If you’ve ever tried to dip your toes into DeFi, you know the feeling: a dozen browser tabs open, each one a different protocol, and a creeping suspicion that you’re missing out on better yields somewhere else. DeFi onboarding has long been a labyrinth—one that’s kept many would-be users on the sidelines. Enter aggregation layers like Soul Protocol, which aim to make DeFi as approachable as ordering a coffee (with fewer existential choices).

Why DeFi Onboarding Needs an Overhaul

The promise of decentralized finance is tantalizing: open access, borderless transactions, and yields that put your local bank to shame. But the reality? For beginners, it’s more like assembling IKEA furniture blindfolded. Each lending protocol—Aave, Compound, Morpho—has its own quirks and interfaces. Add in wallet connections, network fees, and cross-chain confusion, and it’s no wonder newcomers get cold feet.

This is where DeFi onboarding aggregation shines. Aggregators act as the Rosetta Stone for DeFi protocols: they translate fragmented experiences into one seamless interface. Instead of juggling multiple platforms and wallets, users get unified access—and the confidence to actually use it.

Soul Protocol: The Unifier in a Fragmented Landscape

Soul Protocol positions itself as the aggregator-of-aggregators—a single dashboard for all your decentralized lending needs. Rather than herding liquidity into its own silo (as some competitors do), Soul leverages existing infrastructure by plugging into Aave, Compound, Morpho and others via smart contracts or APIs. The result? You get a bird’s-eye view of rates and opportunities across chains without ever leaving Soul’s interface.

This approach solves two major problems:

- Liquidity fragmentation: Instead of splitting funds across protocols (and blockchains), Soul lets you tap unified liquidity pools.

- User confusion: No more learning five interfaces just to earn yield; Soul abstracts away the complexity.

A Beginner’s Checklist for Unified DeFi Lending

If you’re new to DeFi onboarding for beginners, here’s what an aggregator like Soul can do for you:

Top Benefits of DeFi Aggregation Platforms

-

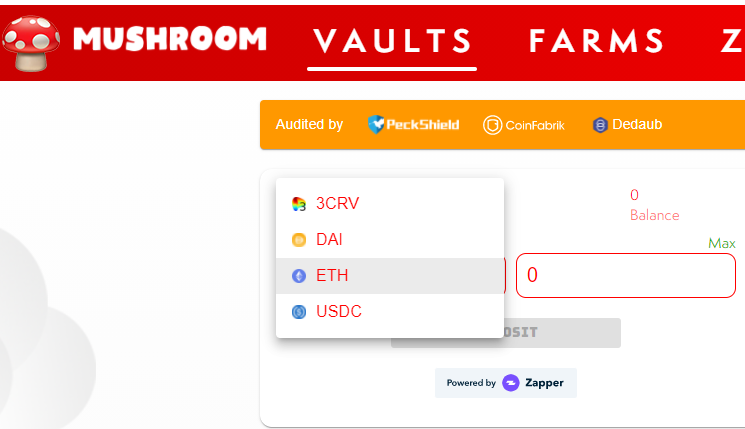

Optimized Yield Opportunities: Aggregators such as Yearn Finance automatically scan and allocate funds to the highest-yielding DeFi strategies, saving users hours of manual research and boosting returns.

-

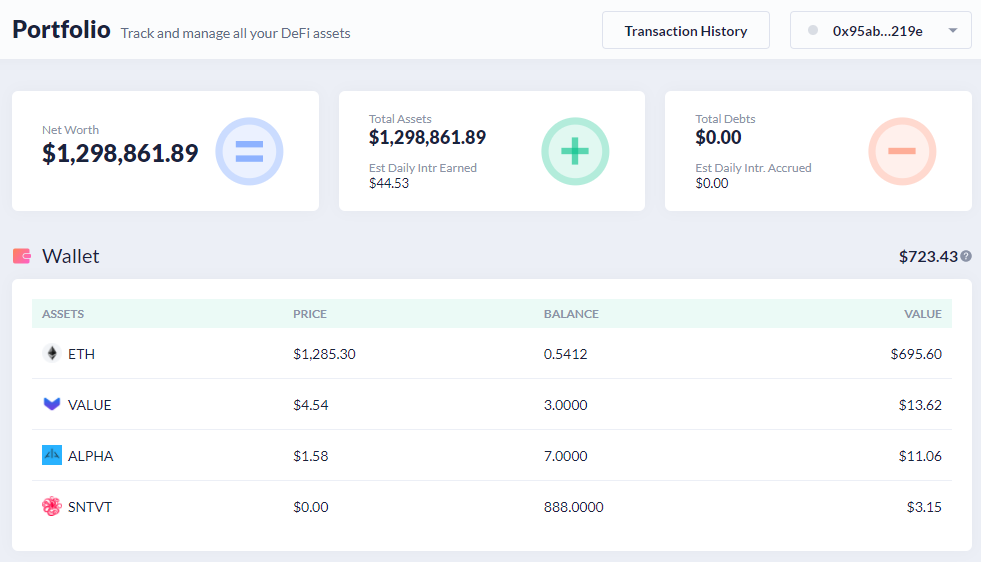

Simplified Portfolio Tracking: Tools such as DeBank consolidate all your DeFi holdings, liabilities, and transaction histories in one dashboard, making it easy to monitor performance across chains and protocols.

