The crypto world is abuzz as XRP rockets to a new milestone, trading at $3.52 as of July 18,2025. This surge isn’t just a number on the screen – it’s reshaping how newcomers enter the crypto space and how the industry approaches sustainability. Let’s dive into what’s driving this momentum and why it matters for anyone interested in joining the next wave of digital finance.

XRP’s $3.52 Surge: Regulatory Wins and Whale Activity Fuel Onboarding

After years of legal uncertainty, Ripple finally secured regulatory clarity in March 2025 with a landmark SEC settlement. This $50 million agreement ended a long-standing dispute and injected fresh confidence into the market. Almost overnight, institutional players began to pile in, with CME Group announcing plans for XRP futures contracts (source). The result? A tidal wave of new wallets and whale accumulation, with XRP leaping over 30% in a single week.

But regulatory progress is only half the story. President Trump’s announcement of a U. S. Crypto Strategic Reserve – which includes XRP alongside Solana and Cardano – has given government backing to Ripple’s vision for global payments (source). This rare convergence of public policy and private innovation is making crypto onboarding more mainstream than ever before.

Green Mining Contracts: How HJT Crypto Is Shaking Up Sustainable Onboarding

One misconception often heard from beginners is that all cryptocurrencies are environmentally damaging due to energy-intensive mining. However, 2025 has flipped that narrative on its head – especially with innovations like HJT Crypto’s green mining contracts based on Ripple (XRP).

While XRP itself isn’t mined like Bitcoin or Ethereum, HJT Crypto now allows users to leverage their XRP holdings to mine Bitcoin directly through renewable energy-powered contracts. This hybrid approach is designed to attract eco-conscious investors who previously hesitated due to sustainability concerns.

Key Benefits of Green Mining Contracts for New Crypto Users

-

Lower Environmental Impact: Green mining contracts use renewable energy sources and efficient technologies, significantly reducing the carbon footprint compared to traditional crypto mining. This appeals to environmentally conscious users entering the crypto space.

-

Enhanced Transparency and Trust: Platforms like HJT Crypto provide verifiable data on energy usage and sustainability, helping new users trust that their investments support eco-friendly practices.

-

Lower Barriers to Entry: Green mining contracts often allow users to participate with smaller investments and without the need for expensive hardware, making it easier for newcomers to start earning crypto rewards.

-

Regulatory and Institutional Support: The shift to sustainable mining has attracted favorable attention from governments and institutions. For example, the U.S. Crypto Strategic Reserve includes eco-conscious assets like XRP, boosting legitimacy and confidence for new users.

-

Potential for Higher Returns: As demand grows for sustainably mined crypto, platforms offering green contracts may provide competitive rewards. The current surge in XRP (trading at $3.52 as of July 18, 2025) demonstrates how sustainable practices can align with strong market performance.

This sustainable model isn’t just good PR; it’s actively lowering barriers for first-timers who want their investments aligned with climate goals. As more platforms adopt similar models, expect onboarding rates among environmentally aware demographics to accelerate.

XRP Price Outlook: What Does $3.52 Mean for New Investors?

The current price action reflects more than just hype – it signals structural changes in how people enter crypto markets. Analysts now predict that if current trends continue, XRP could reach anywhere from $5 to $15 by year-end 2025 (source). The prospect of an upcoming ETF approval could add even more fuel.

XRP (XRP) Price Prediction 2026–2031

Professional outlook based on 2025’s record surge, regulatory clarity, institutional adoption, and sustainable industry trends.

| Year | Minimum Price | Average Price | Maximum Price | Year-over-Year Change (Avg) | Market Scenario Insights |

|---|---|---|---|---|---|

| 2026 | $3.10 | $4.80 | $7.50 | +36% | ETF flows and global payments adoption accelerate, but corrections possible after 2025 surge |

| 2027 | $3.95 | $6.10 | $10.00 | +27% | Macro cycle peaks, increased competition from CBDCs, but Ripple partnerships drive utility |

| 2028 | $4.25 | $7.35 | $12.00 | +20% | Regulatory harmonization in Asia/EU, stablecoins integration; possible retracement if global markets slow |

| 2029 | $5.10 | $8.90 | $14.50 | +21% | Sustained institutional inflows, enhanced DeFi use cases, but risk from new blockchain innovations |

| 2030 | $6.20 | $10.85 | $18.50 | +22% | Mainstream finance integration, cross-border payment dominance, but volatility from market cycles |

| 2031 | $7.80 | $13.40 | $24.00 | +24% | Widespread adoption, maturing crypto regulations, potential for speculative peaks |

