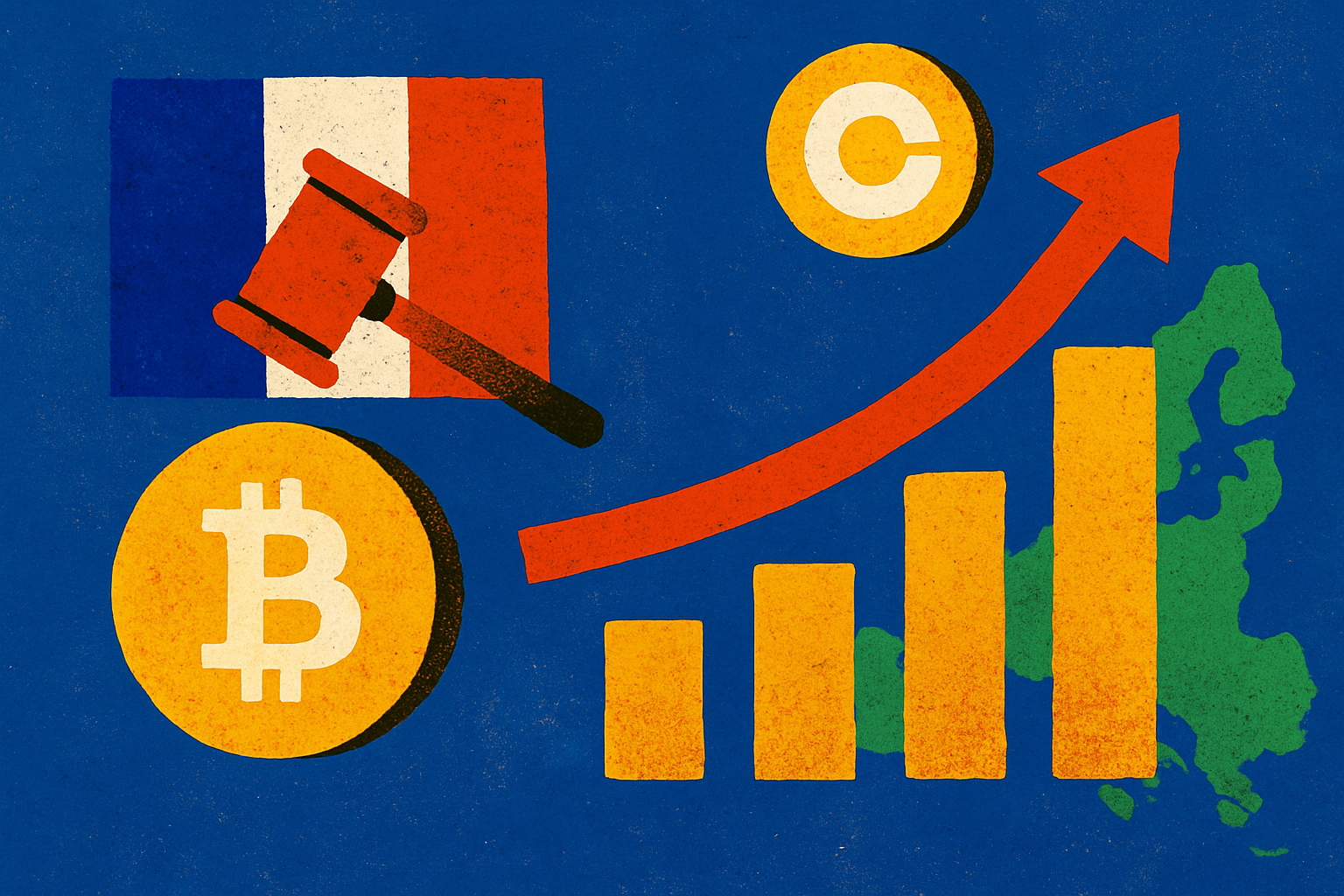

How to Buy Grayscale Bitcoin Mini Trust ETF on E*TRADE: Simplest Onboarding After $1.7B Outflow Reversal

Grayscale's Bitcoin Mini Trust ETF, ticker BTC, just hit E*TRADE platforms, opening the door for seamless Bitcoin exposure amid a pivotal market shift. After enduring $21 billion in outflows from…