-

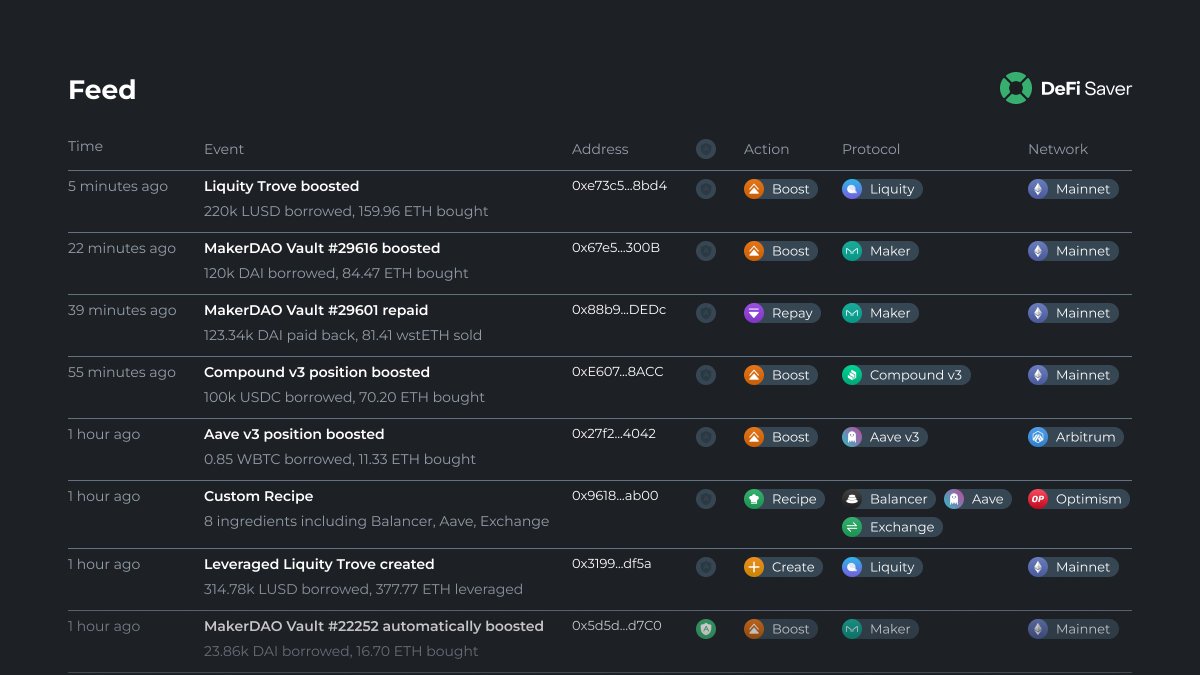

Enhanced Security and Risk Management: By leveraging battle-tested smart contracts and providing transparency on protocol integrations, aggregation platforms like DeFi Saver help users automate risk management and avoid costly mistakes in complex DeFi operations.

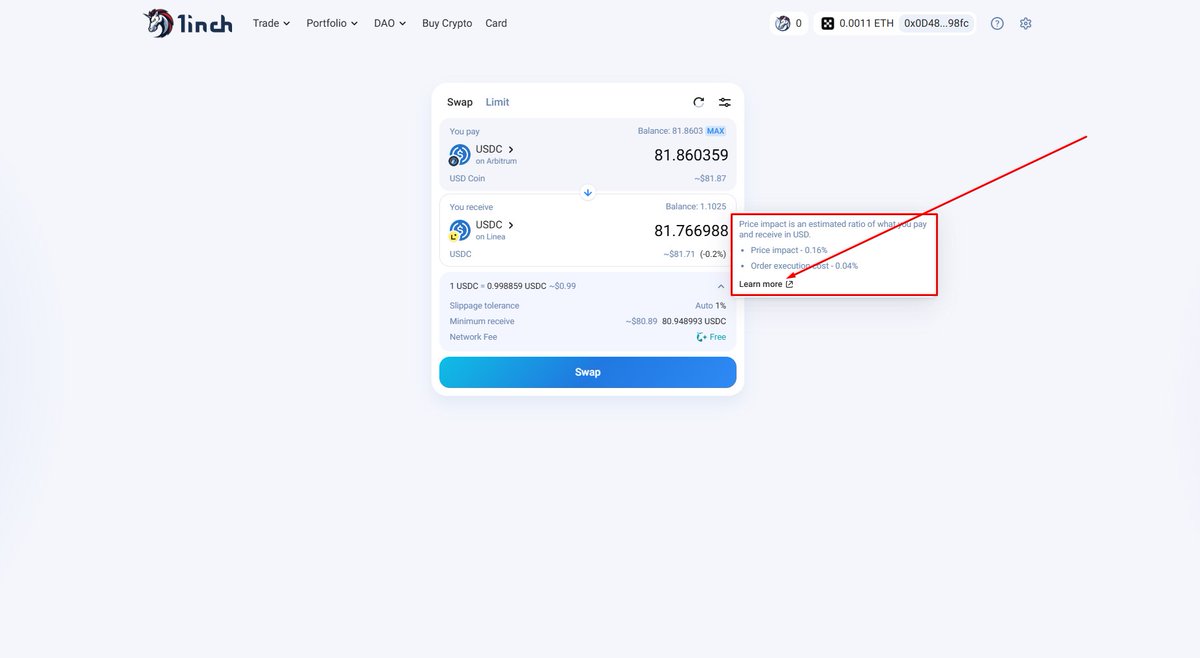

The magic is in composability. By acting as a middleware layer rather than a walled garden, aggregators enable cross-chain moves with minimal friction—and maximal transparency.

