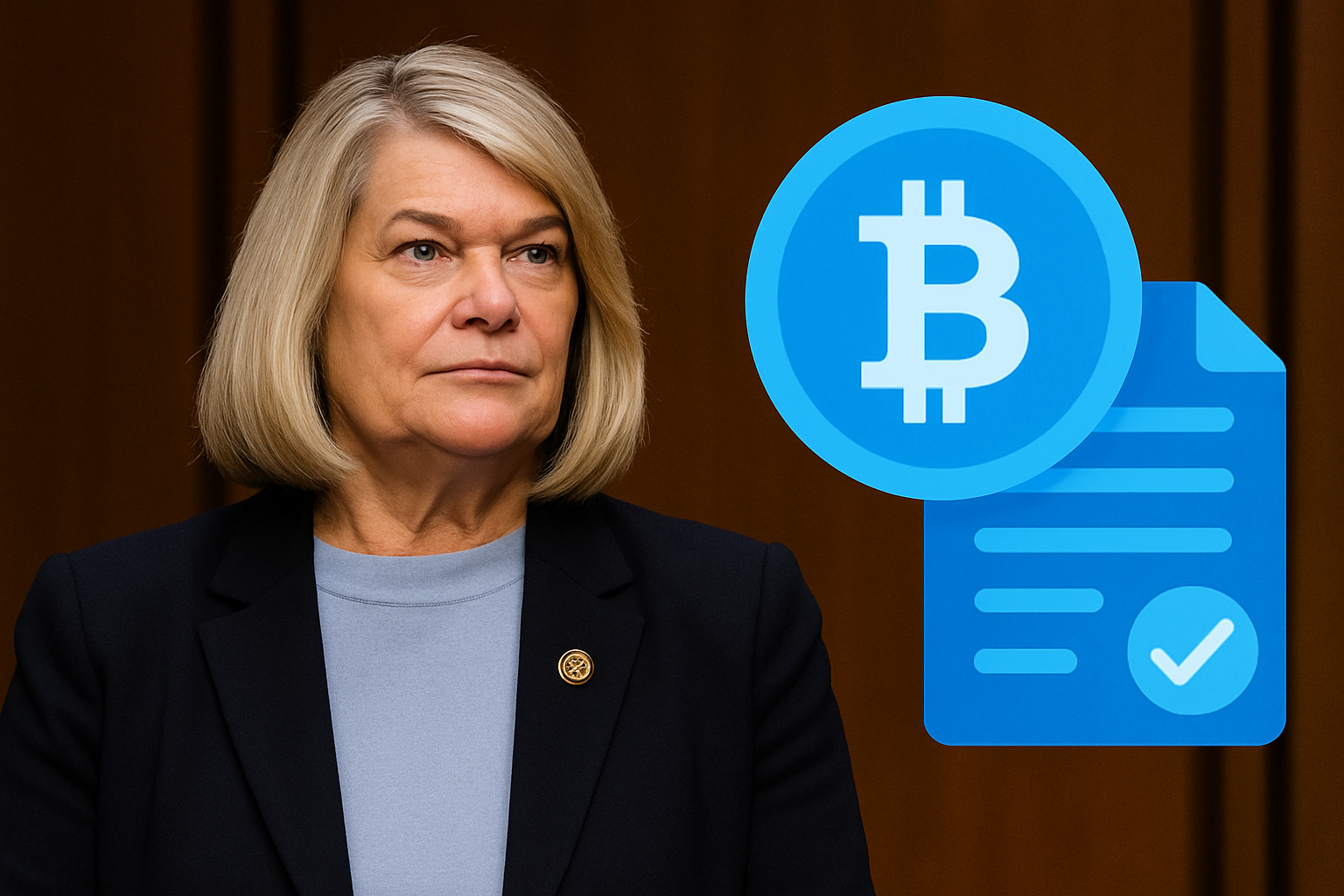

How Senator Lummis’s New Crypto Tax Bill Could Simplify Reporting for Everyday Users: What Onboarders Need to Know

For years, crypto users in the U. S. have faced an uphill battle with tax reporting. Every coffee bought with Bitcoin, every small transfer between wallets, and even modest staking…