Bitcoin Depot’s ATM network is everywhere in 2025, and with Bitcoin trading above $122,540.00, crypto feels more mainstream than ever. But as the orange B lights up more street corners, so do the risks for new users, especially as scammers evolve alongside the tech. Whether you’re buying your first satoshis or helping a friend onboard, understanding both the promise and pitfalls of this expansion is crucial.

Bitcoin Depot’s Expansion: Convenience Meets Caution

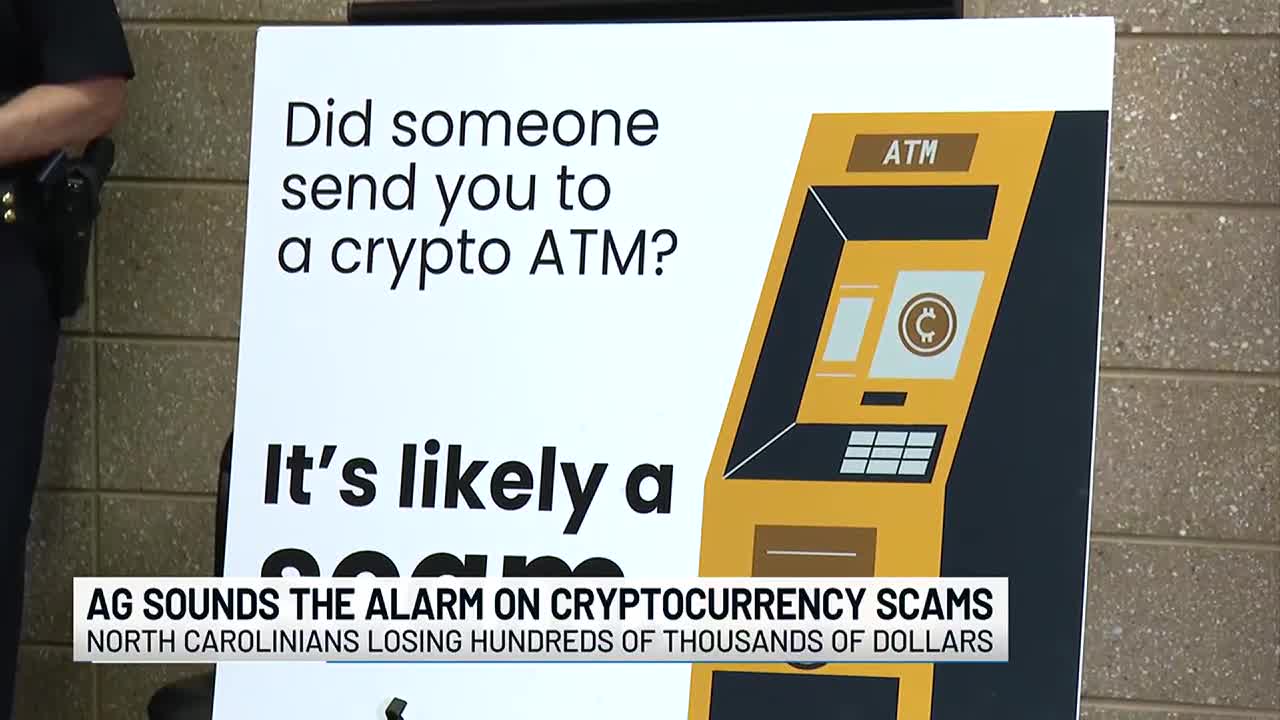

The surge in Bitcoin’s price to $122,540.00 has fueled demand for easy access points, and Bitcoin Depot has answered by rolling out thousands of new ATMs nationwide. These machines make it simple to buy Bitcoin and other cryptocurrencies with cash or card, no bank account or exchange sign-up required. But this convenience has also attracted bad actors. In 2024 alone, crypto ATM scams cost users over $246 million, with complaints nearly doubling year-over-year (source).

As lawmakers respond with new regulations, like the Crypto ATM Fraud Prevention Act of 2025, which imposes daily limits and mandatory scam warnings, Bitcoin Depot has doubled down on user protection. Yet, no amount of legislation can substitute for personal vigilance. Let’s break down the five essential safety tips every new user needs to know before stepping up to a Bitcoin Depot ATM this year.

Top 5 Safety Tips for New Bitcoin ATM Users in 2025

Top 5 Safety Tips for Using Bitcoin Depot ATMs in 2025

-

Verify ATM Legitimacy Before Use: Always confirm that the Bitcoin ATM is operated by a reputable company like Bitcoin Depot by checking the official operator’s website or using their locator tools. This helps you avoid counterfeit or unregistered machines, especially as the network expands in 2025.

-

Never Share Transaction Details or Codes: Keep your transaction information, wallet addresses, and any QR codes private. Legitimate operators and support teams will never ask for this data in person, over the phone, or via email. Sharing these details can lead to irreversible loss of your crypto assets.

-

Use Two-Factor Authentication (2FA) and Strong Wallet Security: Set up 2FA on your crypto wallet and use a unique, complex password. This adds an extra layer of protection for your assets after purchasing at an ATM, reducing the risk of unauthorized access or theft.

