Bitcoin’s hovering at $68,256 right now, up 1.40% in the last 24 hours after dipping to $67,000. ETF outflows are hitting hard in 2026, shaking out weak hands while Michael Saylor’s Strategy keeps stacking sats like it’s going out of style. Wall Street’s jittery, but Goldman Sachs is calling $200,000 by year-end. If you’re eyeing this dip to buy Bitcoin during 2026 ETF outflows, Saylor’s dip-buying strategy is your blueprint. Let’s break it down fast and actionable.

ETF Outflows Exposed: Why Bitcoin’s Bleeding in 2026

Spot Bitcoin ETFs saw massive inflows in late 2025, fueling that run to $126,000. But early 2026 flipped the script – redemptions piled up as macro fears and profit-taking kicked in. Bitcoin crashed toward $60,000, trading below Strategy’s average purchase price. Rumors swirled about Saylor facing a margin call, potentially dumping 3.4% of BTC supply. Pure noise. At $68,256, we’re in prime accumulation territory if you know how to navigate volatility.

Saylor’s not flinching. His firm just scooped 1,286 BTC for $116 million between December 29,2025, and January 4,2026, pushing holdings to 673,783 BTC at an average of $75,026 each. That’s conviction. Even as BTC briefly dipped below the 200-day moving average, Saylor signaled more buys. Sentiment challenge? Sure. Solvency crisis? Laughable.

Bitcoin invited Wall Street in and now it moves like a tech stock. But dips like this at $68,256 are where fortunes flip.

Saylor’s Dip-Buying Strategy: React Fast, Stack Hard

Michael Saylor doesn’t time tops; he crushes bottoms. Strategy’s 99th purchase? 1,142 BTC for $90 million amid panic. Earlier, $264 million when markets freaked. And 855 BTC at $87,974 average in early February. Total haul: relentless. His playbook? Leverage BTC as superior reserve asset, projecting 30% annual returns over 20 years. Math over emotion.

