France is setting a new precedent in European crypto regulation. In late 2024, the French Prudential Supervision and Resolution Authority (ACPR) launched rigorous anti-money laundering (AML) inspections on major exchanges such as Binance and Coinbase. The goal: to determine which platforms will be granted the coveted MiCA license, allowing them to operate legally across all 27 EU member states by June 2026. This regulatory push is reshaping the onboarding experience for new crypto users in Europe, raising both the bar for compliance and user expectations for transparency.

France’s AML Crackdown: What’s Changing for Crypto Onboarding?

For newcomers to digital assets, France’s intensified scrutiny means onboarding processes are becoming more robust and standardized. The ACPR is focusing on strict Know Your Customer (KYC) procedures, risk controls, and IT security. Binance, the world’s largest exchange, has been specifically instructed to enhance its compliance staff and upgrade security systems. Failure to comply could mean exclusion from the EU-wide market under MiCA.

Coinbase, meanwhile, has already secured registration as a Virtual Asset Service Provider (VASP) with France’s Financial Markets Authority (AMF). This allows Coinbase to provide a full suite of crypto services in France – from custody to trading – giving it a head start in pan-European compliance. For users, this translates into more reliable onboarding experiences and increased confidence that their chosen platform meets high regulatory standards.

Impact on User Experience: Higher Standards, More Security

The immediate effect of these changes is a more secure environment for new crypto users in Europe. Enhanced AML checks mean exchanges must verify customer identities rigorously and monitor transactions for suspicious activity. While this may lengthen initial onboarding times or require more documentation from users, it also significantly reduces the risk of fraud or illicit activity on regulated platforms.

This shift comes at a time when Binance Coin (BNB) is trading at $1,099.37, up $32.13 ( and 0.0301%) over 24 hours (source). The heightened regulatory climate may impact fees or available services as exchanges allocate resources toward compliance – but it also signals a maturing market where user protection is paramount.

MiCA Licensing: The New Gatekeeper for European Crypto Access

The Markets in Crypto-Assets (MiCA) regulation is now the definitive framework for legal operation across Europe’s crypto landscape. Only exchanges that pass France’s enhanced AML checks will be eligible for an EU-wide license by June 2026 (details here). So far, just a handful of providers – including Deblock, GOin, Bitstack and Credit Agricole-owned CACEIS – have received approval.

This selectivity raises important considerations for new users comparing platforms or planning their first purchase of digital assets in Europe. Exchanges that fail to meet ACPR standards risk being shut out of one of the world’s largest unified markets.

Binance Coin (BNB) Price Prediction Post-France AML Crackdown (2026-2031)

Professional Forecast Table Incorporating Regulatory, Market, and Adoption Trends. All prices in USD. Current BNB Price (2025): $1,099.37.

| Year | Minimum Price | Average Price | Maximum Price | Estimated % Change (Avg.) | Scenario/Insight |

|---|---|---|---|---|---|

| 2026 | $950 | $1,200 | $1,480 | +9% | Volatility from MiCA licensing deadline; BNB under regulatory pressure but recovers if Binance secures EU license |

| 2027 | $1,080 | $1,350 | $1,700 | +12.5% | Regulatory clarity boosts confidence; growing DeFi/NFT use cases on BNB Chain |

| 2028 | $1,200 | $1,540 | $1,900 | +14% | BNB benefits from broader EU adoption and improved compliance; competition from other L1s persists |

| 2029 | $1,320 | $1,700 | $2,100 | +10.4% | Market matures, BNB Chain ecosystem expands; bullish scenario if Binance maintains leading position |

| 2030 | $1,400 | $1,850 | $2,350 | +8.8% | Crypto market cycle upswing; BNB Chain innovations and institutional adoption drive growth |

| 2031 | $1,500 | $2,000 | $2,600 | +8.1% | Sustained regulatory compliance and mainstream adoption; BNB faces ongoing competition but remains a top-5 asset |

Price Prediction Summary

BNB is expected to experience moderate growth through 2031, with average prices rising from $1,200 in 2026 to $2,000 in 2031. Regulatory clarity and EU-wide licensing will be pivotal, with downside risk if Binance fails to secure or maintain compliance. Upside potential remains strong due to BNB Chain’s ecosystem expansion, but competition and macroeconomic factors may introduce volatility.

