If you’re serious about catching the next crypto boom in 2025, you need more than hype and gut feelings. The market is flooded with noise, scams, and FOMO-driven pumps. But beneath the surface, there are clear signals that separate the next 1000x opportunity from another rug pull. Here’s how to spot them, using real data, not wishful thinking.

1. Analyze On-Chain Data and Developer Activity

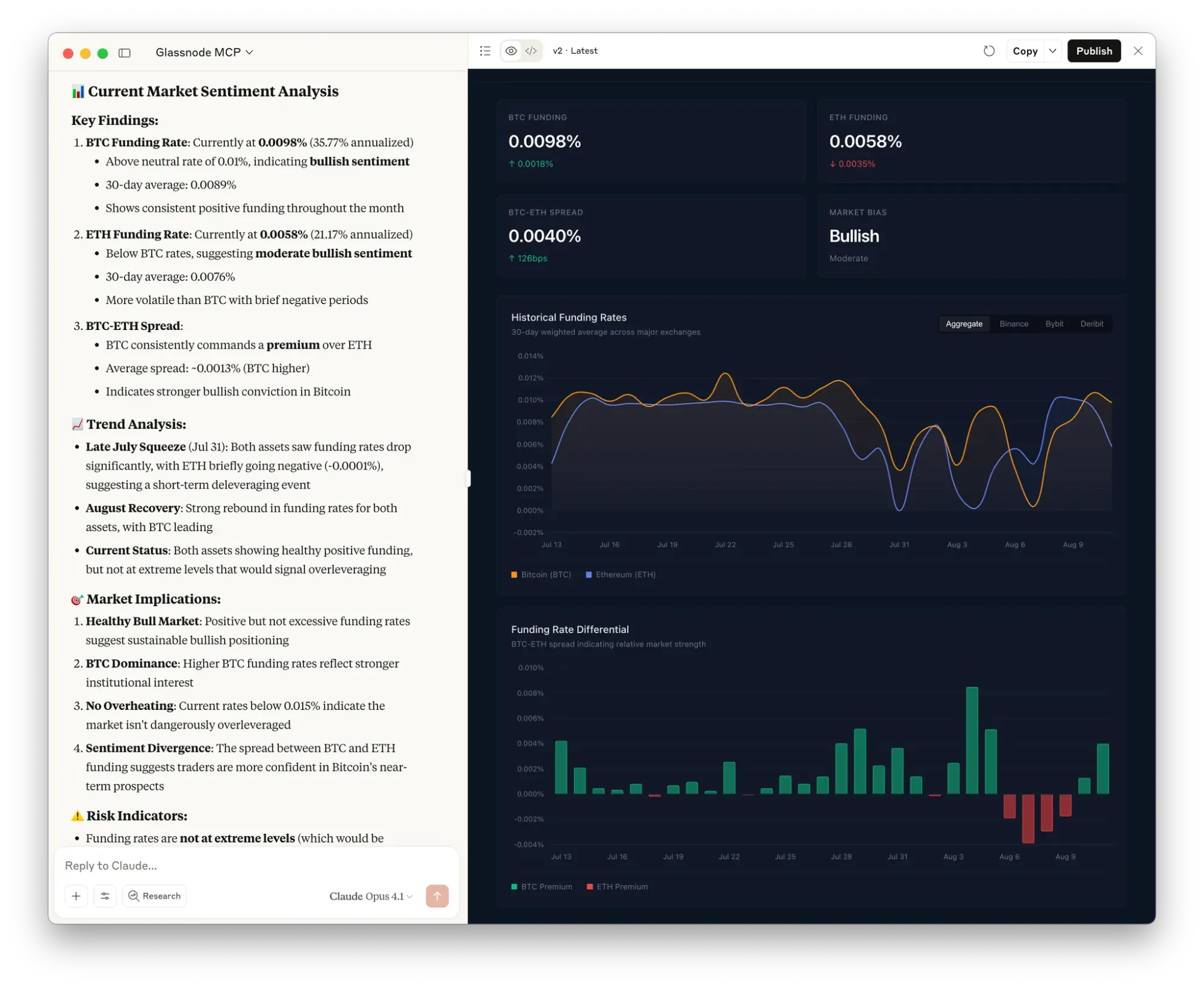

Forget influencer shills, real momentum starts on-chain. Platforms like Glassnode, Santiment, and Token Terminal let you track wallet growth, transaction volume, unique addresses, and even GitHub commits for any project. If you see a steady uptick in active wallets or developer pushes before a price move, that’s a massive green flag. For example, surges in Aster’s on-chain activity preceded its mainstream breakout by weeks.

Why does this matter? Because rising on-chain stats usually mean real users are arriving, not just speculators chasing candles. In 2025’s volatile market, projects with growing network activity are statistically more likely to sustain gains after an initial pump.

2. Focus on Low Market Cap Projects with Strong Fundamentals

The next 1000x coin won’t be a household name yet. Historically, tokens under $100 million market cap have the highest upside, but only if they’re built right. Look for:

- Clear utility: Does the token solve an actual problem or improve existing protocols?