Price Prediction Summary

XRP’s price outlook remains bullish through 2031, propelled by 2025’s pivotal regulatory clarity, institutional adoption, and ETF approval prospects. While significant corrections and volatility may occur after major surges, the trend points to steady long-term growth, especially as Ripple’s technology is increasingly adopted in global finance. Price ranges reflect both bullish scenarios (mainstream finance integration, new partnerships) and bearish risks (market corrections, increased competition).

Key Factors Affecting XRP Price

- Regulatory clarity following SEC settlement and global harmonization

- Institutional adoption via futures, ETFs, and strategic reserves

- Technological advancements in Ripple’s cross-border payment solutions

- Sustained interest due to green mining initiatives and ESG adoption

- Potential competition from CBDCs and next-gen blockchain networks

- Market cycle volatility and macroeconomic shifts

- Ripple’s success in expanding partnerships and real-world utility

Disclaimer: Cryptocurrency price predictions are speculative and based on current market analysis.

Actual prices may vary significantly due to market volatility, regulatory changes, and other factors.

Always do your own research before making investment decisions.

XRP Technical Analysis Chart

Analysis by Market Analyst | Symbol: BINANCE:XRPUSDT | Interval: 1D | Drawings: 5

Technical Analysis Summary

Begin by drawing a strong ascending trend line from the July 2025 low near $2.10 to the current price at $3.52. Mark newly established support at $3.20 with a horizontal line, as this was a key breakout retest zone. Set horizontal resistance at the psychological and recent local high of $3.65. Highlight the steep rally since early July 2025 with a rectangle to indicate a breakout zone and recent momentum. Annotate the consolidation range between $2.10 and $2.60 from May to early July 2025 using a rectangle. Add an arrow marker to the breakout candle above $3.00 to emphasize initiation of the current surge. Use callouts to indicate the influence of positive regulatory news and institutional adoption near the July breakout. For risk management, mark potential stop-loss zones below $3.20 and profit-taking zones near $3.60-$3.65.

Risk Assessment: medium

Analysis: The technicals are extremely bullish, but the rally is steep and could be subject to sharp pullbacks. The $3.20 support is critical for the current move to sustain. Macro news is supportive, but current price is slightly extended for new entries.

Market Analyst’s Recommendation: For medium risk profiles, consider entering on pullbacks toward $3.20 with stops below $3.10. Short-term traders should consider locking in profits near $3.60-$3.65, while longer-term holders can ride the trend with trailing stops.

Key Support & Resistance Levels

📈 Support Levels:

-

$3.2 – Newly established support from post-breakout retest area.

moderate -

$2.8 – Prior resistance turned support; last congestion zone before breakout.

moderate

📉 Resistance Levels:

-

$3.65 – Recent daily high and psychological round number resistance.

strong

Trading Zones (medium risk tolerance)

🎯 Entry Zones:

-

$3.2 – Potential retest of breakout and support confirmation.

medium risk

🚪 Exit Zones:

-

$3.65 – Near-term local high and overextended move; ideal for profit-taking.

💰 profit target -

$3.1 – Breakdown below support would signal reversal or deeper correction.

🛡️ stop loss

Technical Indicators Analysis

📊 Volume Analysis:

Pattern: Not visible in image, but implied by strong price action. Expect surge on breakout candles.

Volume likely spiked significantly on the breakout above $3.00, confirming strength.

📈 MACD Analysis:

Signal: Likely strongly bullish given the steep rally; would expect a wide MACD histogram and rising MACD line.

Momentum is overheated, caution for short-term traders. Watch for bearish divergence on high timeframes.

