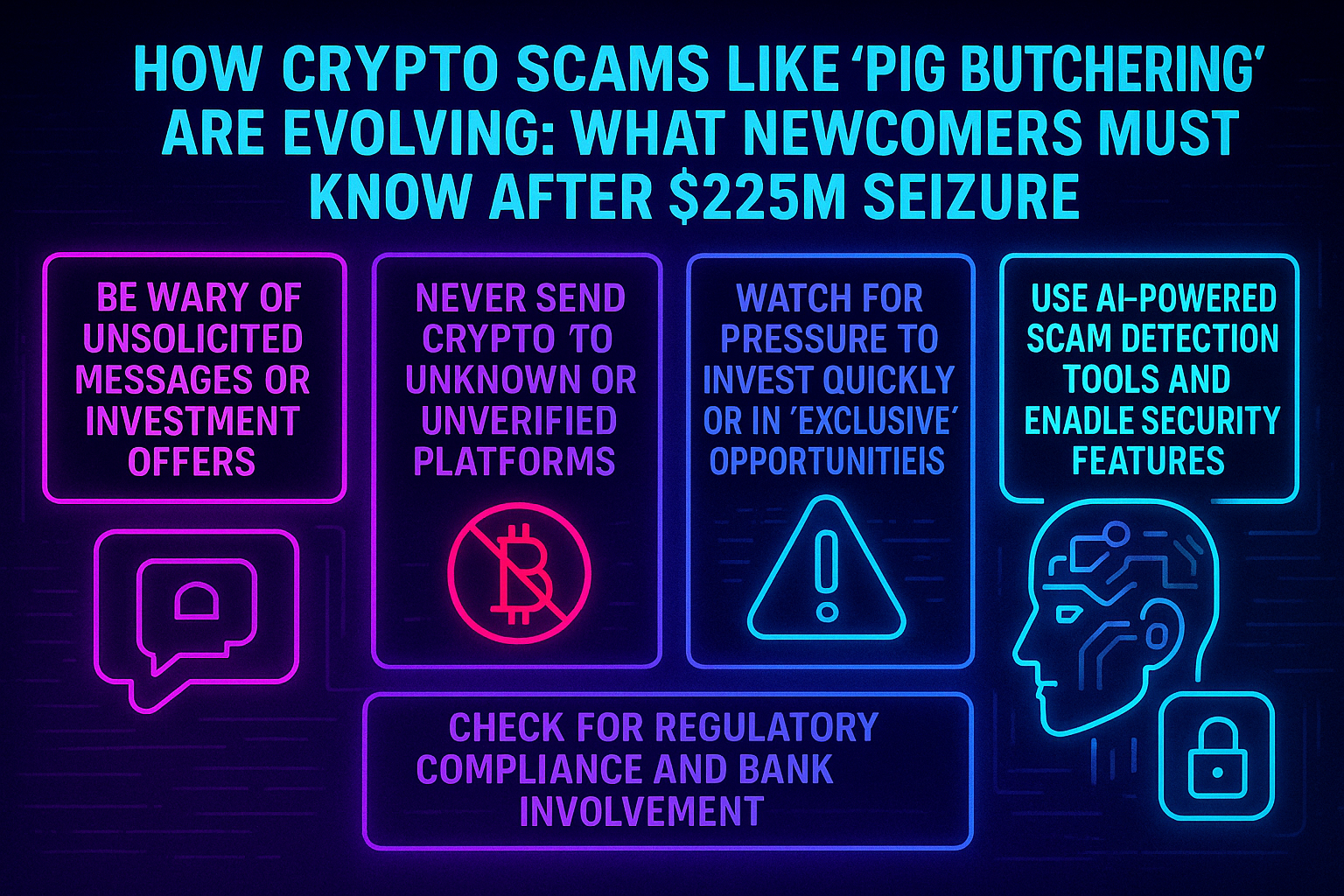

Crypto Phishing Scams Surge: Essential Onboarding Steps to Protect Your Digital Assets in 2025

The crypto market in 2025 has reached new heights, but so have the risks. In April alone, over 7,000 users lost more than $5.2 million to increasingly sophisticated phishing scams,…