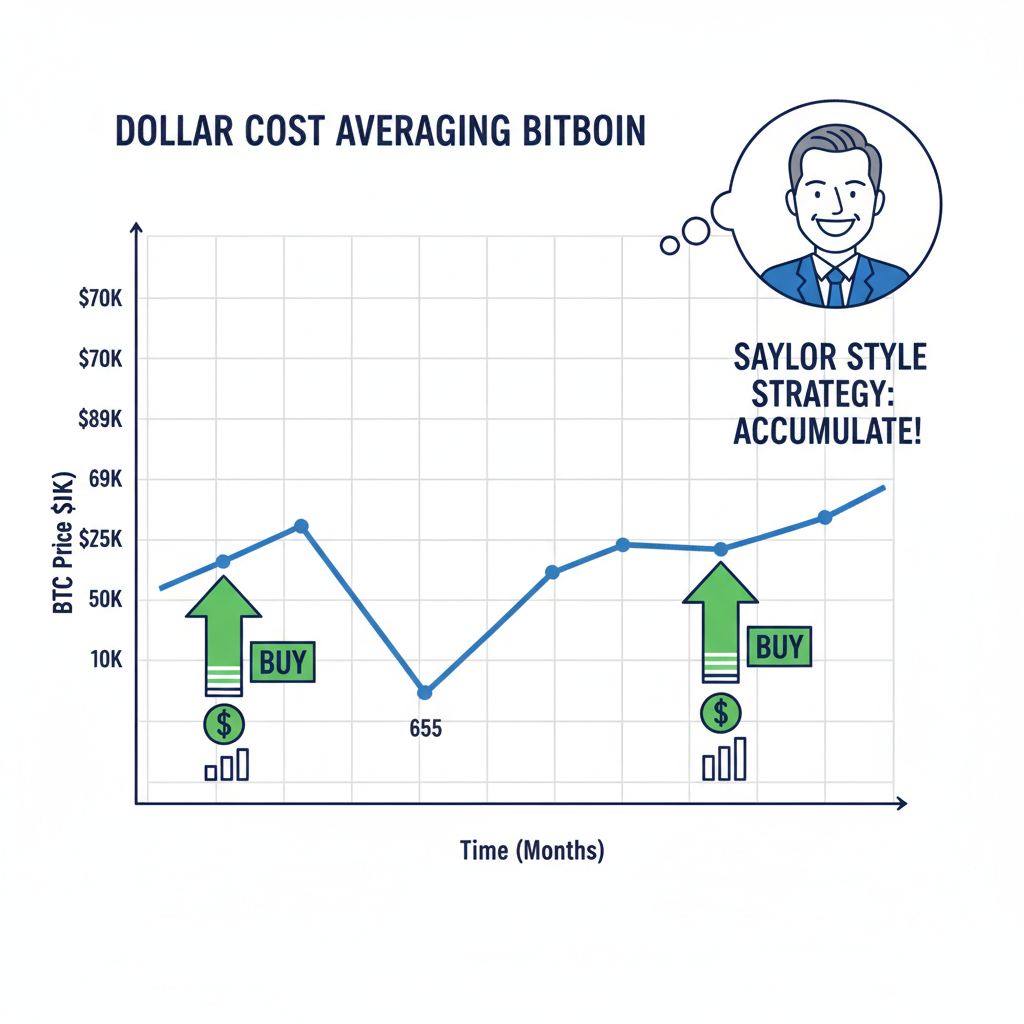

To mimic Saylor buying Bitcoin during 2026 ETF outflows: scale in on 5-10% pullbacks from key supports. Current 24-hour low hit $67,000 – that’s your trigger. Use dollar-cost averaging with tight stops below recent lows. Risk 1-2% per trade. Saylor’s under the microscope because he’s levered up, but retail traders? Stay unlevered, buy the bleed.

Analysts fret over Strategy’s red ink post-$126K peak. Bitcoin’s snake-like 2025 path repeated, but Saylor buys through MSCI FUD and crashes. At $68,256, BTC’s undervalued per Bitwise metrics too. Goldman Sachs agrees – big time.

Goldman Sachs $200K Prediction: Institutional Green Light

January 2026: Goldman drops the bomb – Bitcoin to $200,000 by December, driven by regulatory tailwinds and institutional FOMO. They’re betting on ETF stabilization post-outflows, plus sovereign adoption. Saylor’s math aligns; his long-term hold mirrors this upside.

Bitcoin (BTC) Price Prediction 2027-2032

Forecasts amid 2026 ETF outflows, Michael Saylor’s dip-buying strategy (avg cost $75,026), and Goldman Sachs’ $200K EOY 2026 prediction. Assumes 2026 average price of $150,000 as baseline.

| Year | Minimum Price (Bearish) | Average Price | Maximum Price (Bullish) | YoY % Change (Avg from Prior Year) |

|---|---|---|---|---|

| 2027 | $120,000 | $250,000 | $450,000 | +67% |

| 2028 | $180,000 | $400,000 | $700,000 | +60% |

| 2029 | $280,000 | $600,000 | $1,050,000 | +50% |

| 2030 | $400,000 | $850,000 | $1,500,000 | +42% |

| 2031 | $550,000 | $1,200,000 | $2,100,000 | +41% |

| 2032 | $750,000 | $1,600,000 | $2,800,000 | +33% |

Price Prediction Summary

Bitcoin is expected to recover from 2026 volatility, with average prices rising progressively from $250K in 2027 to $1.6M by 2032. Bearish mins reflect potential corrections, while bullish maxes capture halving-driven rallies and adoption surges.

Key Factors Affecting Bitcoin Price

- Aggressive institutional accumulation (e.g., Strategy’s 673K+ BTC holdings)

- 2028 Bitcoin halving enhancing scarcity

- Goldman Sachs and Wall Street forecasts signaling $200K+ by 2026 EOY

- Regulatory clarity and ETF maturation post-outflows

- Macro tailwinds: inflation hedge amid fiat debasement

- Technological upgrades (scaling solutions, Ordinals) boosting utility

- Historical 4-year cycles with diminishing but strong returns

Disclaimer: Cryptocurrency price predictions are speculative and based on current market analysis.

Actual prices may vary significantly due to market volatility, regulatory changes, and other factors.

Always do your own research before making investment decisions.