-

Be Alert for Common Scam Tactics: Ignore requests from strangers, law enforcement impersonators, or anyone urging urgent ATM transactions. These are frequent scam methods flagged by police and consumer protection agencies in 2024-2025. Always verify the identity of anyone contacting you about your crypto.

-

Understand Fees and Limits Before Buying: Review the ATM’s posted transaction fees, daily limits, and terms before proceeding. Fee structures can vary significantly with the expansion of Bitcoin Depot’s network, and new federal regulations in 2025 set limits for new users—$2,000 per day and $10,000 over any 14-day period. Transparency helps you avoid hidden costs and comply with legal requirements.

Why Verifying ATM Legitimacy Is Your First Line of Defense

Not all Bitcoin ATMs are what they seem. Counterfeit machines can look identical to legit ones but are set up by scammers to steal your cash and crypto. Always confirm you’re using an official Bitcoin Depot ATM by checking the operator’s website or using their locator tool (source). Legitimate machines have clear branding, transparent fee displays, and compliance information visible on-screen or nearby. If anything feels off, like missing logos or suspicious prompts, walk away and report it.

Pro tip: Only trust locations listed on the official Bitcoin Depot locator. Never rely on third-party maps or word of mouth alone.

Privacy Is Power: Keep Your Transaction Details Secret

Scammers thrive on information leaks. They might pose as tech support, law enforcement, or even Bitcoin Depot staff, asking for your wallet address, QR code, or transaction details. Remember: No legitimate operator will ever request this information in person or over the phone. Sharing these details can let fraudsters hijack your funds instantly, crypto transactions are irreversible.

Stay vigilant: if anyone pressures you to share codes, wallet addresses, or even basic transaction info, it’s a red flag. Keep your screen and receipts private, shield your phone at the ATM, and never discuss your transaction with strangers nearby.

Next Up: Wallet Security, Scam Tactics, and Fee Transparency

In the second half of this guide, we’ll dive deeper into wallet security (including why two-factor authentication is non-negotiable), expose the latest scam tactics flagged by police in 2025, and unpack how to read ATM fees and limits before you buy. For now, mastering these first two steps will put you miles ahead of most new users, and could save you thousands as Bitcoin’s bull run continues.

Fortify Your Wallet: Why 2FA and Strong Passwords Are Non-Negotiable

Once you’ve confirmed the ATM’s legitimacy and protected your transaction details, your next line of defense is your crypto wallet itself. Think of your wallet as your digital vault: if it’s weakly secured, all the vigilance at the ATM goes out the window. Enable two-factor authentication (2FA) on your wallet app or exchange account. This means even if someone gets your password, they’ll still need a second code (usually sent to your phone) to access your funds.

Set a unique, complex password, avoid reusing old favorites or simple phrases. Consider using a password manager if you’re worried about remembering it. If your wallet app offers biometric logins or hardware key support, use them. With Bitcoin perched at $122,540.00, the stakes for security have never been higher.

Stay One Step Ahead: Recognize Common Scam Tactics in 2025

Scammers are masters of urgency and impersonation. In 2025, the most common crypto ATM cons flagged by law enforcement include fake tech support calls, government impersonators threatening legal trouble, and investment schemes promising huge returns if you “act now. ” Their goal: pressure you into sending crypto through the ATM, often to QR codes they provide.

Ignore any request for urgent ATM transactions, especially if it comes from someone claiming to be from the IRS, police, or even Bitcoin Depot support. Never scan a QR code or enter details given by someone over the phone. If in doubt, step away from the machine and call the official support number listed on the Bitcoin Depot website, not the one a stranger gives you.

Know Before You Buy: Fees, Limits, and Transparency Matter

With Bitcoin Depot’s expansion, fee structures and transaction limits can vary widely, even between machines in the same city. Always review the ATM’s posted transaction fees, daily limits, and terms before proceeding. Since the Crypto ATM Fraud Prevention Act of 2025, new users face a $2,000 daily limit and $10,000 over any 14-day period. Machines are required to display these limits clearly.

Transparency is your ally. If an ATM hides its fees or doesn’t clearly state limits up front, that’s a red flag. Legitimate operators like Bitcoin Depot provide real-time fee disclosures on-screen before you confirm any purchase (source). If you’re unsure about any part of the process, don’t proceed, ask for help at the store counter or contact official support.

The Bottom Line for New Users in 2025

The convenience of Bitcoin Depot’s expanded ATM network is undeniable. Yet with opportunity comes responsibility, especially as scammers target newcomers eager to buy into crypto’s bull run at $122,540.00. By following these five essential tips, verifying ATM legitimacy, guarding your transaction details, securing your wallet with 2FA, staying alert for scams, and understanding fees, you’ll be equipped not just to survive but thrive as you onboard into crypto.

If you’re ever in doubt or want more guidance before making that first purchase, check out Bitcoin Depot’s official safety resources or consult trusted community forums. Remember: in crypto as in life, it pays to double-check before you commit.