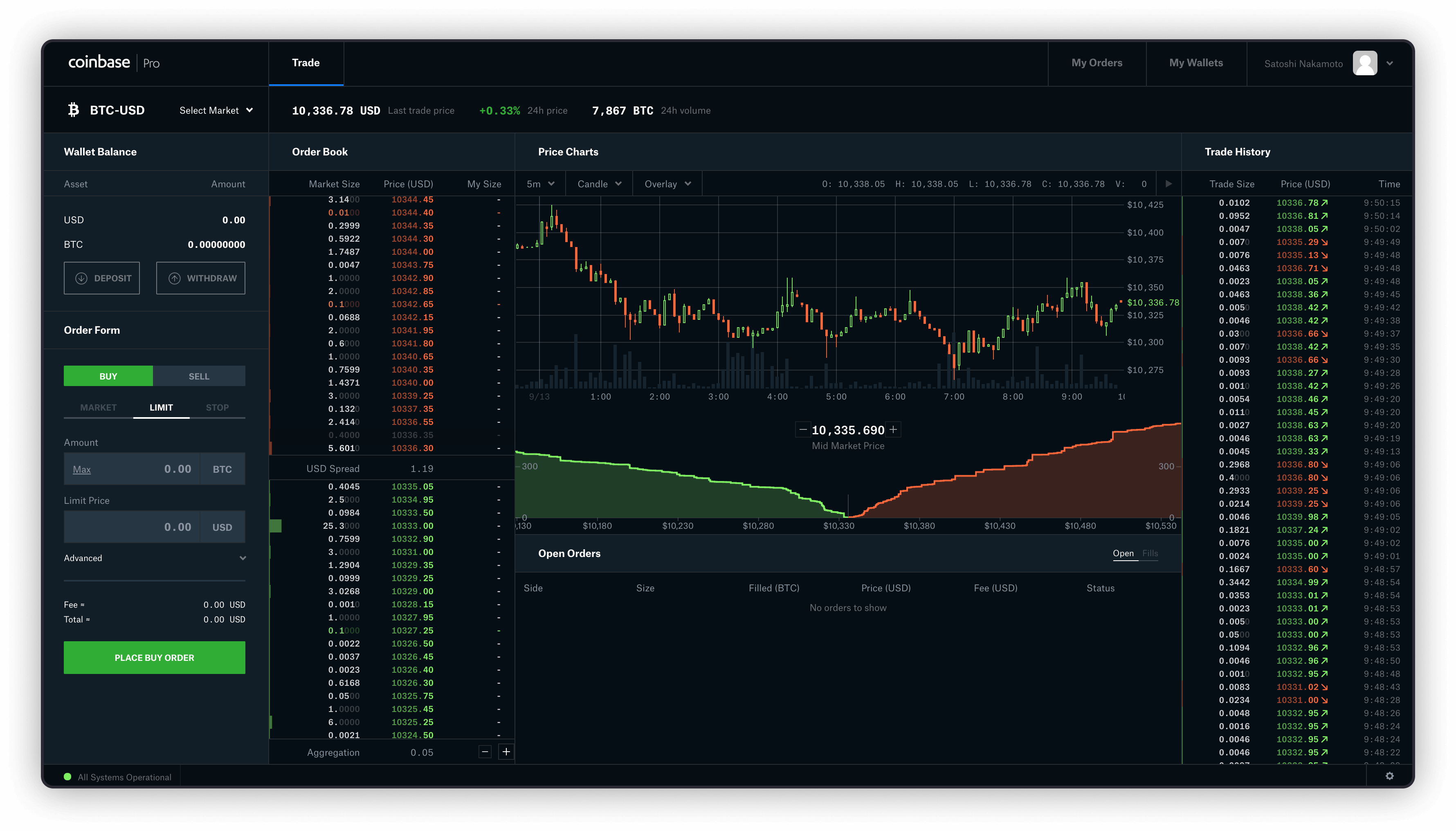

For new users in 2025, onboarding with Coinbase is dramatically improved compared to just a year ago:

- Simplified KYC: With unified federal standards, identity verification now takes minutes instead of days.

- Expanded Services: Federal licensing paves the way for new offerings like insured custodial accounts and integrated lending products.

- Tighter Security: Advanced protocols such as threshold signature schemes and mandatory hardware security keys protect user assets at every step (BTCC).

This is not just about speed; it’s about trust and accessibility for retail investors who may have hesitated due to past regulatory ambiguity or security fears.