Key Factors Affecting Binance Coin Price

- France/EU AML and MiCA regulatory outcomes for Binance

- Overall crypto market cycles (bull/bear trends)

- BNB Chain adoption in DeFi, NFTs, and real-world assets

- Competition from other layer-1 blockchains (Ethereum, Solana, etc.)

- Binance’s ability to maintain global market share and trust

- Technological upgrades and ecosystem growth

- Macroeconomic conditions and institutional adoption

Disclaimer: Cryptocurrency price predictions are speculative and based on current market analysis.

Actual prices may vary significantly due to market volatility, regulatory changes, and other factors.

Always do your own research before making investment decisions.

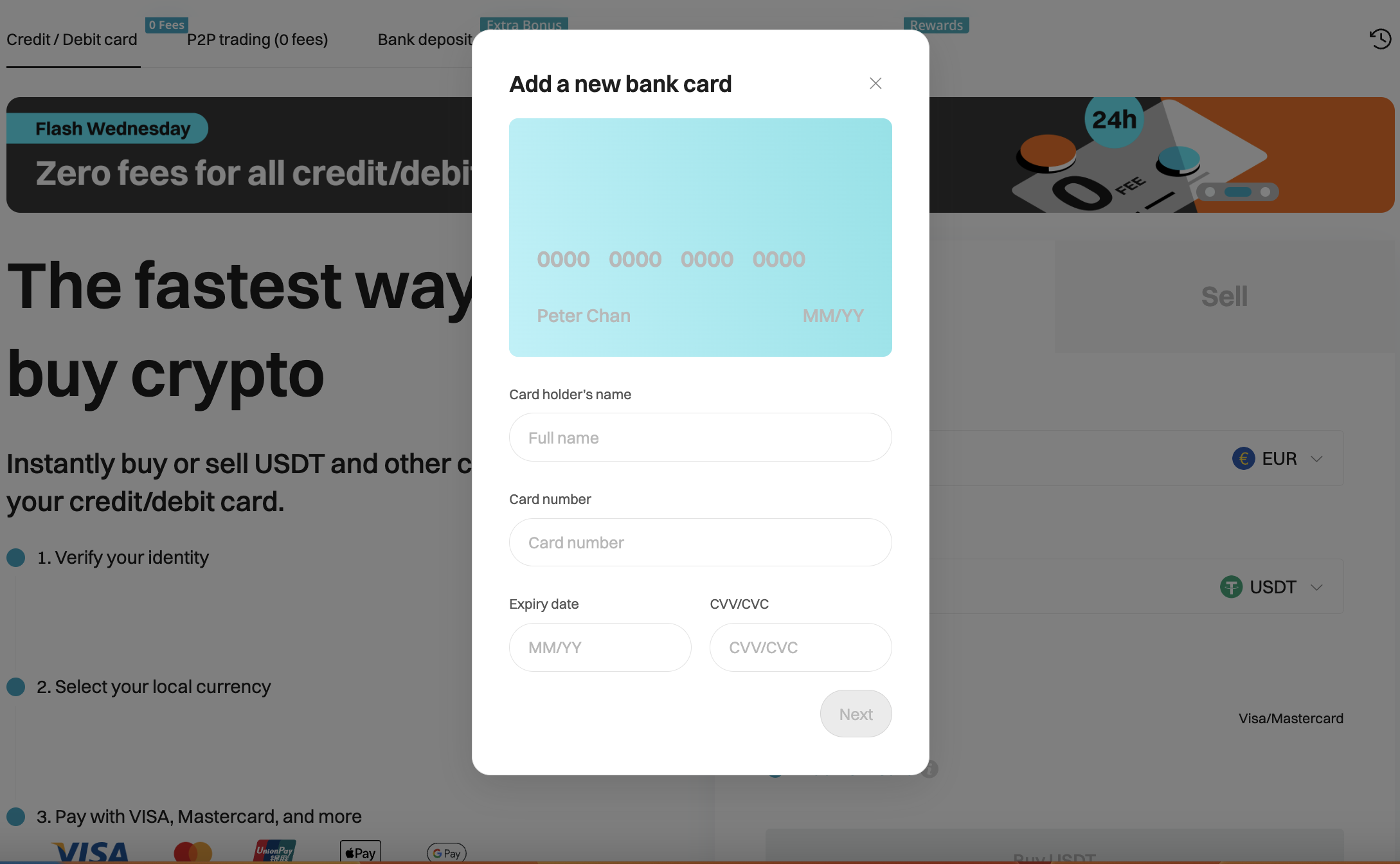

For those entering the crypto market in 2025, the landscape is evolving rapidly. France’s regulatory rigor is forcing exchanges to overhaul not just their compliance frameworks but also their onboarding flows. Expect more thorough identity verification, stricter source-of-funds checks, and enhanced transaction monitoring as standard aspects of signing up and transacting on major platforms. These changes are designed to weed out bad actors and ensure that only compliant, financially robust entities survive the MiCA licensing process.

Platforms like Coinbase, which have already secured French VASP registration, are likely to become go-to options for new users seeking a seamless and compliant entry into crypto. Binance’s future in Europe hinges on its ability to address French authorities’ concerns around AML controls and IT security. The stakes are high: failure to meet ACPR requirements could result in a loss of access not just to France but to the entire EU market.

What New Users Should Watch For

Essential Onboarding Tips for Crypto Newcomers in France (2025)

-

Verify Exchange Licensing Status: Before registering, confirm that the crypto exchange holds a valid or pending MiCA license from French regulators (ACPR/AMF). Only licensed exchanges will be permitted to serve EU users after June 2026.

-

Prepare Comprehensive Identity Documents: France’s AML rules require strict Know Your Customer (KYC) checks. Ensure you have a valid passport or EU ID, proof of address, and—if applicable—tax identification numbers ready for onboarding.

-

Understand Transaction Monitoring: Be aware that all deposits, withdrawals, and trades are subject to enhanced AML monitoring. Unusual activity may trigger requests for additional information or temporary account holds.