The Network Effect: Why Early Aggregators Win Big

The first-mover advantage in this space is real. As more protocols integrate with an aggregator like Soul, its value proposition compounds—more options mean more users, which in turn attracts even more integrations. This virtuous cycle could cement early leaders as permanent fixtures in the DeFi landscape.

But the aggregation game isn’t just about convenience—it’s a strategic play. Platforms like Soul are racing to become the default gateway for all things DeFi. Think of it as the Google Maps of decentralized lending: the more data and integrations it collects, the stickier its user base becomes. And as liquidity and users concentrate, competitors face an uphill battle to catch up.

Risks and Realities: What Aggregation Can—and Can’t—Fix

Of course, no aggregator is a silver bullet. While DeFi platform aggregation removes much of the UX friction, it doesn’t eliminate underlying protocol risks. Smart contract bugs, governance drama, or sudden shifts in yield rates still lurk beneath the surface. Aggregators can only be as secure and transparent as the protocols they plug into.

And then there’s the question of decentralization itself. Relying on a single interface could introduce new points of failure or centralization—ironically, the very thing DeFi set out to avoid. The best aggregation layers will need to balance slick onboarding with robust transparency and user sovereignty.

What Does This Mean for You?

If you’re looking to dip your toes into unified DeFi lending, here’s what matters:

Essential Steps for Safe Soul DeFi Onboarding

-

Set up a secure crypto wallet using trusted providers like MetaMask or Coinbase Wallet. Always back up your seed phrase offline.

-

Connect your wallet to Soul (or another major DeFi aggregator). Double-check the URL and ensure you’re on the official website to avoid phishing.

-

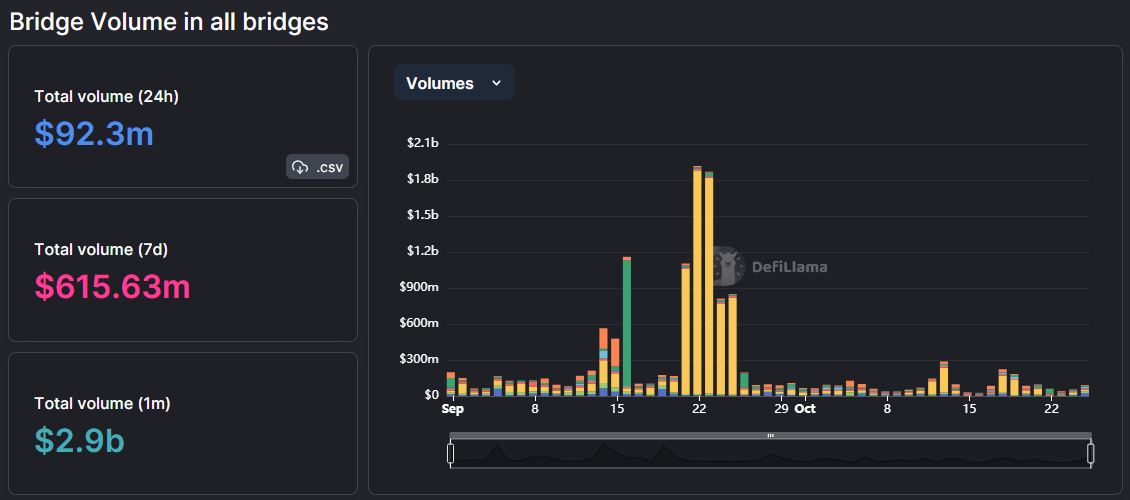

Start small and monitor your positions. Use Soul’s portfolio tools to track your assets, and leverage analytics from platforms like DeFiLlama for market insights.

Aggregators like Soul are lowering barriers left and right—but users should still do their homework before jumping in headfirst. Take advantage of unified dashboards to compare yields, but don’t forget to check protocol health and community reputation.

The Future: Seamless Onboarding or Just More Layers?

The next evolution in DeFi onboarding aggregation will likely involve even deeper cross-chain composability, more intuitive mobile experiences, and perhaps AI-driven portfolio optimization (because who doesn’t want their yield farming automated while they sleep?). As these layers mature, expect onboarding flows that feel less like rocket science and more like signing up for a streaming service—minus the monthly guilt trip.

The real test will be whether aggregators can maintain openness while scaling up features. If they succeed, we might finally see mass adoption move from crypto Twitter threads to everyday reality.