- Transparent team: Are the founders public? Is their track record legit?

- Active community: Is there organic buzz on forums like Discord or Telegram?

If a low-cap gem checks these boxes, it stands a real chance of explosive growth once wider attention hits. But skip anything with anonymous devs or copy-paste whitepapers, those are classic scam signals.

5 Expert Strategies to Spot the Next Crypto Boom in 2025

-

Analyze On-Chain Data and Developer Activity: Use platforms like Glassnode, Santiment, and Token Terminal to monitor wallet growth, transaction volume, and GitHub commits. Rising on-chain activity often precedes price surges and signals genuine user adoption.

-

Focus on Low Market Cap Projects with Strong Fundamentals: Target tokens under $100 million market cap that have clear utility, transparent teams, and active communities. Historically, coins with smaller caps and solid foundations offer higher 1000x potential.

-

Evaluate Real-World Partnerships and Ecosystem Integrations: Prioritize projects securing partnerships with established companies or integrating into major DeFi/NFT ecosystems. Recent surges in coins like Aster were driven by high-profile collaborations and ecosystem growth.

-

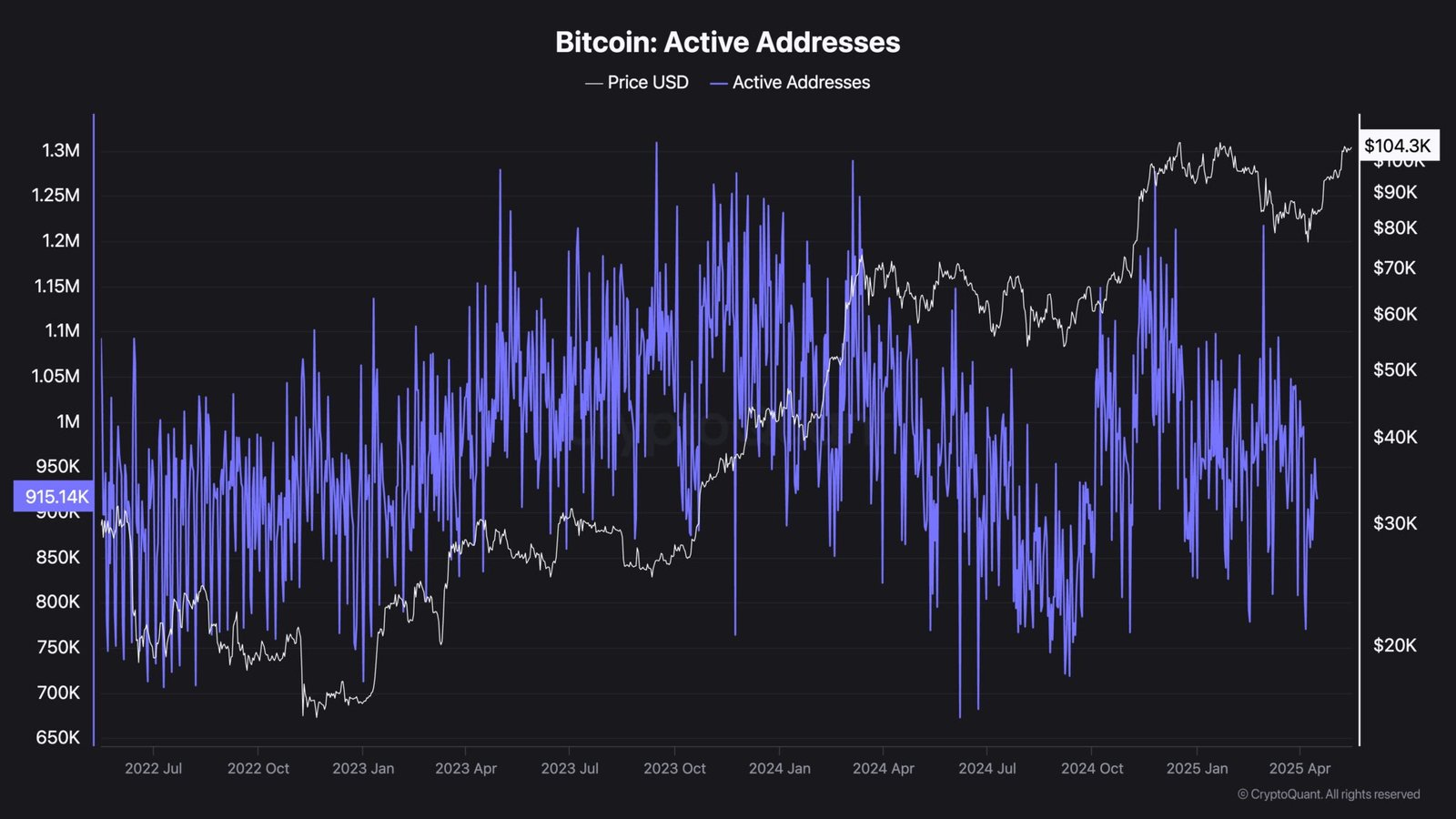

Monitor Social Sentiment and Hype Cycles Responsibly: Use tools like LunarCrush or CryptoQuant to gauge social media trends but always cross-reference with fundamental analysis. While hype can fuel short-term pumps, sustainable booms combine strong sentiment with real progress.