Applied TradingView Drawing Utilities

This chart analysis utilizes the following professional drawing tools:

Disclaimer: This technical analysis by Market Analyst is for educational purposes only and should not be considered as financial advice.

Trading involves risk, and you should always do your own research before making investment decisions.

Past performance does not guarantee future results. The analysis reflects the author’s personal methodology and risk tolerance (medium).

This bullish environment is ideal for onboarding newcomers, especially as platforms roll out beginner-friendly guides and tools tailored for those eager to capitalize on Ripple’s momentum.

For those just entering the crypto space, the current landscape is more inviting than ever. The combination of regulatory clarity, institutional enthusiasm, and green mining innovation is lowering the learning curve and building trust. With XRP sustaining a price of $3.52, many first-time investors are looking for practical ways to get started without feeling overwhelmed by technical jargon or environmental guilt.

Platforms like HJT Crypto are leading this new wave by offering transparent onboarding processes, clear educational resources, and step-by-step guidance for leveraging XRP in eco-friendly mining contracts. This approach is helping demystify crypto for beginners, making it easier to take that first step with confidence.

Practical Onboarding Tips: How to Start with XRP in 2025

If you’re considering jumping into XRP or exploring green mining contracts, here are some actionable steps to help you navigate the process:

Essential Onboarding Tips for New XRP Investors (2025)

-

Understand XRP’s Current Market Position: As of July 18, 2025, XRP is trading at $3.52 following a period of significant price growth and increased institutional interest. Stay updated with real-time prices on reputable platforms like CoinMarketCap or Binance.

-

Leverage Regulatory Clarity: The SEC’s settlement with Ripple in March 2025 has provided much-needed legal certainty. Review official updates from the U.S. Securities and Exchange Commission and Ripple Insights to understand the implications for investors.

-

Explore Institutional Investment Opportunities: With the CME Group launching XRP futures (pending regulatory approval), investors can access new trading products. Monitor official announcements from CME Group for updates on futures contracts and trading options.

-

Consider Sustainable Investment Practices: The crypto industry’s shift toward green mining contracts is attracting eco-conscious investors. While XRP itself is not mined, platforms like HJT Crypto now offer XRP-based mining models for Bitcoin. Research these platforms and their environmental commitments before participating.

-

Stay Informed on Government Initiatives: The U.S. government’s creation of a Crypto Strategic Reserve (including XRP) in March 2025 signals growing institutional support. Follow updates from The White House and major news outlets for policy developments impacting crypto markets.

-

Use Secure, Reputable Wallets: Choose established wallets that support XRP, such as Ledger, Trezor, or Trust Wallet. Enable two-factor authentication and safeguard your recovery phrases.

