Altcoin investors have been watching regulatory developments closely, and the latest move from the U. S. Securities and Exchange Commission (SEC) is a game-changer for anyone holding Solana (SOL), XRP (XRP), Cardano (ADA), Litecoin (LTC), or Dogecoin (DOGE). On October 1,2025, the SEC requested that ETF issuers withdraw their pending Form 19b-4 filings for these five major altcoins. This shift comes as the SEC introduces new generic listing standards for crypto ETFs, which could reshape how quickly and efficiently altcoin-based ETFs come to market.

Why Did the SEC Request ETF Withdrawals for SOL, XRP, ADA, LTC, and DOGE?

The SEC’s action wasn’t a rejection of these altcoin ETFs. Instead, it reflects a regulatory pivot: under the new framework, exchanges no longer need to file individual 19b-4 forms for each token-based ETF. As reported by CryptoBriefing, this is designed to streamline approvals and reduce bureaucratic delays. For SOL, XRP, ADA, LTC, and DOGE holders, this means that while there’s a temporary pause in ETF progress, the path ahead could be much smoother if tokens meet standard criteria.

“The SEC’s move signals a more standardized approach to crypto ETF approval – but it also means issuers must quickly adapt to new rules. “

Current Prices: How Are These Altcoins Responding?

The market has responded with cautious optimism. Here’s where prices stand as of October 1st:

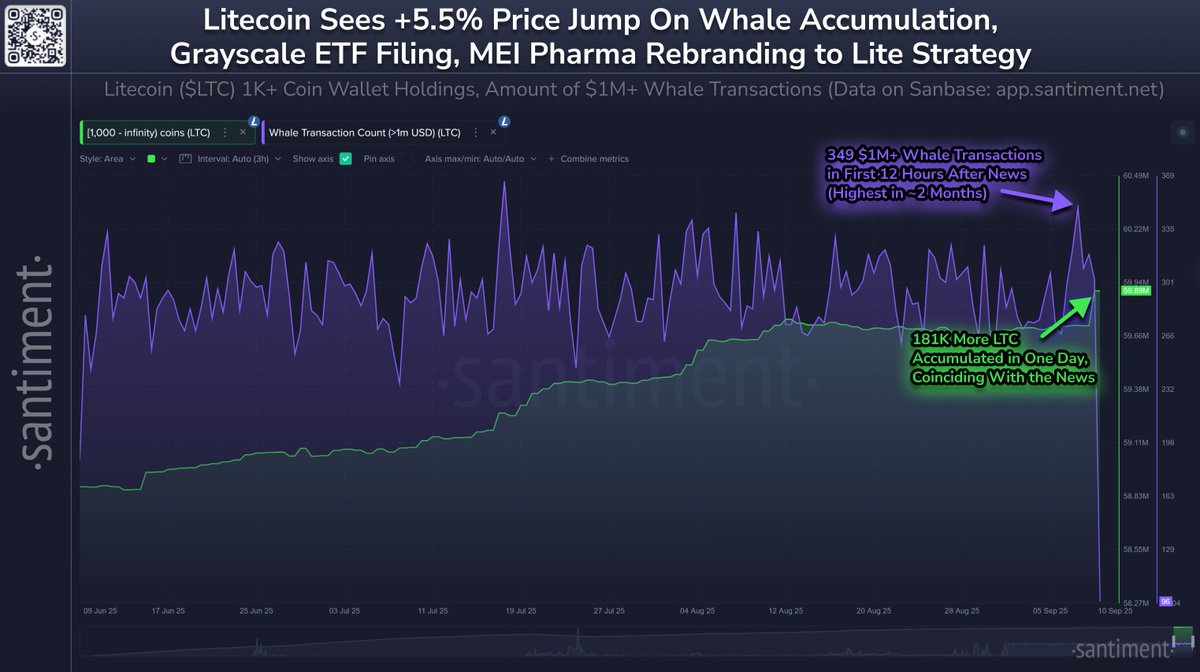

Litecoin (LTC) leads with a current price of $110.67, up $5.48 in the last 24 hours – showing resilience amid regulatory uncertainty.

Solana (SOL) is trading at $201.48, reflecting its continued status as a top-tier altcoin.

XRP and DOGE are both at $0.2316, while Cardano’s latest price continues to attract active traders.

This stability suggests that markets are not reacting with panic but are instead waiting for clarity on how quickly new ETFs might launch under the streamlined process.

What Does This Mean for Altcoin ETF Investors?

If you’re holding any of these five assets – SOL, XRP, ADA, LTC, or DOGE – you’re directly affected by these regulatory changes:

- Accelerated Timelines: The new process could cut approval times from up to 240 days down to about 75 days (Mitrade). Faster approvals mean less time waiting on regulatory sidelines.

- Simplified Listings: If your chosen altcoin meets established criteria under generic standards, exchanges can list related ETFs more easily – potentially boosting liquidity and access.

- No Guarantee Yet: The catch? Issuers must ensure their filings comply with these new standards; there may still be hurdles before we see live trading of these ETFs.