3. Evaluate Real-World Partnerships and Ecosystem Integrations

This is where hype meets reality: has the project landed deals with established companies? Is it being integrated into major DeFi or NFT ecosystems? Recent surges, like Aster’s rally, were triggered by high-profile collaborations and ecosystem expansions.

You want to see announcements of partnerships that aren’t just fluff but bring real users or liquidity to the protocol. Check for integrations into platforms like Uniswap or collaborations with payment processors, the more interconnected a project is within crypto’s core infrastructure, the greater its staying power when volatility hits.

The Bottom Line (So Far): Data Over Drama

The first step to smart crypto onboarding in 2025 is cutting through noise with hard evidence: on-chain metrics, solid fundamentals at low caps, and tangible business development moves, not just social media buzzwords.

4. Assess Regulatory Compliance and Security Audits

Ignore this step at your own peril. In 2025, regulatory scrutiny is at an all-time high, and scams are evolving just as fast as the tech. Before putting money into any project, verify that it has completed reputable smart contract audits from firms like Certik or Hacken. Even more important: check for clear compliance with regional laws. If a project is dodging KYC/AML requirements or operating in legal grey zones, you’re asking for trouble.

Why does this matter for spotting the next boom? Because legit projects with clean audits and regulatory green lights are less likely to implode during market corrections or get delisted overnight. The days of wild-west speculation are fading, professional investors now demand transparency and security. Don’t settle for less.

5. Monitor Social Sentiment and Hype Cycles Responsibly

Social sentiment moves markets, but it’s a double-edged sword. Tools like LunarCrush and CryptoQuant let you track Twitter mentions, Reddit buzz, and trading volume spikes in real time. Sure, a viral hashtag can send prices vertical, but if there’s no fundamental progress behind the chatter, it’ll crash just as fast.

The pros use sentiment analysis as an early warning system, not a buy signal on its own. Cross-reference surges in hype with actual on-chain growth or major partnership news before jumping in headfirst. Sustainable booms combine strong community energy with real traction, not just FOMO.

Avoiding Traps: Red Flags That Still Matter

If you want to avoid becoming exit liquidity for smarter traders, keep these classic red flags on your radar:

- No third-party audit reports published

- An anonymous or unresponsive team

- Pump-and-dump Telegram groups pushing coordinated buys

- Lack of real-world integrations or partnerships

- Whitepapers full of jargon but no clear business model

React Fast, Manage Risk: Final Thoughts for Crypto Onboarding in 2025

The next big crypto winner won’t be found by chasing TikTok trends or trusting anonymous YouTube calls, it’ll be hiding in plain sight inside the data: growing wallets, active devs, audited codebases, and deals that bring actual users into the ecosystem.

Expert Checklist for Vetting New Crypto Projects

-

Analyze On-Chain Data and Developer Activity: Use platforms like Glassnode, Santiment, and Token Terminal to monitor wallet growth, transaction volume, and GitHub commits. Rising on-chain activity often precedes price surges and signals genuine user adoption.

-

Focus on Low Market Cap Projects with Strong Fundamentals: Target tokens under $100 million market cap that have clear utility, transparent teams, and active communities. Historically, coins with smaller caps and solid foundations offer higher 1000x potential.

-

Evaluate Real-World Partnerships and Ecosystem Integrations: Prioritize projects securing partnerships with established companies or integrating into major DeFi/NFT ecosystems. Recent surges in coins like Aster were driven by high-profile collaborations and ecosystem growth.

-

Assess Regulatory Compliance and Security Audits: Ensure the project has undergone reputable smart contract audits (e.g., Certik, Hacken) and complies with regional regulations. This reduces scam risk—especially important amid 2025’s heightened regulatory scrutiny.

-

Monitor Social Sentiment and Hype Cycles Responsibly: Use tools like LunarCrush or CryptoQuant to gauge social media trends, but cross-reference with fundamental analysis. While hype can fuel short-term pumps, sustainable booms combine strong sentiment with real progress.

If you’re onboarding into crypto this year, stay sharp and keep your process tight:

- Dive deep into on-chain analytics, don’t just skim headlines.

- Prioritize low-cap projects with strong fundamentals over meme coins.

- Demand proof of partnerships and ecosystem relevance.

- Nail down security audits and compliance checks before committing capital.

- Treat social sentiment as a tool, not gospel truth, and always cross-reference with hard evidence.

This approach won’t guarantee you’ll catch every moonshot, but it will seriously tilt the odds away from scams and towards sustainable gains when volatility spikes again.