Finland is taking a decisive step into the future of crypto regulation. Starting January 1,2026, the country will implement comprehensive crypto-asset reporting rules that align with the OECD’s Crypto-Asset Reporting Framework (CARF) and the EU’s DAC8 directive. This move places Finland at the forefront of global tax transparency efforts in digital assets, impacting both new and seasoned investors.

Finland’s 2026 Crypto Reporting Rules: What’s Changing?

The new rules are not just incremental tweaks – they represent a fundamental shift in how crypto transactions are monitored and reported in Finland. Crypto-asset service providers (CASPs), including exchanges and wallet services operating in or reporting to Finland, will be required to collect detailed information on all users. This applies whether users are Finnish residents or foreigners using Finnish platforms.

Key requirements include:

- Data Collection: CASPs must record user identities as well as details of purchases, sales, and transfers involving crypto assets.

- Annual Reporting: All collected data must be submitted annually to the Finnish Tax Administration. The first report is due by January 31,2027, covering transactions from the entire 2026 calendar year.

- International Data Exchange: Information on foreign users will be shared with their home countries, while Finland will receive similar data about Finnish residents from abroad. This closes many previous gaps exploited for tax evasion.

The Impact on New Crypto Investors

If you’re just starting out in crypto or considering your first purchase on a Finnish platform, these changes will affect your onboarding experience significantly. Expect more rigorous identity verification (KYC) processes and detailed transaction tracking from day one. Service providers will be obligated to collect accurate personal and transactional information for every user – even for small trades or infrequent activity.

This enhanced scrutiny is designed to ensure that all gains and losses are accurately reported for taxation purposes. As a result, newcomers should prepare by maintaining clear records of their deposits, withdrawals, trades, and any transfers between wallets or exchanges. Keeping thorough documentation is no longer just good practice; it will be essential under Finland’s new regime.

What Experienced Crypto Investors Need to Know

For those already active in digital assets – especially anyone trading across multiple platforms or jurisdictions – Finland’s adoption of CARF means that historical habits around privacy and self-reporting must evolve. The days when certain trades might escape notice due to lack of cross-border cooperation are ending fast.

You’ll want to pay close attention to:

- Tax Authority Visibility: The Finnish Tax Administration will have access to granular transaction histories provided directly by service providers.

- Avoiding Discrepancies: Any mismatch between your self-reported tax filings and what CASPs report could trigger audits or penalties.

- International Scope: If you use foreign exchanges but reside in Finland (or vice versa), expect your data to be shared between countries as part of this global framework.

This level of transparency is unprecedented in Europe’s crypto scene. While it may feel intrusive to some investors used to more anonymity, it ultimately brings digital assets closer in line with traditional finance when it comes to compliance obligations.

As the landscape shifts, both new and experienced investors will need to adapt quickly. The era of “casual” crypto investing without a paper trail is rapidly closing. With service providers now acting as intermediaries for tax authorities, the margin for error or omission narrows considerably. For some, this might seem daunting, but it’s also an opportunity to professionalize your approach and avoid future compliance headaches.

Practical Steps to Prepare for Finland’s CARF Implementation

Whether you’re just starting your crypto journey or already have a diverse portfolio, a few practical actions can help you stay ahead of the curve:

Essential Steps for Finnish Crypto Investors in 2026

-

Organize and Maintain Detailed Transaction RecordsWith Finland’s 2026 crypto reporting rules, keeping comprehensive records of every crypto purchase, sale, and transfer is crucial. This includes dates, amounts, counterparties, and wallet addresses to ensure accurate tax reporting and reconciliation with service provider submissions.

-

Consult Reputable Tax Professionals Familiar with CryptoSeek guidance from tax advisors experienced in cryptocurrency and Finnish tax law. They can help interpret the new OECD-aligned regulations, optimize your tax position, and ensure full compliance.

-

Use Compliant, Registered Crypto Exchanges and WalletsTransact through regulated platforms such as Coinmotion or Coinbase, which are known for adhering to Finnish and EU reporting requirements. This ensures your transactions are properly reported to the Finnish Tax Administration.