Solana (SOL) Price Prediction 2026-2031

Professional Forecasts Based on Latest SEC ETF Developments and Market Trends

| Year | Minimum Price | Average Price | Maximum Price | YoY % Change (Avg) | Market Scenario Insights |

|---|---|---|---|---|---|

| 2026 | $160.00 | $225.00 | $340.00 | +11.7% | ETF acceleration and increased liquidity drive recovery, but volatility remains as ETF adoption grows. |

| 2027 | $185.00 | $262.00 | $395.00 | +16.4% | Broader ETF market participation, DeFi and NFT expansion on Solana, but competition from ETH/L2s limits upside. |

| 2028 | $215.00 | $305.00 | $460.00 | +16.4% | Macro bull cycle, institutional inflows, and improved scalability; possible new ATH if adoption outpaces rivals. |

| 2029 | $250.00 | $350.00 | $520.00 | +14.8% | Maturing ETF market, global adoption, but regulatory risks and tech challenges may temper gains. |

| 2030 | $270.00 | $390.00 | $580.00 | +11.4% | Mainstream integration of blockchain, robust DeFi/NFT activity on Solana, but cyclical corrections possible. |

| 2031 | $240.00 | $370.00 | $550.00 | -5.1% | Potential post-bull market retracement; profit-taking and regulatory tightening could cause consolidation. |

Price Prediction Summary

Solana (SOL) is poised for steady growth from 2026 to 2031, supported by streamlined ETF approvals and rising institutional interest. While the new SEC rules should accelerate ETF launches and improve liquidity, the market will remain sensitive to regulatory changes, competition, and broader crypto cycles. Bullish scenarios could see SOL testing new highs, while bearish cases involve corrections and increased regulation.

Key Factors Affecting Solana Price

- SEC regulatory framework and ETF listing process

- Adoption of Solana-based DeFi, NFT, and enterprise use cases

- Institutional inflows via ETFs and traditional finance

- Competition from Ethereum, Layer-2s, and other L1 blockchains

- Macroeconomic trends and global digital asset regulation

- Solana network upgrades, scalability, and security advancements

Disclaimer: Cryptocurrency price predictions are speculative and based on current market analysis.

Actual prices may vary significantly due to market volatility, regulatory changes, and other factors.

Always do your own research before making investment decisions.

Navigating Regulatory Uncertainty: Strategies for Today’s Holders

This regulatory shakeup is not just about paperwork – it’s about market psychology and future accessibility:

Smart Strategies for Altcoin Holders Amid SEC Changes

-

Solana (SOL): Monitor ETF issuer updates and network developments. With the SEC’s new standards, SOL holders should stay alert for news on ETF relistings and assess how increased liquidity could affect Solana’s ecosystem and price action.

-

XRP (XRP): Stay informed on regulatory milestones and ETF progress. XRP investors should track SEC announcements and issuer responses, as streamlined ETF approvals could boost market participation and impact liquidity.

-

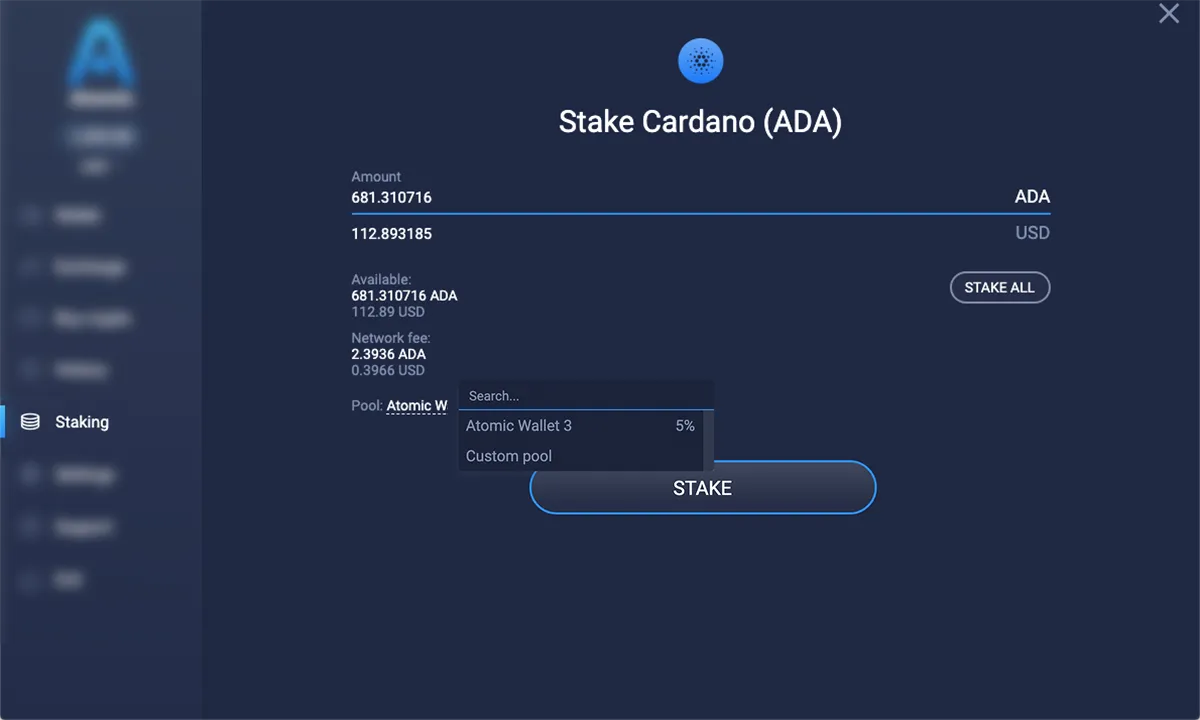

Cardano (ADA): Evaluate staking and portfolio diversification options. ADA holders may benefit from reviewing their staking strategies and considering how ETF-driven inflows could influence network growth and token demand.