-

Choose Platforms with Proven Compliance: Consider exchanges with established regulatory records, such as Coinbase (registered with France’s AMF) or Deblock, GOin, Bitstack, and CACEIS (all approved by ACPR).

-

Review Fee Structures and Service Changes: Stricter compliance may increase operational costs for exchanges, potentially impacting trading fees or available services. Always check the latest fee schedules and service terms before trading.

-

Monitor Supported Cryptocurrencies and Market Data: Under MiCA, only certain digital assets may be supported. For example, BNB is currently priced at $1,099.37 (24h change: +$32.13). Ensure your preferred assets are available and track official market data.

With only a select group of exchanges currently approved under MiCA’s strict criteria, new users should prioritize platforms with transparent regulatory status and proven track records in compliance. Look for clear disclosures about KYC requirements, customer support responsiveness, and data protection practices.

The increased cost of compliance may result in higher trading fees or reduced promotional offers as exchanges shift resources toward meeting regulatory demands. However, these costs are offset by greater peace of mind regarding funds safety and legal recourse in case of disputes.

The Bigger Picture: A Safer Crypto Ecosystem for Europe

France’s AML crackdown is not just about limiting risk – it’s about setting a new gold standard for crypto regulation across the continent. As more exchanges align with MiCA’s requirements, users can expect a more unified experience when moving between platforms or countries within the EU.

This harmonization will likely drive further institutional adoption and innovation within Europe’s digital asset sector. Already, over 776 blockchain firms are projected to operate in France by 2025, with 62% targeting global markets (source). Government-backed initiatives like ADAN continue to fuel growth while ensuring that compliance remains at the core of this expansion.

For now, new users should embrace these higher standards as an investment in long-term security and legitimacy. As exchanges like Binance adapt or exit certain markets based on their ability to comply with French AML demands, users who prioritize regulated platforms will be best positioned to benefit from Europe’s increasingly mature crypto ecosystem.