-

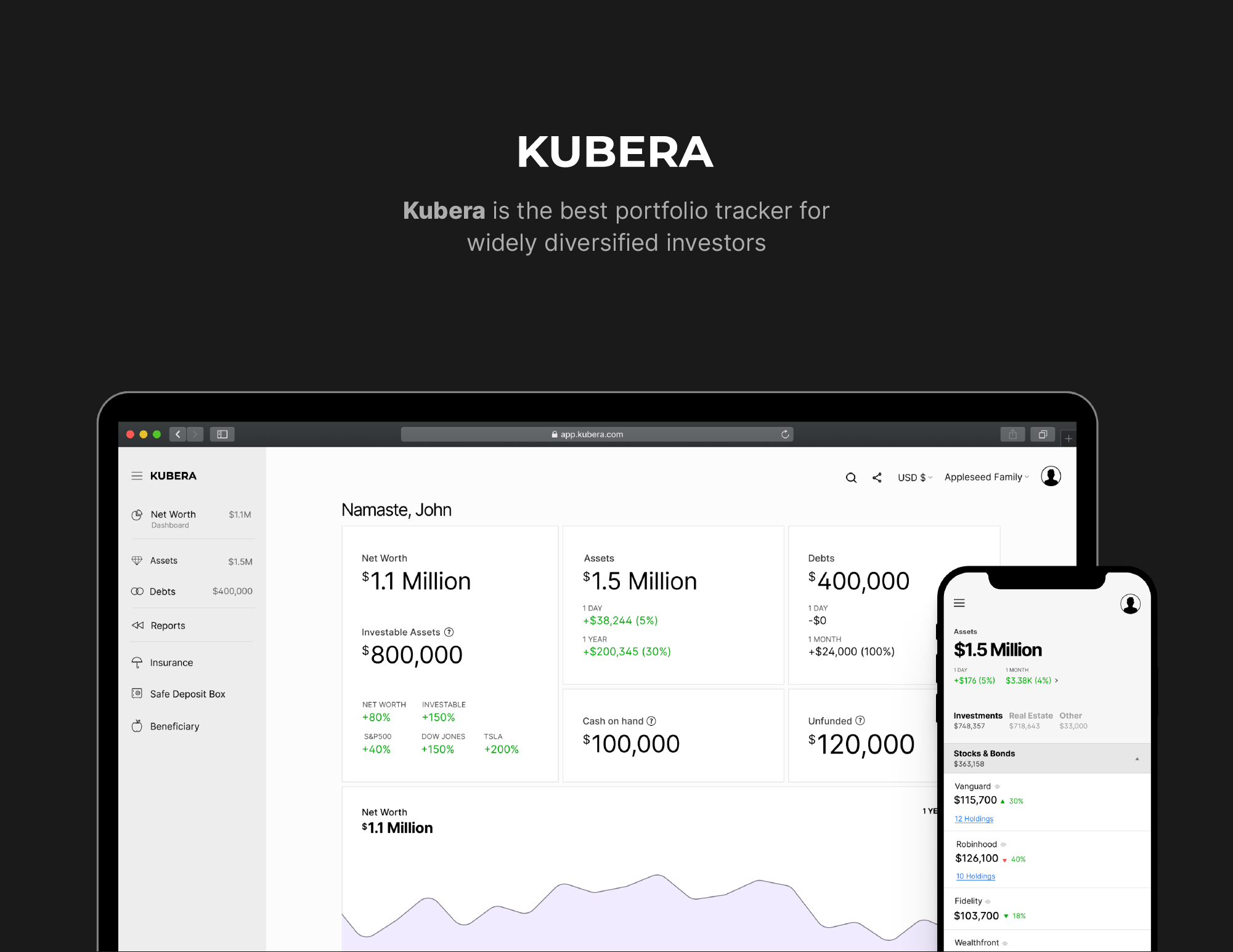

Review and Reconcile Your Portfolio RegularlyPerform routine portfolio reviews to match your records with reports from exchanges and wallets. This helps identify discrepancies early and prepares you for any potential audits or inquiries from tax authorities.

-

Stay Informed on Regulatory UpdatesMonitor updates from the Finnish Tax Administration (Vero) and major news sources to stay ahead of new compliance requirements and deadlines.