From $68,256, that’s nearly 3x potential. Outflows are temporary; Saylor’s proving it by loading up. Next: how to execute your own dip buys safely, platforms, risk management. But first, check that price widget – momentum’s building.

For deeper dives on Bitcoin ETF outflows and 2026 price predictions, hit this guide.

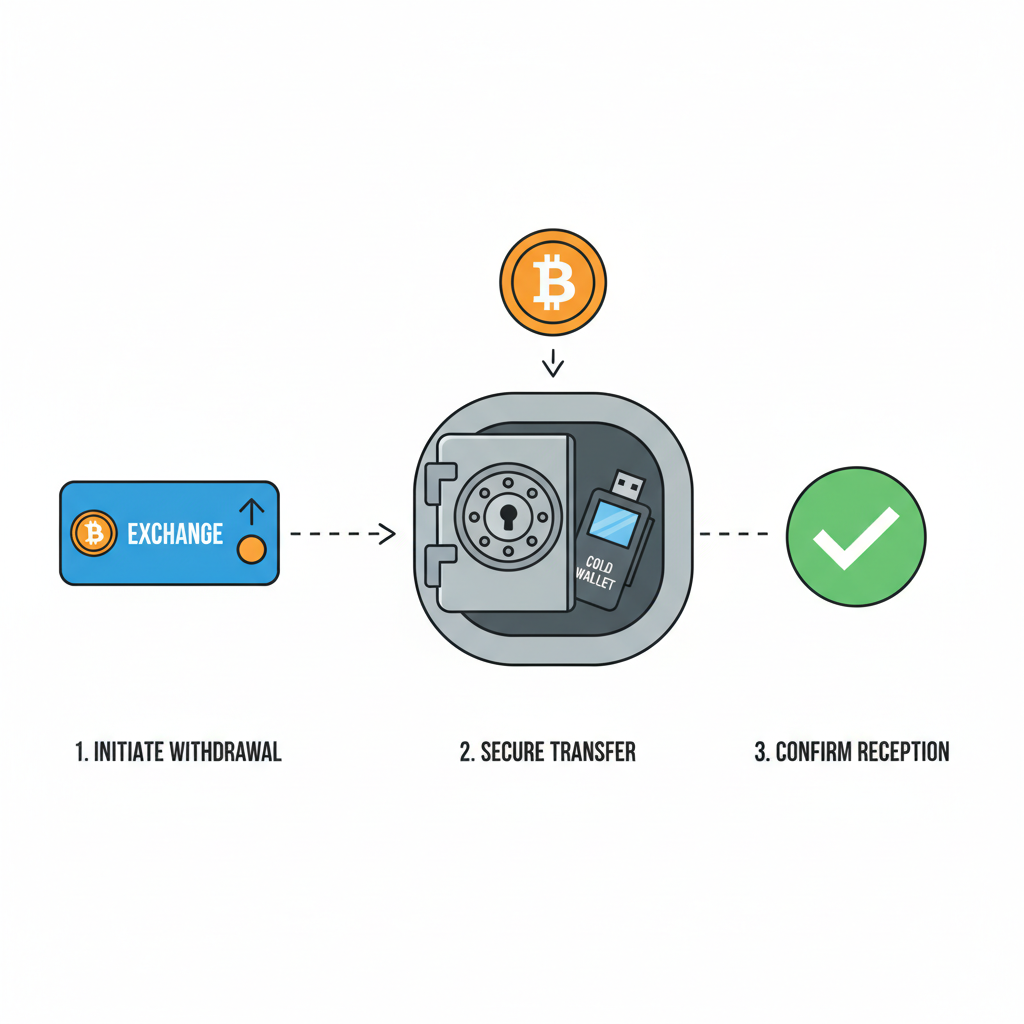

Time to get tactical. Buying Bitcoin during 2026 ETF outflows means channeling Saylor’s relentless accumulation without the leverage drama. Spot the bleed at $68,256, confirm support near $67,000 lows, and deploy capital systematically. Platforms like Coinbase or Binance make it dead simple for U. S. traders – fund fiat, hit buy on dips. But Saylor’s edge? Conviction sizing. Allocate 10-20% of your portfolio to BTC now, scaling in as outflows drag prices lower.