-

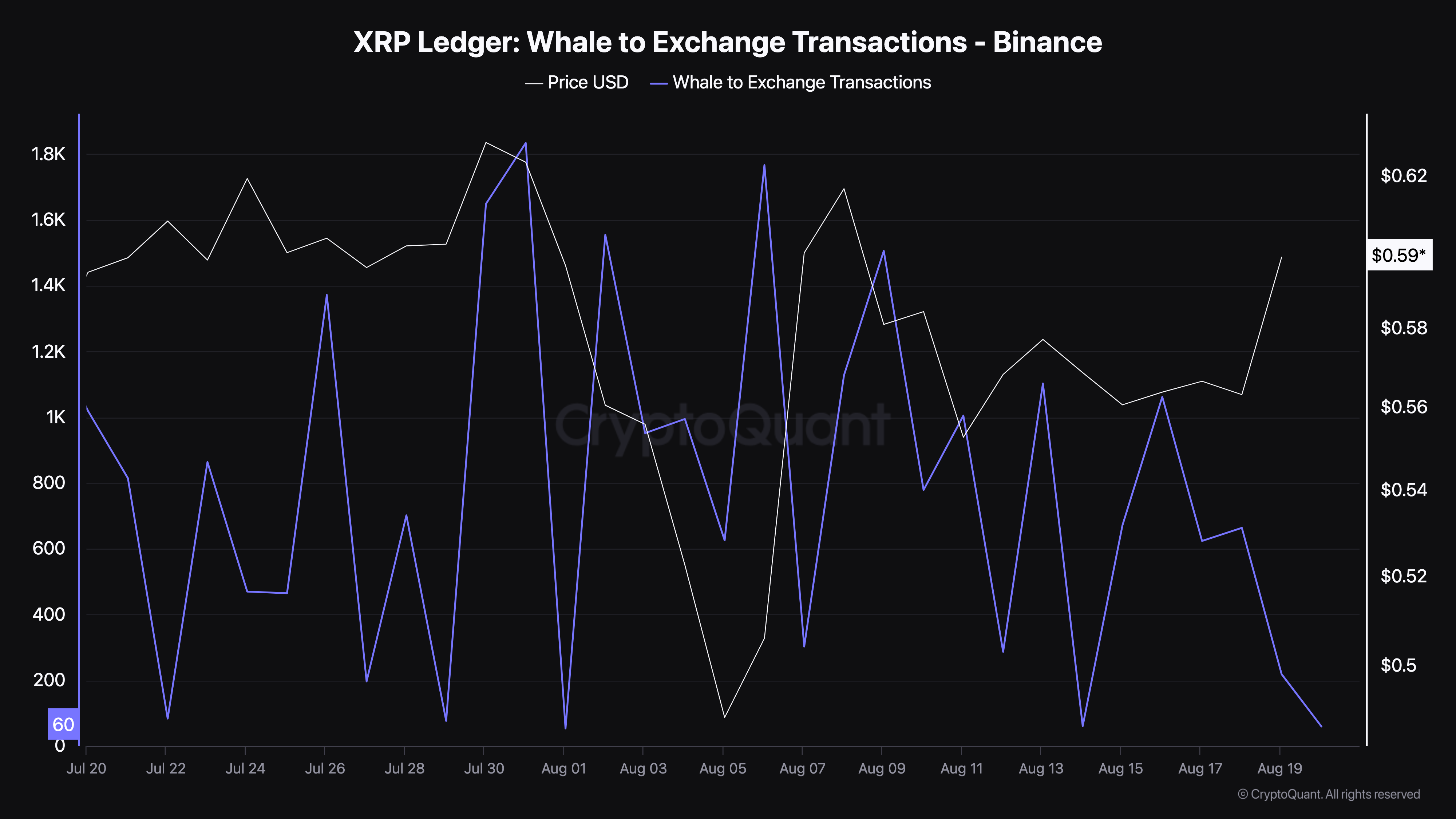

Monitor Whale Activity and Market Trends: Track large transactions and wallet activity using analytics platforms like Santiment or Whale Alert. This can provide insights into market sentiment and potential price movements.

-

Prepare for ETF and New Product Launches: An XRP ETF is anticipated to attract further institutional investment. Stay updated on ETF approval status via SEC filings and financial news platforms like Bloomberg Crypto.

Community-driven education is also playing a pivotal role. Social media channels and dedicated forums are abuzz with tutorials, Q and As, and real-time market updates, making it easier than ever to learn from both experts and fellow newcomers. The surge in wallet creation isn’t just about speculation; it’s about people actively seeking out knowledge and making informed decisions.

The Ripple Effect: Broader Impacts on Crypto Adoption

The ripple effect of these changes goes far beyond just price action. As governments signal support through initiatives like the U. S. Crypto Strategic Reserve and major financial institutions roll out accessible products tied to XRP, we’re witnessing a shift from niche speculation to mainstream integration.

This momentum is likely to accelerate as ETFs gain approval and more platforms adopt renewable energy practices, not only benefiting XRP but raising standards across the industry. The result? A more inclusive, sustainable crypto ecosystem that welcomes everyone from seasoned traders to eco-conscious beginners.

Ultimately, XRP’s record-breaking surge to $3.52 isn’t just a headline, it’s a turning point for how people discover, evaluate, and participate in digital assets. Whether you’re motivated by potential returns or a desire to support greener technology, now is an opportune time to explore what onboarding looks like in this new era of crypto.