Imagine a world where connecting your bank account to a crypto exchange is as seamless as linking PayPal or Venmo. For years, US crypto users have faced friction, delays, and outright roadblocks when trying to move money between their bank and digital asset platforms. But that landscape is on the verge of a radical shift, thanks to a regulatory push for open banking rules and fresh momentum from Washington power players like Senator Cynthia Lummis.

Why Open Banking Matters for Crypto Onboarding

At its core, open banking means you control your financial data. With these rules in place, you can securely share your bank information with trusted third-party apps, including crypto exchanges. No more waiting days for manual transfers or worrying about banks blocking your transactions simply because they’re crypto-related. Instead, onboarding becomes faster, safer, and more transparent for everyone.

Senator Lummis has been vocal about the stakes. She warns that some banks have “weaponized account access” against crypto firms, making it nearly impossible for users to fund their accounts or cash out smoothly. Her push for the Consumer Financial Protection Bureau (CFPB) to finalize open banking rules is about leveling the playing field and giving consumers back their autonomy (Source: Decrypt).

The Regulatory Wave: OCC and CFPB in the Spotlight

March 2025 marked a pivotal moment. The Office of the Comptroller of the Currency (OCC) issued Interpretive Letter 1183, which clarified that national banks and federal savings associations can now offer crypto-asset custody, stablecoin services, and even participate in distributed ledger networks, without jumping through endless regulatory hoops. The catch? They must maintain robust risk management controls (see official OCC release).

This means your local bank could soon let you buy, sell, or store digital assets directly from your checking account. No more third-party workarounds. No more fear of surprise account closures. The path from fiat to crypto is being bulldozed open by regulation.

How Open Banking Could Transform the User Experience

Let’s break down what these changes could mean for everyday users trying to onboard into crypto:

Key Benefits of Open Banking for US Crypto Onboarding

-

Enhanced Consumer Control: With open banking, users can choose which financial data to share with crypto platforms, improving privacy and empowering individuals to manage their digital asset journey.