Coinbase Global Inc. (COIN) Stock Price Prediction 2026-2031

Professional forecast based on regulatory developments, company fundamentals, and crypto market outlook as of September 2025

| Year | Minimum Price (Bearish) | Average Price (Base) | Maximum Price (Bullish) | YoY Change (Avg) | Key Scenario |

|---|---|---|---|---|---|

| 2026 | $245.00 | $335.00 | $410.00 | +4.5% | Regulatory clarity boosts user growth; minor volatility persists |

| 2027 | $265.00 | $360.00 | $450.00 | +7.5% | Federal bank charter approved; product suite expands |

| 2028 | $285.00 | $390.00 | $490.00 | +8.3% | Mainstream adoption of crypto finance accelerates |

| 2029 | $305.00 | $425.00 | $540.00 | +9.0% | Earnings growth driven by institutional clients |

| 2030 | $330.00 | $465.00 | $600.00 | +9.4% | Global expansion and new revenue streams |

| 2031 | $355.00 | $510.00 | $670.00 | +9.7% | Crypto integration with traditional finance matures |

Price Prediction Summary

Coinbase (COIN) is forecast to experience steady growth through 2031, supported by regulatory clarity, expanded product offerings, and increasing crypto adoption. While volatility remains due to the evolving regulatory landscape and crypto market cycles, the company’s proactive stance and potential federal bank charter position it for robust long-term performance. The average price is projected to rise from $335.00 in 2026 to $510.00 by 2031, with bullish scenarios reflecting successful expansion and integration with mainstream finance.

Key Factors Affecting Coinbase Global Inc. Stock Price

- Federal crypto regulation and its consistency

- Progress toward a federal bank charter and new product launches

- Crypto market adoption rates and trading volumes

- Coinbase’s earnings growth and profitability

- Competition from other exchanges and fintechs

- U.S. and global macroeconomic conditions

- Potential for regulatory setbacks or enforcement actions

- Technological advancements and security measures

Disclaimer: Stock price predictions are speculative and based on current market analysis.

Actual prices may vary significantly due to market volatility, economic conditions, and other factors.

Always do your own research before making investment decisions.

The Ongoing Debate: Federal vs State Crypto Laws in Practice

The move toward uniform federal regulation does not come without controversy. Some states argue that local oversight allows them to address unique risks or foster innovation tailored to their economies. However, for national platforms like Coinbase, and their millions of users, the benefits of predictable, centralized rules are hard to ignore.

For individual users, the debate around federal vs state crypto laws is more than a policy squabble. It directly influences how quickly you can open an account, what assets you can access, and what protections are in place if something goes wrong. While some regional flexibility may be lost, the consistency gained means fewer onboarding surprises and less risk of sudden service interruptions due to shifting local rules.

Coinbase’s alignment with federal agencies has also led to a more unified approach to anti-money laundering (AML) and counter-terrorism financing (CTF) protocols. This not only satisfies regulators but also reassures users that their funds are less likely to be caught up in compliance snafus or frozen unexpectedly.

What Users Can Expect Next: Enhanced Products and Smarter Onboarding

The regulatory momentum of 2025 is setting the stage for even broader changes ahead. If Coinbase secures a federal bank charter, expect to see:

Potential New Coinbase Features with a Federal Bank Charter

-

Instant USD Bank Accounts for Crypto Users: If Coinbase secures a federal bank charter, users may gain access to FDIC-insured USD accounts directly within their Coinbase wallets, streamlining deposits and withdrawals between crypto and fiat.

-

Integrated Interest-Bearing Accounts: A federal charter could enable Coinbase to offer interest-bearing savings accounts for both USD and select stablecoins, similar to traditional banks, but with seamless crypto integration.

-

Crypto-Backed Loans and Credit Products: Users might see the introduction of crypto-collateralized loans and credit lines, allowing them to borrow USD or stablecoins against their crypto holdings directly within the platform.