Execute Saylor-Style Dip Buys: Your 2026 Playbook

Strategy’s latest haul – 1,286 BTC at around $90,000 average – proves the method. They bought when panic peaked, BTC sliding 13% over a weekend. You can too, unlevered. Watch ETF flow data daily; net outflows signal retail fear, institutional opportunity. Goldman’s $200,000 call hinges on this reversal. From $68,256, every 5% drop is your green light.

Bitcoin (BTC) Price Prediction 2027-2032

Projections amid 2026 ETF outflows, incorporating Michael Saylor’s dip-buying strategy, Goldman Sachs’ $200K target, and 30% annual return outlook (Current BTC price: $68,256 as of Feb 2026)

| Year | Minimum Price | Average Price | Maximum Price |

|---|---|---|---|

| 2027 | $80,000 | $130,000 | $220,000 |

| 2028 | $110,000 | $180,000 | $300,000 |

| 2029 | $150,000 | $250,000 | $400,000 |

| 2030 | $200,000 | $330,000 | $500,000 |

| 2031 | $250,000 | $430,000 | $650,000 |

| 2032 | $320,000 | $550,000 | $800,000 |

Price Prediction Summary

Bitcoin is forecasted to experience robust growth from 2027 to 2032, with average prices rising from $130K to $550K at a ~30% CAGR. Minimums reflect bearish cycles and dips, while maximums capture bull runs driven by halvings, adoption, and institutional demand.

Key Factors Affecting Bitcoin Price

- Michael Saylor’s relentless Bitcoin accumulation during 2026 dips, signaling long-term confidence

- Goldman Sachs’ bullish $200K end-2026 forecast amid institutional adoption

- 2028 Bitcoin halving expected to ignite new bull market cycle

- Recovery from 2026 ETF outflows with renewed inflows and regulatory clarity

- Growing use cases as digital gold, reserve asset, and technological upgrades

- Market cap expansion potential surpassing $10T by 2032 in optimistic scenarios

Disclaimer: Cryptocurrency price predictions are speculative and based on current market analysis.

Actual prices may vary significantly due to market volatility, regulatory changes, and other factors.

Always do your own research before making investment decisions.

Saylor’s not guessing; he’s stacking based on Bitcoin’s scarcity math. Mimic by setting alerts at $67,000, $65,000, down to $60,000 crash levels. Use limit orders to snag below market. Post-buy, HODL through noise – Strategy’s at 673,783 BTC, average cost $75,026. You’re buying below that today.

Pragmatic risk management seals it. Never risk more than 1-2% of capital per dip buy. Stops below 24-hour lows like $67,000 prevent blowups. Diversify entries across weeks, not days. Saylor’s levered bets draw scrutiny – Strategy underwater post-$126K peak – but you? Pure spot buys build wealth without margin calls. Rumors of dumping 3.4% supply? FUD fuel for your accumulation.

Risk Radar and Exit Signals: Protect Gains to $200K

Volatility’s your friend at $68,256, but manage it. Track the 200-day moving average; dips below rattled sentiment in February 2026, yet Saylor bought 855 BTC at $87,974 average. Exit partials at $80,000, $100,000 en route to Goldman’s target. Trail stops at 10% below peaks. If outflows persist, BTC could test $60,000 – prime Saylor territory.

| Dip Level | Action | Risk % |

|---|---|---|

| $67,000 (24h low) | Buy 25% allocation | 1% |

| $65,000 | Buy 50% allocation | 1.5% |

| $60,000 | Full stack | 2% |

| $80,000 and | Partial sell | Trail stop |

This table’s your cheat sheet for buy Bitcoin ETF outflows 2026 plays. Saylor’s 99th buy amid volatility? Same logic. Bitcoin’s tech-stock wiggles post-Wall Street entry create these setups. Bitwise calls it undervalued; Goldman eyes $200,000.

Markets panic, Saylor stacks. At $68,256 with and 1.40% momentum, 2026’s dip is your launchpad. React fast on supports, manage risk tight, and ride institutional flows higher. Strategy’s microscope moment passed; yours starts with that first buy order.