-

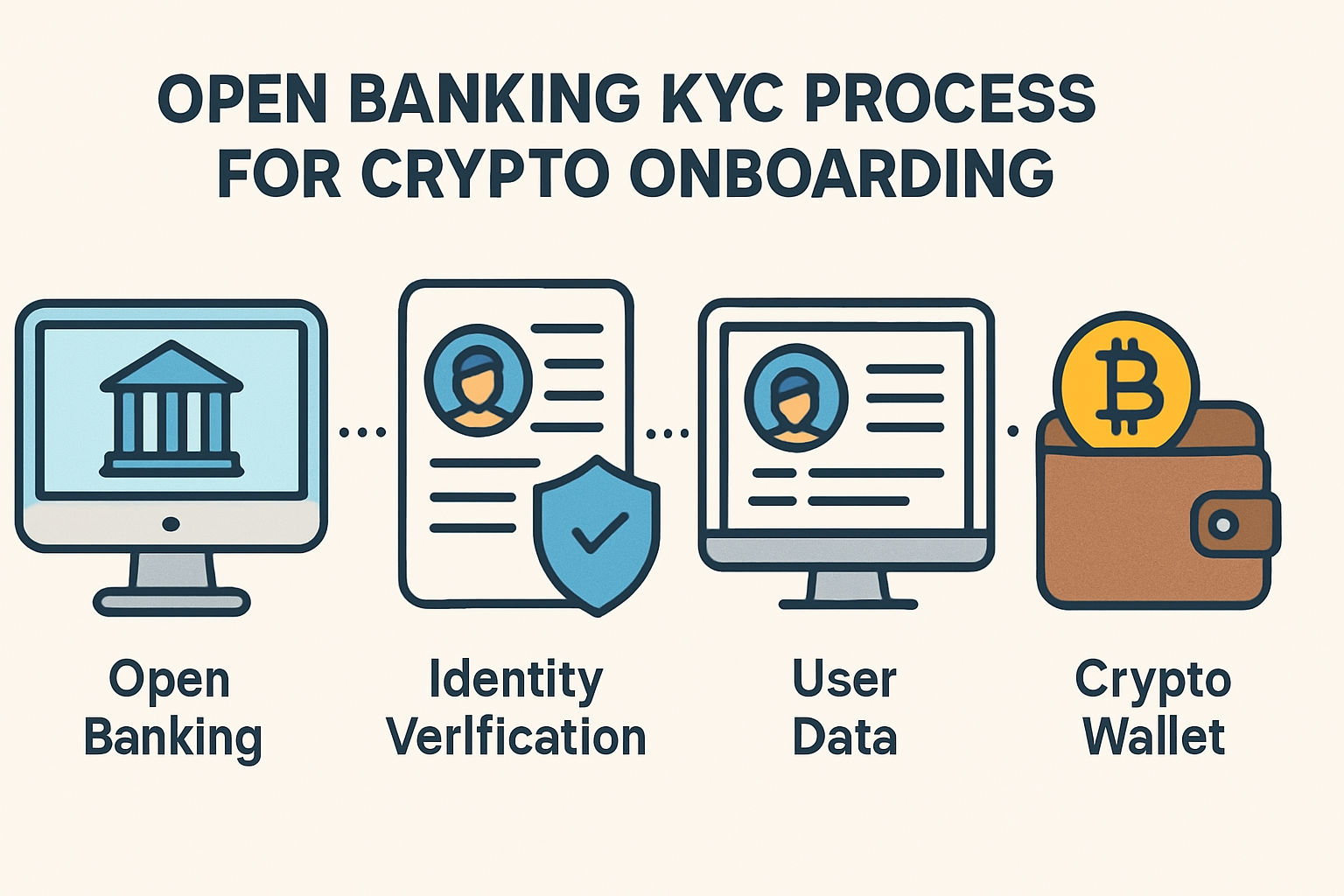

Faster and More Reliable KYC: Open banking allows crypto platforms to instantly verify user identity and financial history through secure APIs, streamlining Know Your Customer (KYC) checks and reducing onboarding time.

-

Increased Access for Underserved Groups: By leveraging open banking, fintechs and exchanges can offer crypto services to users with limited credit history or non-traditional banking backgrounds, expanding financial inclusion.

-

Greater Security and Fraud Prevention: Direct, API-based connections reduce the need for manual data entry and risky screen scraping, minimizing exposure to fraud and enhancing the safety of onboarding to platforms like Binance.US.

-

Streamlined Integration for Banks: Following the OCC’s Interpretive Letter 1183, national banks can now offer crypto custody and related services without prior approval, making it easier for customers to access digital assets through trusted institutions.

-

Boosted Consumer Trust: Regulatory clarity and standardized data sharing build confidence in crypto onboarding, encouraging broader adoption of digital assets across the US financial ecosystem.

With these new rails, onboarding could shrink from days to minutes. Imagine instant KYC verification using your existing bank credentials, real-time funding for your exchange wallet, and the ability to track all your transactions in one dashboard. Open banking isn’t just a regulatory buzzword, it’s the backbone of a smoother, safer crypto journey.

Senator Lummis isn’t alone in this vision. A growing chorus in Congress and across state governments (Wyoming is leading the charge) sees open banking as the missing link for true digital asset access in America (Source: CoinCentral). As banks and regulators align on this new framework, the US could leapfrog ahead in global crypto adoption.

But the impact of open banking rules goes deeper than convenience. By giving users the freedom to securely share their financial data, these regulations could finally break the cycle of banks acting as gatekeepers. For crypto newcomers, this means fewer rejected transfers, less confusion, and a dramatically lower risk of getting caught in bureaucratic limbo just for trying to buy Bitcoin or stablecoins.

The Ripple Effects: Trust, Security, and Market Growth

Trust is the currency of onboarding. When users know their bank won’t freeze their account for a crypto transfer, and that their data is protected by clear standards, hesitation fades. Open banking rules, combined with the OCC’s green light for crypto custody, could spark a surge in first-time buyers and mainstream adoption.

The Federal Reserve’s move to end its specialized crypto bank oversight program is another subtle but important signal: crypto is no longer fringe. It’s being woven into the fabric of everyday finance. As a result, traditional banks are likely to innovate faster, partnering with crypto firms and integrating digital asset services directly into their apps and websites. This convergence means crypto onboarding will soon look and feel like any other online banking experience, familiar, fast, and frictionless.

Security is also getting a boost. With clear legal frameworks, banks and fintechs can invest in better fraud prevention and identity verification tools, making it harder for bad actors to exploit onboarding gaps. For users, this translates to peace of mind: you can transfer funds to a crypto exchange with the same confidence you have paying your electric bill online.

What’s Next? The Road to Seamless Crypto Access

The momentum from Senator Lummis and her allies is hard to ignore. As the CFPB finalizes its open banking rule and the OCC’s guidance takes root, expect a wave of new partnerships between banks and crypto platforms. Early adopters will likely see new features roll out: instant account linking, real-time transfers, and consolidated dashboards that blend traditional and digital assets.

Still, challenges remain. Not all banks will embrace these changes at the same pace, and some may continue to resist, citing compliance or risk concerns. But with Washington’s regulatory stance shifting and consumer demand rising, resistance is likely to fade.

Do you trust your bank to offer crypto services if open banking rules are finalized?

With new open banking rules and recent OCC guidance, U.S. banks may soon offer crypto services directly. Would you feel comfortable trusting your bank with your crypto assets?

For users ready to dive in, staying informed is key. Watch for updates from your bank and favorite crypto platform. If you’re curious about how broader US crypto regulation is evolving, check out this deep dive on SEC and US crypto onboarding rules.

Visualizing the Future: A Step Closer to Mainstream Crypto

Picture this: you open your banking app, tap “Add Crypto Account, ” and in seconds your wallet is funded and ready for trading. No paperwork. No waiting for ACH transfers. Just a seamless bridge between your fiat and digital life. That’s the promise of open banking for crypto onboarding, and it’s closer than ever.