-

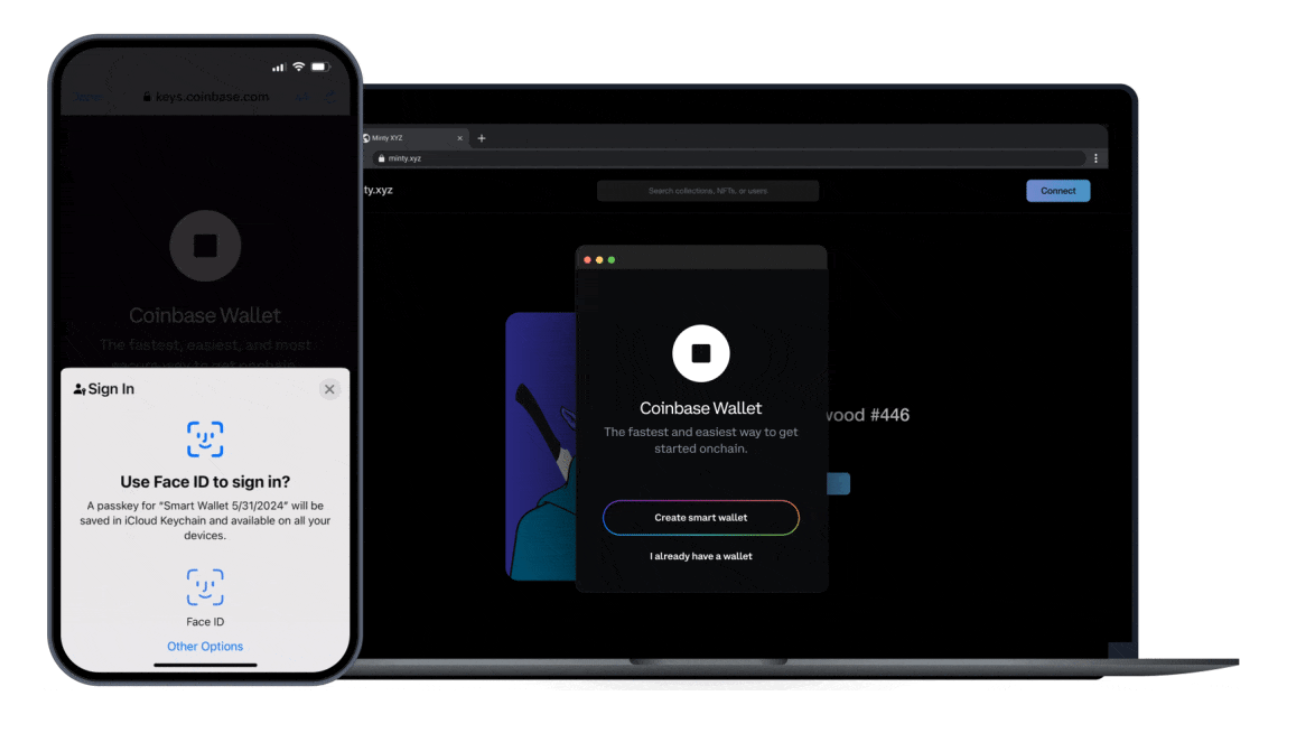

Streamlined KYC and Compliance: With unified federal oversight, Coinbase is expected to further simplify onboarding KYC processes, reducing wait times for new users while maintaining robust compliance standards.

-

Enhanced Security Protocols: Adoption of advanced security measures like threshold signature schemes and mandatory hardware security keys will help protect user assets and personal data at onboarding and beyond.

-

Expanded Insurance Coverage: A federal bank charter may allow Coinbase to offer expanded insurance on user deposits, potentially covering both fiat and digital assets against loss or theft.

These innovations would mark a fundamental shift from crypto exchanges as simple trading venues to full-spectrum financial service providers, think insured accounts, instant fiat withdrawals, and seamless integration with traditional banking apps.

Of course, this evolution brings new responsibilities for users. As compliance becomes more sophisticated, so too will identity verification methods and ongoing account monitoring. But for most retail investors, the tradeoff is clear: streamlined onboarding and enhanced security outweigh the minor inconveniences of stricter KYC checks.

How This Impacts Your First Steps Into Crypto

If you’re new to digital assets in 2025, onboarding help is easier than ever thanks to these regulatory shifts. Federal guidelines have forced platforms like Coinbase to clarify every step, no more guessing about which documents are needed or why certain features are restricted based on your state.

You’ll also notice greater transparency around fees, asset availability, and risk disclosures. This makes it simpler for beginners to compare offerings across platforms or understand exactly what they’re signing up for before making their first purchase.

Staying Informed as Regulation Evolves

The pace of change in crypto legislation means that staying informed is as important as ever. Even as onboarding becomes easier, users should keep an eye on updates from both regulators and exchanges. For example, the disbanding of the DOJ’s crypto enforcement team earlier this year (CoinLaw) hints at further policy shifts on the horizon, some of which could again reshape how exchanges operate nationwide.

Bottom line: Coinbase’s proactive stance on federal crypto regulation has already improved onboarding speed, security, and product breadth for U. S. users in 2025. While some debates remain unresolved between federal oversight and state autonomy, most retail investors now enjoy a smoother path into digital assets, and that’s a win for mainstream adoption.