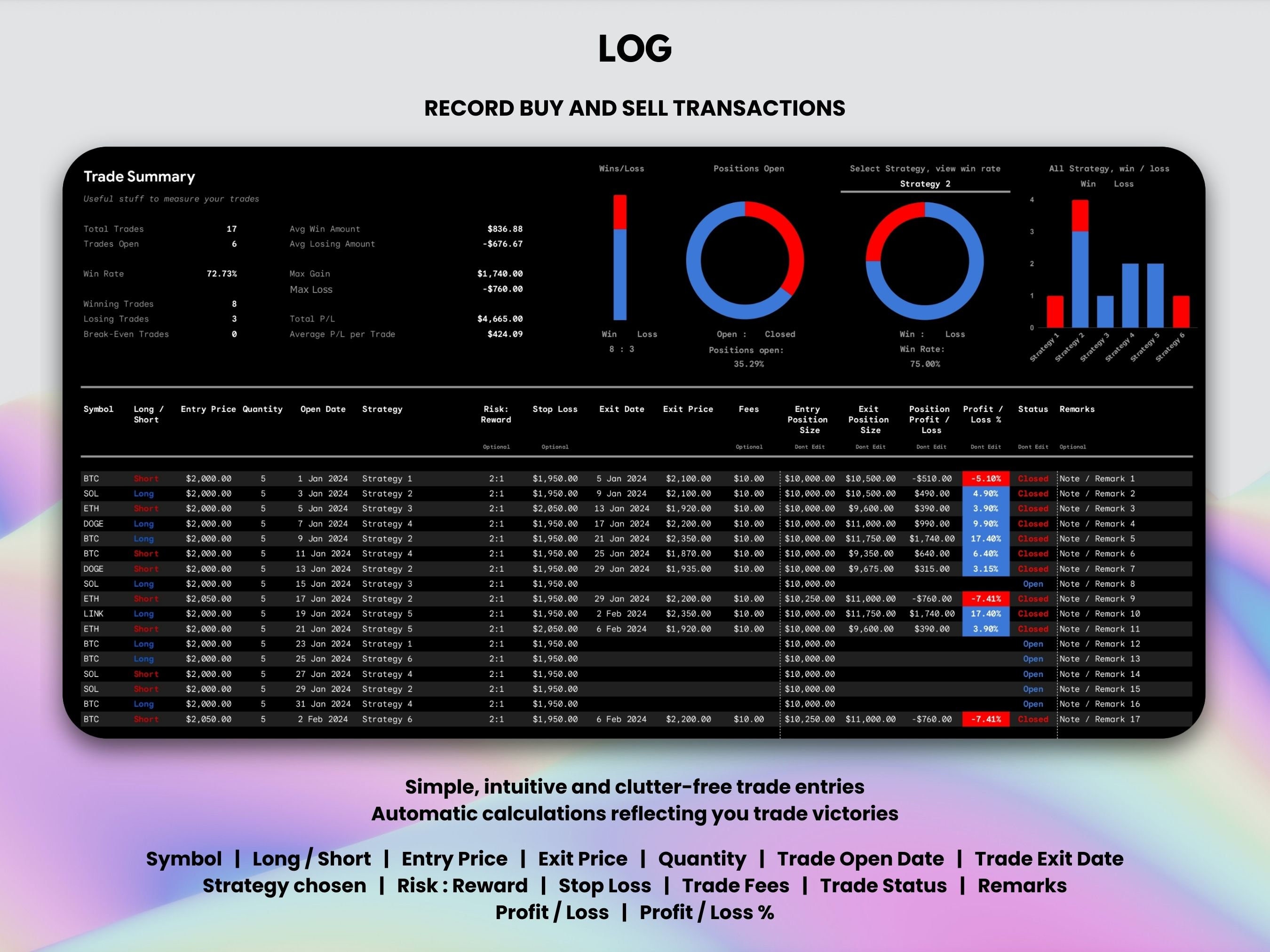

1. Organize Your Records: Begin tracking all transactions now, deposits, withdrawals, trades, staking rewards, and transfers between wallets. Use spreadsheets or specialized crypto tax software that supports Finnish compliance.