-

Litecoin (LTC): Watch for liquidity shifts and price movements. With Litecoin trading at $110.67, investors should monitor how ETF accessibility might affect LTC’s trading volume and price volatility in the coming weeks.

-

Dogecoin (DOGE): Assess market sentiment and trading opportunities. DOGE holders should keep an eye on ETF-related news and social trends, as improved access could drive new interest and trading activity.

The bottom line? Stay informed and agile as issuers adapt to evolving SEC requirements.

While the SEC’s withdrawal request for pending altcoin ETF filings might appear disruptive, it’s actually a sign of maturation in crypto regulation. For holders of Solana (SOL), XRP (XRP), Cardano (ADA), Litecoin (LTC), and Dogecoin (DOGE), the key is understanding how this transition could affect both short-term volatility and long-term opportunity.

Potential Upside: Faster Access, More Liquidity

One of the most immediate benefits for investors is the potential acceleration in ETF launches. With the SEC’s new generic listing standards, issuers do not need to wait out lengthy review periods for each individual token. If SOL, XRP, ADA, LTC, or DOGE pass the standardized criteria, their ETFs could hit major exchanges much sooner than under the old system.

This streamlined process could enhance liquidity for these altcoins by making institutional investment more accessible. Historically, ETF listings have brought increased trading volume and tighter spreads to underlying assets. For example, Litecoin’s current price of $110.67 and Solana’s $201.48 may see additional support if ETF products are greenlit quickly.

Cautious Optimism: Remaining Risks and Unknowns

However, there are still unknowns that could impact investor outcomes:

- Regulatory Hurdles Remain: The SEC has set generic standards but hasn’t guaranteed that every asset will qualify automatically. Each token, whether it’s Cardano or Dogecoin, will still be scrutinized for compliance and risk factors.

- Market Sentiment Shifts Quickly: While prices have remained relatively stable, XRP and DOGE both at $0.2316, ADA trading actively, the mood can change fast if there are delays or further regulatory curveballs.

- Issuer Readiness: Not all ETF issuers may be ready to adapt instantly to new requirements. This could stagger launches or create temporary gaps in access across different altcoins.

What Should SOL, XRP, ADA, LTC and DOGE Holders Do Now?

The best approach is a balanced one: stay alert but avoid knee-jerk reactions. Consider these steps while monitoring developments:

Smart Strategies for Altcoin Holders Amid SEC ETF Changes

-

Solana (SOL): Consider diversifying your portfolio to manage risk during regulatory shifts. SOL’s rapid ecosystem growth may benefit from streamlined ETF approvals, but volatility can increase as rules change. Stay updated on Solana’s official channels for project developments.

-

XRP (XRP): Monitor liquidity trends as ETF processes accelerate. XRP’s history with regulatory scrutiny makes it vital to track SEC updates and exchange listings. Use XRPL resources to follow network and compliance news.

-

Cardano (ADA): Leverage staking opportunities while ETF timelines evolve. ADA holders can earn passive income through staking on secure platforms, maintaining engagement as regulatory clarity emerges. Visit Cardano’s official site for staking guides.

-

Litecoin (LTC): Track market price movements closely—LTC is currently trading at $110.67. Regulatory changes may impact liquidity and trading volume. Use reputable exchanges and stay informed via Litecoin’s website for real-time updates.

-

Dogecoin (DOGE): Engage with community-driven initiatives as DOGE adapts to new ETF standards. The vibrant Dogecoin community often leads in advocacy and education; join forums and follow official Dogecoin news for timely information.

If you’re managing a portfolio with any combination of these five altcoins, remember that regulatory clarity often precedes broader adoption, and potentially higher valuations over time. However, it’s wise to diversify positions and keep an eye on issuer updates as well as official SEC announcements.

The move toward generic standards is a milestone, but patience is still required as details get ironed out.

Staying Ahead: Resources and Community Insights

The crypto landscape moves quickly when regulation evolves. To keep your edge:

- CryptoBriefing coverage on SEC withdrawal and what it means for altcoin ETFs

- Mitrade analysis on accelerated ETF timelines due to new rules

The next few months will be pivotal for SOL ($201.48), XRP ($0.2316), ADA (latest price), LTC ($110.67), and DOGE ($0.2316) holders as issuers resubmit filings under the updated framework. Stay tuned, and stay nimble, as this regulatory evolution unfolds.