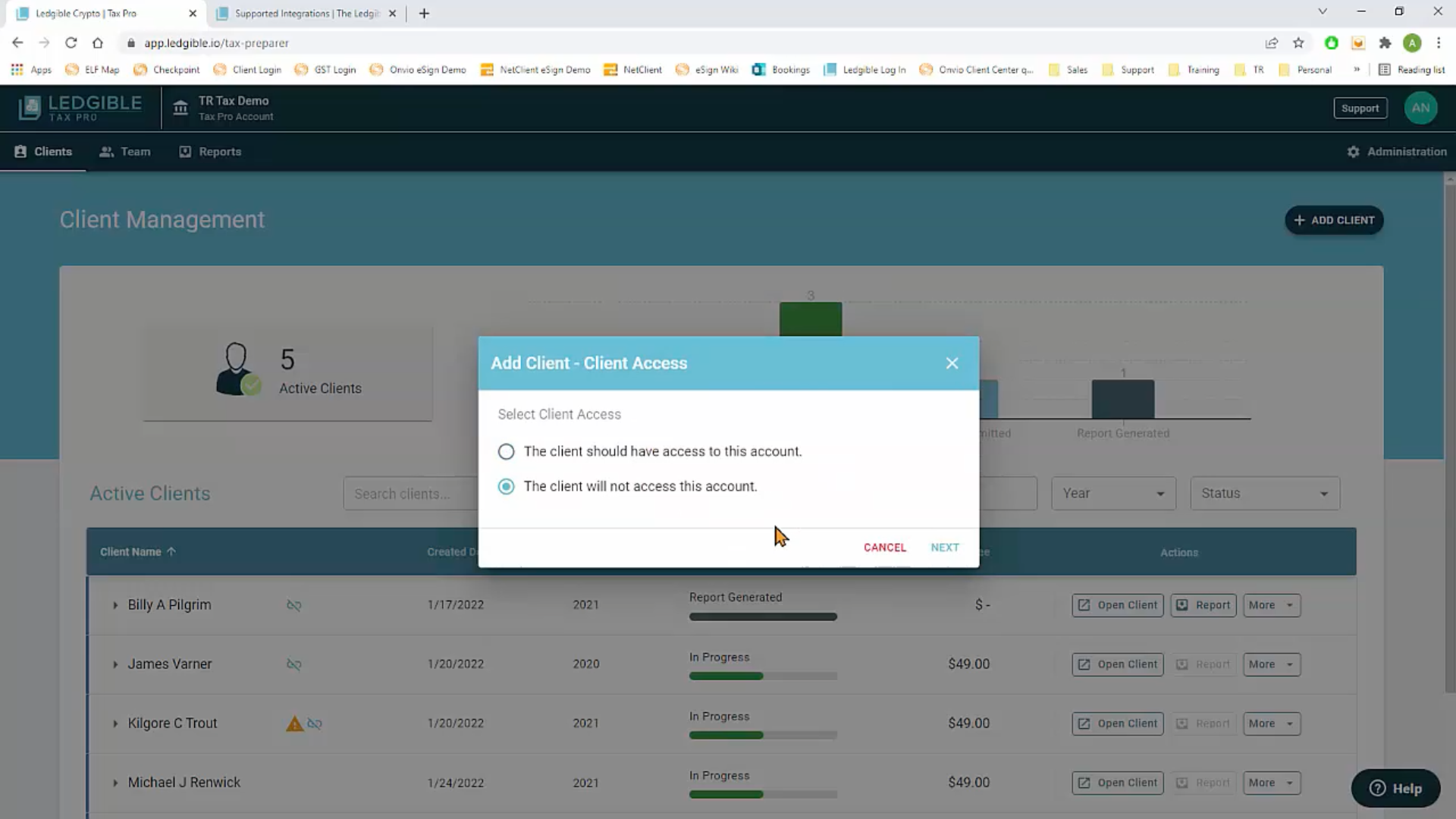

2. Choose Compliant Platforms: Prefer exchanges and wallet services that are transparent about their reporting obligations under CARF/DAC8. This reduces surprises and ensures your data is handled properly.

3. Consult Tax Professionals: If you’re unsure how these rules apply to your specific situation, especially if you have cross-border activities, seek advice from professionals familiar with both Finnish tax law and international crypto regulations.

4. Regular Portfolio Reviews: Set aside time each quarter to reconcile your own records with those provided by service platforms. This helps catch discrepancies early before they become audit triggers.

Broader Implications: Privacy vs Transparency

The debate between privacy advocates and regulators is far from over. Finland’s adoption of CARF marks a decisive tilt toward transparency in the name of fair taxation and anti-money laundering efforts. While some investors may lament the loss of anonymity that once defined crypto’s appeal, others will see this as necessary maturation for digital assets to gain mainstream legitimacy.

The reality is clear: regulatory clarity brings stability, and likely paves the way for greater institutional participation in Finland’s crypto markets over time.

Looking Ahead: What This Means for Crypto in Finland

Finland’s proactive stance sets a precedent for other EU nations preparing similar frameworks under DAC8. For investors willing to embrace greater transparency, and who take their record-keeping seriously, the risks of falling afoul of tax law are minimized.

If you’re uncertain about any aspect of compliance or reporting under these new rules, don’t wait until January 2026 to act. Start building good habits now; accurate documentation is your best defense against future disputes or audits.

The bottom line? The Finnish government isn’t aiming to stifle innovation, it wants to ensure everyone plays by the same rules as digital assets become a larger part of personal wealth portfolios. By preparing early and staying informed on regulatory updates, you can turn these changes into an advantage rather than an obstacle.